Key Takeaways

- Chainlink whale dumps 1.622 million LINK tokens worth $28.924 million as the price struggles to gain momentum.

- Price action suggests that if LINK holds above the $16.80 level, it has the potential to soar 20%, potentially reaching $21.57.

- Traders maintain a strong bullish outlook, with Coinglass revealing that currently 70.52% of Binance traders are in long positions.

Selling pressure on Chainlink (LINK) intensified after a whale offloaded millions of tokens, raising questions about whether the decline will continue or if a pullback may occur. According to crypto transaction tracker Whale Alert, today a whale dumped nearly 1.622 million LINK tokens, worth $28.924 million.

Recent Whale Activity and Current Price

Whale dumps and a strengthening bearish market structure are contributing to an overall negative outlook for LINK. According to the latest data, the asset is currently trading at $17.70, posting a price dip of 6.05%. Investor interest also melted down, with 24-hour trading volume down 12% to $1.25 billion, suggesting limited selling pressure at current levels

This decline in trading volume suggests that market participants are not interested in pushing prices to lower levels.

The key catalyst behind the lack of participation is the current price level and its history of reversals.

Chainlink (LINK) Price Action and Upcoming Levels

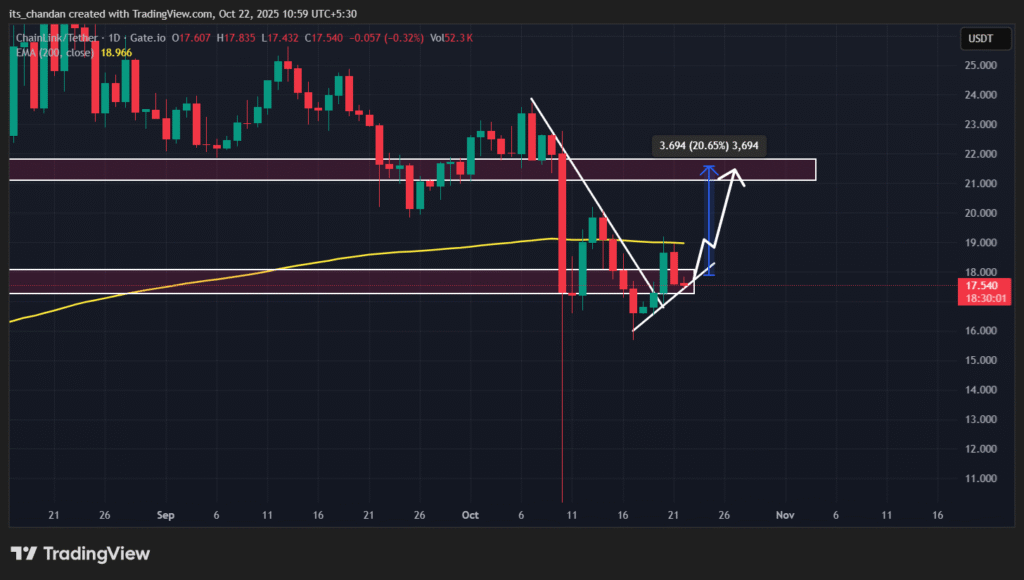

According to TimesCrypto’s technical analysis, the current level appears to be a make-or-break point for LINK, as it acts as strong support. However, the asset has already broken its prolonged descending trendline on the daily charts and now seems to be retesting it.

Based on the current price action, if LINK holds above the $16.80 level, it could see an impressive 20% price jump, potentially reaching the $21.57 level.

At press time, the Average Directional Index (ADX) reached 38.22, above the key threshold of 25, indicating strong directional momentum. Meanwhile, the 200-day Exponential Moving Average (EMA) trading above LINK’s price suggests that the asset is in a downtrend.

Traders Bullish Outlook

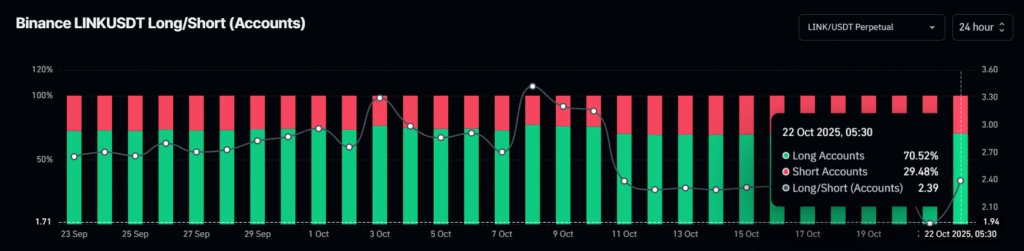

Derivative tracker Coinglass reveals that traders hold a contrasting outlook, with strong bets on long positions.

The latest Binance LINK/USDT Long/Short ratio stands at 2.39, indicating a bullish sentiment among traders. The data further shows that currently 70.52% of traders are in long positions, while 29.48% are in short positions.

Additionally, LINK’s major liquidation levels stand at $17.22 on the lower side and $17.98 on the upper side. At these levels, traders have built $9.23 million worth of long positions and $2.46 million in short positions.