Key Takeaways

- Price action suggests that Ethereum (ETH) may drop to the $4,000 mark if it fails to sustain the $4,265 level.

- Amid this dip, BlackRock dumped 33,884 ETH worth $148.6 million.

- On-chain data reveals that Ethereum has been in a Taker Sell Dominant Phase.

Bearish sentiment around Ethereum (ETH) intensified, as traders, whales, and institutions continue to create strong selling pressure. The asset recently broke out of a bullish pattern but failed to sustain and is now struggling to move higher.

On-Chain Data Reveals Intensified Selling Trends

Over the past 24 hours, several bearish activities have been recorded, raising concerns about further downside momentum.

The blockchain-based transaction tracker Lookonchain reported that asset management giant BlackRock sold 33,884 ETH, worth approximately $148.6 million, to Coinbase Prime.

Meanwhile, two crypto wallets, likely belonging to a whale, dumped 3,690 ETH worth $15.6 million in panic, which had been purchased on September 3, 2025.

Ethereum’s bearish outlook is further intensified by spot taker CVD data. The on-chain analytics platform CryptoQuant reveals that the asset has been in a Taker Sell Dominant Phase for the past week, meaning aggressive sellers are dominating aggressive buyers.

This metric often indicates strong selling pressure in the spot market, which is already evident in the asset’s price.

At press time, Ether stands at the $4,270 level, down 4.25% over the past 24 hours. This dip has reduced participation among investors and traders, triggering a 10% drop in trading volume.

Ethereum (ETH) Technical Outlook: Key Levels to Watch

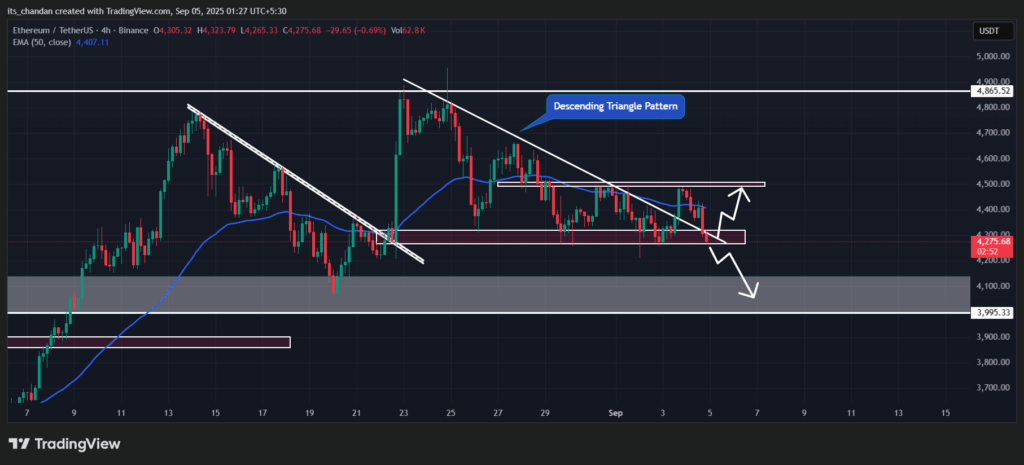

According to expert technical analysis, Ethereum (ETH) is back in its consolidation zone, currently hovering near the lower boundary. However, its strong descending triangle breakout has already failed, raising questions about a potential further dip.

On the four-hour chart, ETH has been persistently taking support at the $4,265 level since August 22, 2025, marking its sixth test of this level today. It will now be interesting to see whether the asset repeats its past performance or breaks below this support.

Based on recent price action and historical patterns, if ETH sustains above the $4,265 level, there is a strong possibility that history will repeat and the price may see an upside move. However, if it fails to hold, Ethereum could face a quick drop toward the next support level at $4,000.

At press, the 50-day Exponential Moving Average (EMA) is providing resistance to ETH, suggesting that bearish momentum may continue unless the price reclaims this level.