Table of Contents

Key Takeaways

- Ethereum revenue dropped 44% in August 2025 compared to the past month.

- The network earned $14.1 million in August, which was down from $25.6 million in July.

- ETH marks an all-time high (ATH) price of $4,957 on August 24 amid the revenue drop.

- Analysts like Dean Chen state that in the short term, Ethereum’s protocol revenue may remain stagnant.

Ethereum, the leader in layer-1 blockchain for smart contracts, had faced its revenue drop by 44% in August 2025. ETH marked its recent all-time high of $4,957 on August 24, while the revenue dropped from $25.6 million in July to $14.1 million in August. The price continues to signal the gap between both the metrics (price performance and network revenue).

The current price for the asset trends at $4295. As Ethereum suffers through this difficult status, questions pop up about whether its economic model is sustainable in the face of fewer fees and token burnings.

Ethereum Revenue Drop: An Overview

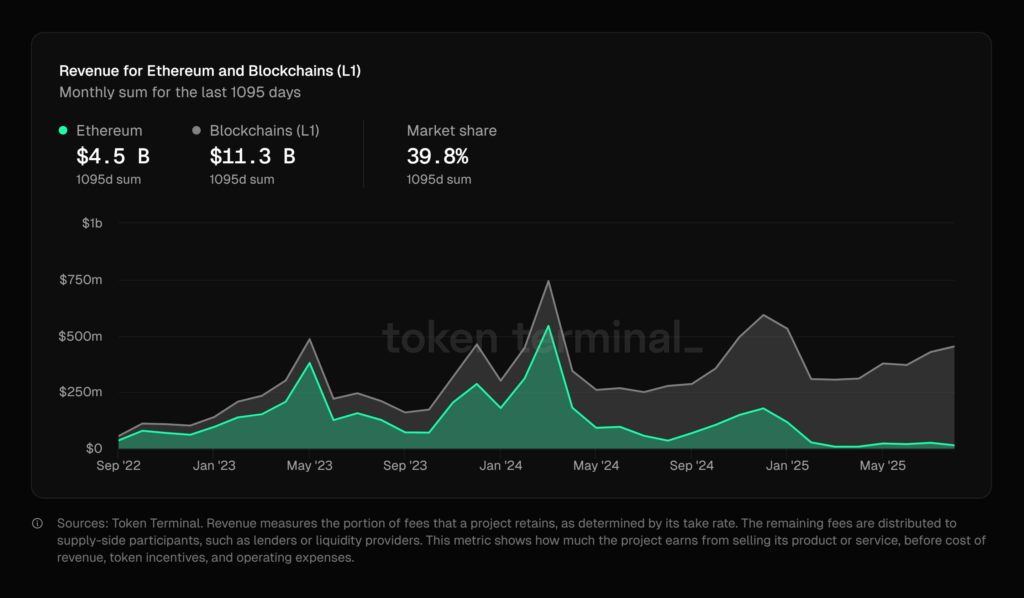

The 44% decline in Ethereum revenue was the result of lower network fees, which are the basis for burns of ETH tokens. The decline in network fees was about 20%, from $49.6 million in July to $39.7 million in August, as a result of a decline in transaction activity on the base layer. Ethereum’s price is up 240% since April yet usage on the network has shown a drop. The lower activity suggests lower burning for ETH, which negatively impacts the revenue.

Dencun Upgrade Impact

Back on March 13, 2024, Ethereum activated the Dencun upgrade, which added the negative pressure for the average transaction costs on layer-2 (L2) networks such as Optimism and Arbitrum that utilize Ethereum for the settlement purposes. Although Dencun effectively increased L2 adoption, on the other hand, it caused a decrease in transactions on the base layer, reducing total network fees. Lower fees point towards fewer ETH burns, and fewer ETH burns suggest fewer rewards and revenue for ETH holders as a whole.

However, the Dencun upgrade allowed for greater scalability; it also raised fundamental issues in Ethereum’s fee-driven economy, leading to questioning of its long-term viability.

What analysts suggest

According to analysts like Dean Chen, inflows into newly approved spot ETH ETFs became the primary driver of ETH’s price. In August, spot ETH ETFs recorded net inflows of roughly $3.8–3.9 billion, in sharp contrast to Bitcoin ETFs, which saw outflows.

Dean states that in the short term, Ethereum’s protocol revenue may remain stagnant due to higher gas limits and expanded blob capacity, but ETF and institutional inflows should continue to support price action. For the mid- to long-term time period, analyst comments,

Shifting value capture from L1 to L2 does not mean value disappears—it changes where fees accrue. If L2 ecosystems continue to grow and recycle value back into ETH via blob fees, collateral use, or settlement costs, overall economic impact could still expand.

The above statement suggests that L2 is still adding value to ETH’s overall economic impact.

What’s next for Ethereum

As Ethereum struggles with the challenges and moving forward, finding a balance between scalability and revenue generation is critical. It could employ protocol changes and/or staking incentives to help create a stable economy. To market investors, there is a clear role reversal as ETH achieves an all-time high in price while also showing a significant drop in revenues, indicating the shift to a yield-bearing asset.