Key Takeaways

- Today, an unknown wallet transferred 132.4 million Dogecoin (DOGE) to the Robinhood exchange.

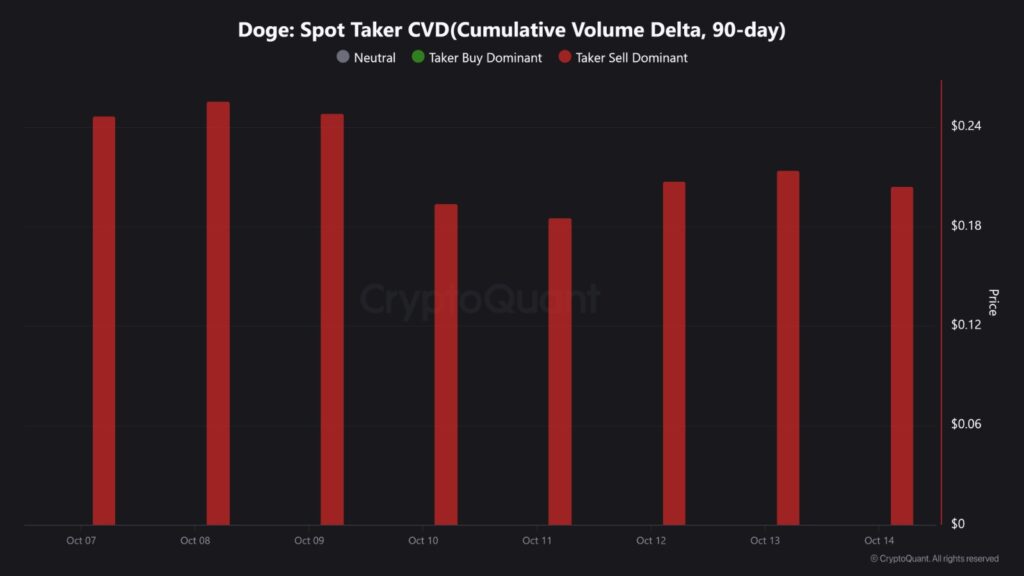

- On-chain metric Spot Taker CVD further reinforces DOGE’s bearish outlook by signaling aggressive selling activity.

- Price action suggests a potential 25% dip if DOGE fails to reclaim the $0.209 level.

As the crypto market faces uncertainty, a whale’s transfer of 132.4 million Dogecoin (DOGE) to the Robinhood exchange has sparked fears of potential selling pressure. The wallet address behind the transaction remains unknown, and the move comes just as the market has begun showing signs of recovery.

Dogecoin Current Price and On-Chain Metrics

Despite the whale’s significant transaction, DOGE’s price remains neutral. In the crypto landscape, transferring assets from a wallet to an exchange is typically considered a potential sell-off signal and a bearish indicator for asset holders. Despite this, DOGE’s price has remained stable following the whale’s large transfer.

According to the latest data from TradingView, the meme coin is currently trading at $0.203, reflecting a 0.24% decline today. However, market participation remains cautious, as evident from the trading volume, which has dropped by 45% to $3.45 billion over the past 24 hours.

Another red flag-raising concern for DOGE is the Spot Taker CVD (Cumulative Volume Delta) metric. According to on-chain analytics platform CryptoQuant, DOGE’s spot taker CVD has consistently printed red bars over the past week, indicating dominant taker-sell activity over the past 90 days and reinforcing bearish sentiment in the market.

Also Read: DOGE’s 14-month Support under Threat, Eyes on $0.1780!

