Key Takeaways

- An Ethereum whale purchased 26,029 ETH worth $118 million from Kraken.

- An expert noted that ETH’s mirroring of gold’s bullish setup suggests a potential rise to the $15,000 level in the future.

- Current price action hints that upward momentum may only materialize if ETH clears the $4,600 level.

Whale and institutional interest in Ethereum (ETH) continues to rise, with over $110 million worth of accumulation recorded in the last 24 hours.

Ethereum Whale and Institutional Activity Surges

On-chain transaction tracker Lookonchain revealed that the whale wallet address 0x982c recently scooped up 26,029 ETH, worth approximately $118 million, from the Kraken exchange.

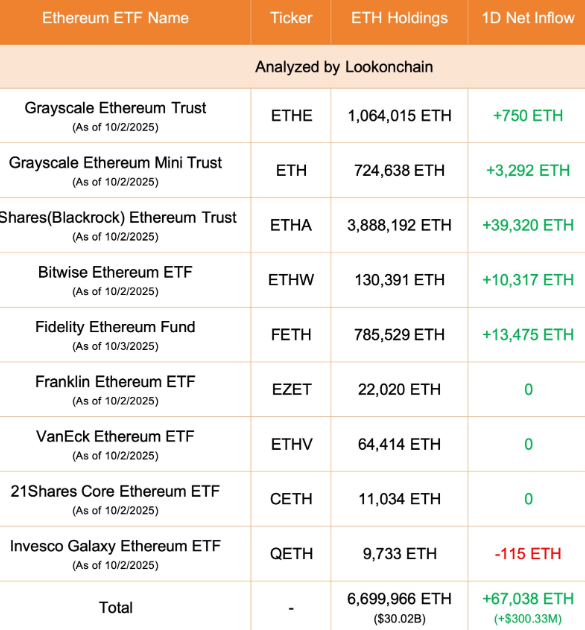

Meanwhile, institutions are following the same trend by accumulating ETH through Exchange-Traded Funds (ETFs). Lookonchain shared a post on X, revealing that nine Ethereum ETF issuers have added 67,038 ETH worth $300.33 million, indicating rising confidence and growing demand ahead of a potential rally.

Ethereum (ETH) Current Price and Market Sentiment

Despite the substantial accumulation, ETH’s price remains sideways, posting a 0.35% decline today. Currently, the asset is trading at $4,485, while market participants appear hesitant as trading volume has decreased. CoinMarketCap data shows that ETH’s 24-hour trading volume dropped by 10% to $41.55 billion.

Besides the sideways price movement, several bold predictions have recently surfaced on X, appearing achievable given the recent activity of whales and institutions.

Also Read: Bit Digital Plans $100M Convertible Note Offering to Expand Ethereum Treasury

Expert Hints Ethereum Mirror Gold’s 2024 Bullish Setup

A prominent crypto expert shared a post on X, noting that Ethereum is mirroring gold’s 2024 bullish setup. According to the shared data, gold formed a similar pattern in 2024 and surged from the $2,100 level to $3,865. The expert expects a similar rally in Ethereum’s price, stating that ETH has the potential to reach the $15,000 level in the future.

In the meantime, another expert shared a bold prediction, noting that ETH could hit the $8,000 mark by the end of 2025. Adding to the bullish sentiment, $3.5 trillion giant Goldman Sachs recently stated that it is witnessing a huge surge in institutional participation in Ethereum, hinting that the asset has strong long-term potential.

Ethereum Price Technical Outlook: Key Levels to Watch

Besides these bold predictions, TimesCrypto’s technical analysis suggests a potential correction before the next leg up. On the daily chart, ETH has been moving within a descending channel pattern between its upper and lower boundaries and is currently facing resistance at the upper boundary.

Based on the current price action, if ETH fails to break above the upper boundary, it could see a 5% price decline, potentially reaching the $4,250 level in the coming days. However, an upside rally could begin only if the asset breaks out of the descending channel pattern and closes a daily candle above the $4,600 level. If that occurs, ETH could see a 6% price uptick, potentially reaching the $4,865 level.

At press time, ETH’s Supertrend indicator has turned red and moved above the current price, indicating a downtrend. Meanwhile, the Average Directional Index (ADX) value has dropped to 14, below the key threshold of 25, signaling weak or fading trend momentum and a lack of strong directional movement in the market.

Also Read: Bitcoin ETF vs. Ethereum ETF: $241M BTC Inflows Clash With $79M ETH Outflows