Key Takeaways

- Dogecoin whales added 10.5 billion DOGE at the $0.21 level, but the current price plunge hints at a potential buying opportunity.

- Price action suggests that if DOGE holds the $0.184 level, it could soar by 49% and potentially reach the $0.293 level.

- Despite the bullish outlook, trader sentiment appears bearish, indicating short-term struggles ahead.

Dogecoin whales’ massive 10.50 billion DOGE accumulation is now backfiring as the price plunges notably from the buying level, forming a strong resistance zone. Today, a well-followed crypto expert shared a post on X, noting that whales purchased substantial amounts of DOGE at the $0.21 level, but the meme coin’s price has since dropped more than 7%.

Dogecoin (DOGE) Current Price Momentum

According to TradingView data, DOGE is trading at $0.193 at press time, recording a 3% price dip. The asset’s decline is now raising questions about whether this is an ideal buying opportunity or if the price will plunge further in the coming days.

Technical Analysis and Upcoming Levels to Watch

TimesCrypto’s technical analysis, DOGE is in a downtrend with strong directional momentum. On the daily chart, the meme coin appears to be trading below the 200-day Exponential Moving Average (EMA), with the Average Directional Index (ADX) value above 37 — well above the key threshold of 25.

However, the price level where DOGE is currently hovering appears to be strong support, as the meme coin has respected this level since the beginning of July 2025. Historically, whenever DOGE reaches or approaches this level, it has often witnessed a price reversal — a pattern that has occurred more than six times.

Looking at the current market sentiment and price action, if DOGE holds above the $0.184 level, history could repeat itself, potentially leading to a price uptick of over 45%, with the coin possibly reaching the $0.29 level.

The DOGE bullish thesis will remain valid as long as the price holds above the $0.184 level; otherwise, sentiment could turn bearish, and the meme coin may experience a sharp decline.

Traders Bearish Outlook

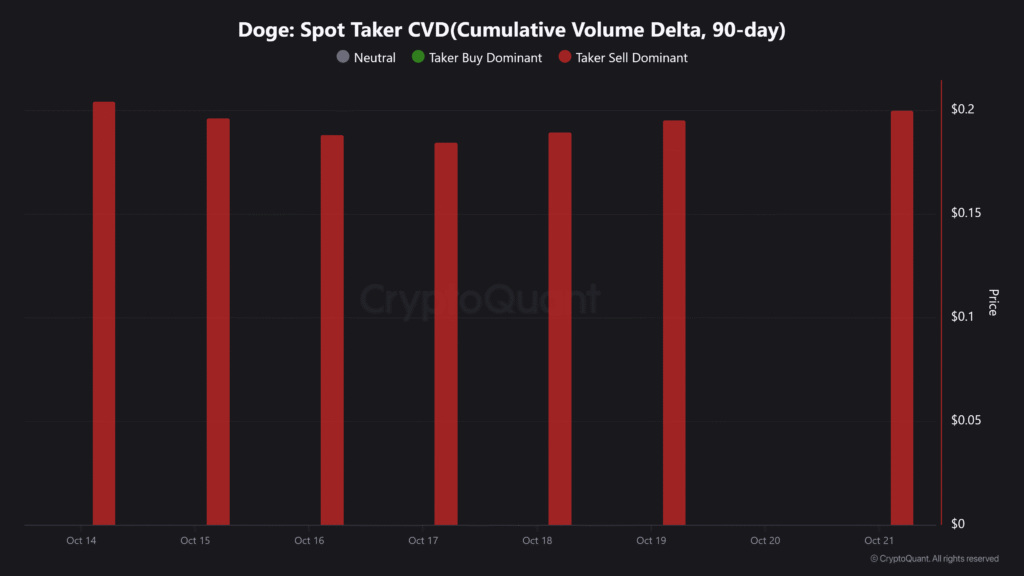

Despite the optimistic price action, on-chain metrics are still flashing a red flag, suggesting potential struggles in the coming days. Data from CryptoQuant’s Spot Taker CVD (Cumulative Volume Delta) reveals that the difference between buy and sell volume has remained in the red for the past seven days, indicating that sellers have been more aggressive than buyers.

According to the data, Dogecoin’s selling pressure appears to be dominant, indicating that traders are offloading DOGE rather than accumulating it.

Major Liquidation Levels

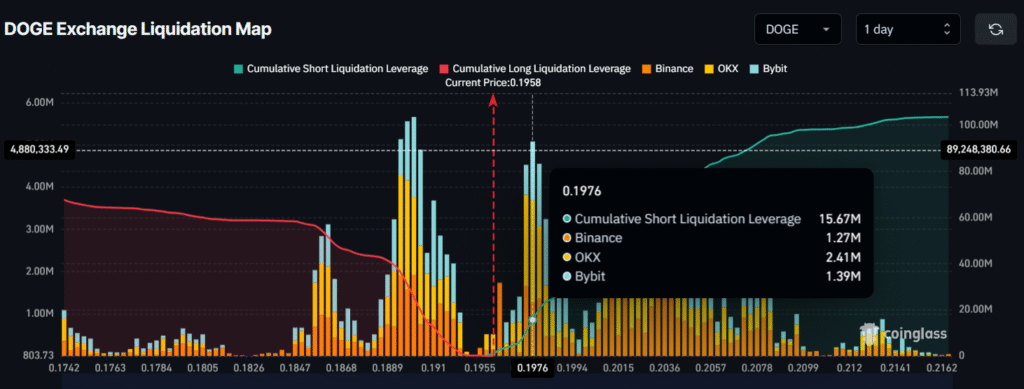

Meanwhile, derivative data from Coinglass shows that DOGE’s major liquidation levels currently stand at $0.1901 on the lower side and $0.1976 on the upper side. At these levels, traders have built $10.32 million in long positions and $15.67 million in short positions.

Considering the whales’ accumulation alongside the current trader sentiment, DOGE still appears to have long-term potential; however, short-term sentiment remains weak, suggesting the coin may face further struggles in the coming days.