Today’s upside move in the crypto market has surprised the participants, with its impressive gains across major cryptocurrencies. According to crypto tracker CoinMarketCap, the overall market is up by 3.03%, which has added a substantial $150 billion to the overall market capitalization and pushed it to $3.16 trillion.

The top assets that joined upside momentum are Bitcoin, Ethereum, and Solana, all moved impressively in the last 24 hours, gaining 3.10%, 7.25%, and 5.08%, respectively. The move clearly hints at fresh buying interest returning to the market.

Some altcoins, however, stole the spotlight. Zcash (ZEC) jumped 10.45%, FET added 9.74%, and Pudgy Penguin, the Solana-based meme coin, climbed 10.30%, making them the top performers of the day.

Factors Fueling the Crypto Market Today

You might be wondering what has been fueling such an upward momentum, especially since the market has barely moved in recent days.

The key catalysts driving today’s upward momentum include U.S. President Donald Trump’s comments on rate cuts, Polymarket’s bold prediction on future cuts, and Twenty One Capital CEO Jack Mallers’ strong statement on Bitcoin purchases, among other factors.

Federal Reserve’s decision

Recently, a local media outlet shared a post on X noting that U.S. President Donald Trump stated that immediate rate cuts are required from the next Fed Chair.

Adding to the optimism, the prominent forecasting platform Polymarket also predicts strong demand for rate cuts, with the odds of a potential cut now soaring to 95%.

The platform indicates a 95% chance that the Federal Reserve will reduce interest rates by 25 bps. This rate cut optimism has been further reinforced by White House Advisor Hassett, who noted there is plenty of room for interest rate cuts.

A rate cut often triggers an upside move because it makes borrowing cheaper and weakens the dollar. Large investors and institutions often seize rate cuts as an opportunity by increasing their crypto purchases, which adds buying pressure on the asset and brings upside momentum.

Twenty One Capital CEO Eyes on Bitcoin

Besides the rate-cut optimism, Twenty One Capital CEO Jack Mallers recently made a bold statement in an interview with CNBC, which is now drawing widespread attention from crypto enthusiasts. Mallers stated, “We are going to buy as much Bitcoin as we possibly can.”

A statement by institutions like Twenty One Capital has a strong potential to influence the crypto market, as these firms manage large volumes of capital and their outlook often shapes investor sentiment.

Crypto ETFs Demand Soars on Wall Street

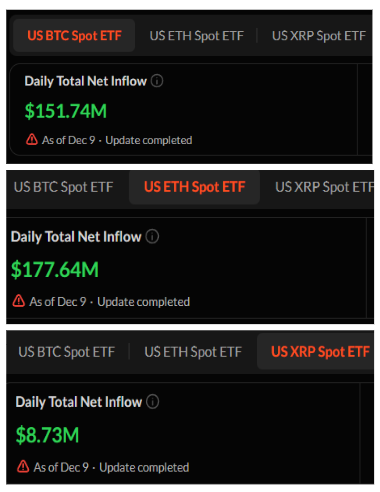

Another factor that influences upside momentum seems to be heavy inflows into large Crypto Exchange-Traded Funds (ETFs), as per an on-chain analytics platform, SoSoValue.

On December 9, 2025, major U.S. crypto ETFs, including Spot Bitcoin, Ethereum, and XRP, recorded inflows of $151.74 million, $177.64 million, $8.73 million, and $16.54 million, respectively.

The heavy inflow in the crypto ETFs suggests growing demand from Wall Street investors and also points to a flow of capital from investors into crypto products.

Also Read: Solana (SOL) Price Gains 6% as Whale Moves $13.5 Million SOL to Binance, But ETF Inflows Grows!