Key Takeaways

- With a 2.50% dip, Ethereum (ETH) risks $426.90 million long liquidations if the ETH price drops below the $4,060 level.

- Ethereum traders have built $1.12 billion short positions around $4,261.60, anticipating that the price will not surpass that level.

- Price action suggests a major rally could occur only if ETH breaks above the $4,250 resistance level.

As the Ethereum (ETH) price continues to slide, the risk of long liquidations worth nearly $427 million rises. Over the past four hours, $21 million long positions have been liquidated, according to derivatives data from Coinglass.

Ethereum Price Action and Trader Sentiment

TradingView shows that the Ethereum price has lost over 2.5% in the past 24 hours and is currently trading near a strong support level of $4,100. As a result, traders have been actively betting on $4,061.2 on the lower side and $4,241.6 on the upper side.

So far, traders at these levels have built $426.9 million in long positions and $1.12 billion in short positions over the past 24 hours. It appears they have a strong bearish outlook, believing that the ETH price is unlikely to surpass the $4,241.6 level anytime soon.

Based on the current market sentiment, if the momentum remains unchanged and the price falls below the $4,061 level, nearly $426.9 million worth of long positions could be liquidated. Conversely, if the sentiment shifts and the price surges above the $4,261.6 level, approximately $1.12 billion in short positions will be liquidated.

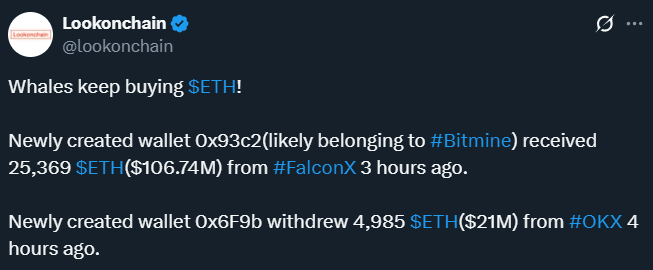

Ethereum Whale Activity Surges

Despite bearish outlook in the derivatives market, some whales have emerged, accumulating ETH and seemingly following a buy-the-dip strategy. Lookonchain, a crypto transaction tracker, reveals that two newly created wallets have added 30,354 ETH, worth $127.74 million, from FalconX and OKX over the past 24 hours.

Adding to the bullish outlook, Coinglass’s spot ETH inflow/outflow data shows that exchanges have recorded an outflow of $226.57 million worth of ETH over the past 24 hours. Such an outflow suggests potential accumulation and could reduce selling pressure.

Considering these metrics, it appears that short-term sentiment for ETH is bearish, while the long-term outlook remains bullish as accumulation continues to rise.

Ethereum Technical Outlook: Key Levels to Watch

TradingView’s four-hour chart indicates that ETH is in an uptrend, forming a higher-high and higher-low pattern since September 25. Today’s 2.5% dip has pushed ETH down to the higher-low support level at $4,100.

Based on the current price action, if this structure continues, the market could see a 3% price jump, potentially reaching $4,240. However, such a quick rally would only be possible if ETH clears the strong resistance at $4,250. On the other hand, if bearish momentum intensifies and ETH closes a four-hour candle below $4,060, it could drop to the $3,900 level.

At press time, the technical indicator Supertrend holds a green trend and hovers below the asset price, indicating a continued bullish momentum for the asset.

Read More: Bitcoin Q4 Playbook: Fed Rate Cut, ETF Flows, Key Indicators Fuel BTC’s Future