Derivatives Data Signal Mixed Sentiment

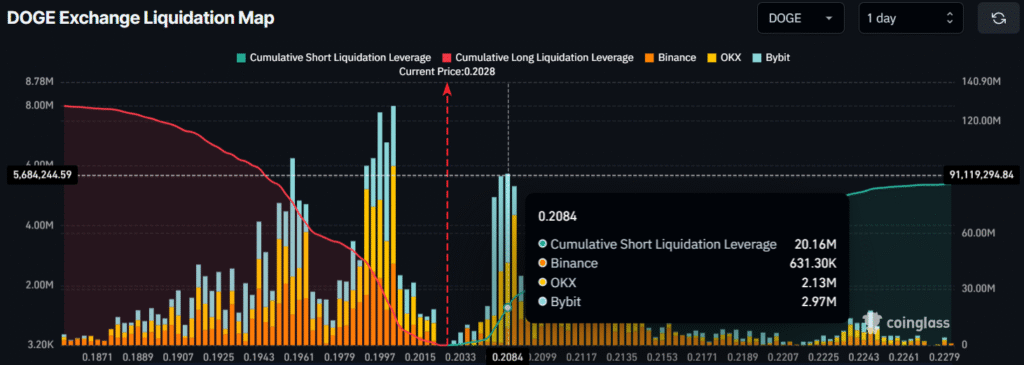

Derivative platform Coinglass further reinforces the bearish outlook for DOGE on a shorter time frame, while long-term investors remain bullish, continuing to accumulate the tokens.

According to the latest data, DOGE’s major liquidation levels (where traders are over-leveraged) stand at $0.2003 on the lower side and $0.2084 on the upper side, marking the points with the highest bets.

The data further reveals that traders at these levels have built $17.53 million in long positions and $20.16 million in short positions. These figures indicate that DOGE’s intraday sentiment is bearish.

On the other hand, DOGE spot inflow/outflow data reveals that over the past 24 hours, exchanges have recorded an outflow of $17.17 million worth of DOGE, suggesting potential accumulation and reduced selling pressure.

Dogecoin (DOGE) Price Action and Key Levels to Watch

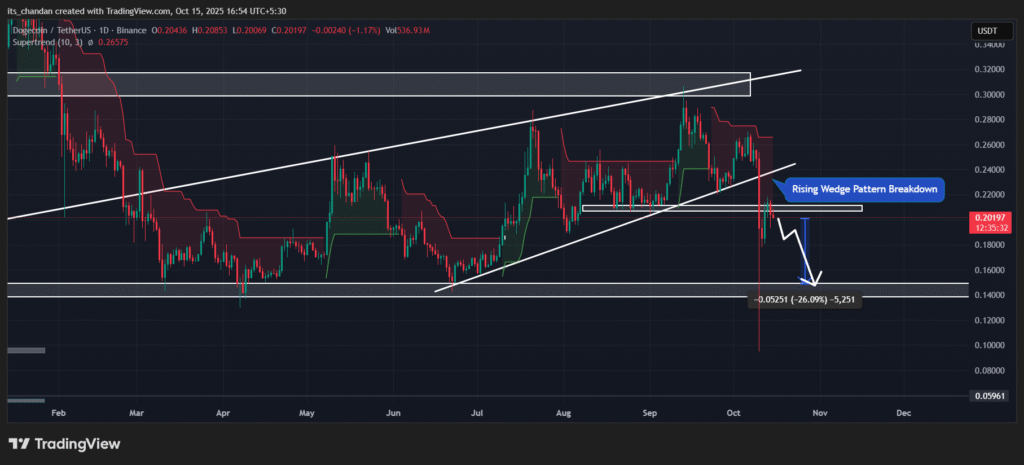

Besides on-chain metrics and derivative data, DOGE’s daily chart still signals a bearish outlook for the meme coin. The key factor driving this bearish sentiment is the recent breakdown of a rising wedge pattern, along with a critical support level at $0.209.

In recent days, while the overall crypto market was recovering, DOGE failed to reclaim this support and continues to hover below $0.209.

Based on the current price action, if DOGE’s downward momentum continues, there is a strong possibility that the meme coin could experience another 25% dip, potentially reaching the $0.145 level.

At present, the Supertrend indicator remains in a red trend and is positioned above the coin, signaling that the asset is in a downtrend with strong selling pressure.

Also Read: Dogecoin News Today: DOGE Price Under Pressure, 20% Crash Possible