Key Takeaways

- Dogecoin (DOGE) price could crash 13% if it fails to hold the $0.256 level.

- Crypto whales have dumped 680 million DOGE over the past 96 hours.

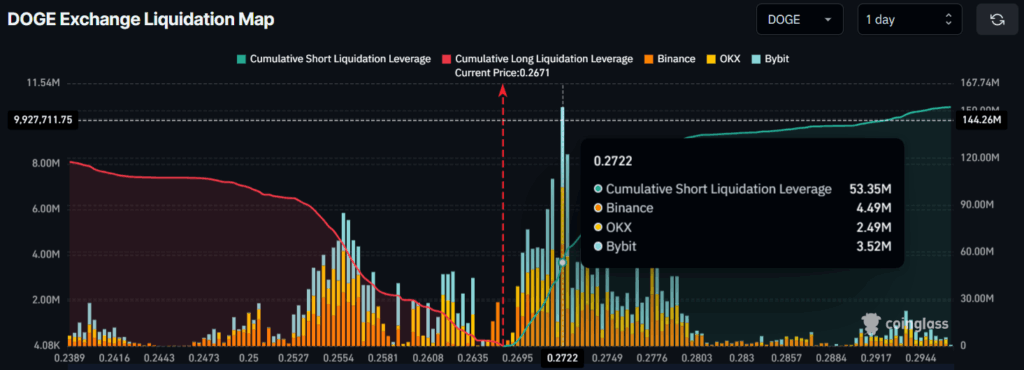

- DOGE’s major liquidation levels are at $0.2557 on the lower side and $0.2722 on the upper side.

The recent price uptick in the largest meme coin, Dogecoin (DOGE), was seized by a crypto whale as they dumped millions of tokens.

Whale Activity and Token Dump

A prominent crypto expert recently shared Santiment data revealing that Dogecoin (DOGE) whales holding between 100 million and 1 billion DOGE have offloaded 680 million tokens.

This substantial dump was recorded over the past 96 hours, equivalent to four trading days. During this period, the meme coin plunged 13%, according to TradingView’s daily candle data.

Current Price Momentum

As of writing, DOGE is trading near $0.268, recording a modest 0.50% gain over the past 24 hours. During this period, the meme coin’s trading volume dropped by 33%, indicating a lack of investor and trader participation compared to the previous day.

The potential catalyst behind this dump appears to be the recent price uptick, which triggered profit-booking along with price action that suggests potential downside momentum.

Also Read: Space Mission DOGE-1 Cuts Costs While U.S. Dogecoin ETF Approaches Debut

Dogecoin (DOGE) Technical Analysis and Key Levels

According to TimeCrypto’s technical analysis, DOGE appears to be in an uptrend, but on the daily chart, it has been hovering within an ascending channel pattern between the upper and lower boundaries.

With the recent price jump, the meme coin has reached the upper boundary and has since been witnessing selling pressure and further downside momentum. Historically, DOGE has reached this level twice, and each time it recorded a sell-off followed by downside momentum.

Based on the current price action, if DOGE closes a daily candle below the $0.256 level, there is a strong possibility that history may repeat, and the price could see a 13% downside move. On the other hand, if the momentum rebounds and the price holds the $0.256 level, further upside and a potential 20% price jump are also possible.

Despite the substantial sell-off and price dip, the Supertrend indicator still hovers below the DOGE price and remains green. This indicates that the meme coin is in an uptrend, with bullish momentum likely to continue in the near term.

Whereas, the Average Directional Index (ADX) value reaching 26 indicates a strengthening trend, suggesting that DOGE’s ongoing momentum could be sustained.

Traders’ Sentiment and Liquidation Levels

Given the current market sentiment, it appears that traders are strongly following the current trend by betting on short positions.

Coinglass, an on-chain analytics tool, reveals that DOGE’s major liquidation levels are at $0.2557 on the lower side and $0.2722 on the upper side. At these levels, traders are over-leveraged, holding $28.72 million worth of long positions and $53.35 million worth of short positions.

Looking at this metric, it appears that traders’ current sentiment is bearish, as they believe that DOGE’s price is unlikely to rebound to the $0.2722 level anytime soon.