Key Takeaways

- Ethereum (ETH) price dropping below $4,100 could push the asset down to the $3,860 to $3,400 range.

- Experts say recent dumps by Binance and whales triggered the sell-off.

- Traders strongly believe that ETH’s price won’t cross the $4,242.5 level anytime soon.

Amid the market dip, Ethereum (ETH) appears to have been hit the hardest compared to other major assets. Data from the on-chain analytics tool Coinglass reveals that today’s price decline in Ether has wiped out $501.73 million worth of traders’ long and short positions.

Ethereum (ETH) Loses 6.75% in 24 Hours

At press, ETH is trading at $4,160, having dropped 6.75% over the past 24 hours. However, investors and traders have shown strong activity, driving a 155% surge in trading volume during the same period.

With this dip, ETH touched the $4,100 liquidity level, which acts as a key support for the asset.

Here’s Why the Ethereum Price is Falling

On X, several bold claims have surfaced regarding this notable price dip.

Some claim that Binance is manipulating by dumping millions of ETH to liquidate long positions. While others believe heavy selloff by whales. Recently, a crypto expert shared transaction data where it appears that a crypto whale’s wallet address 0x900 has sold 16,800 ETH worth $72.80 million on Binance. This dump was recorded just ahead of the market dip.

ETH Technical Outlook: Key Levels

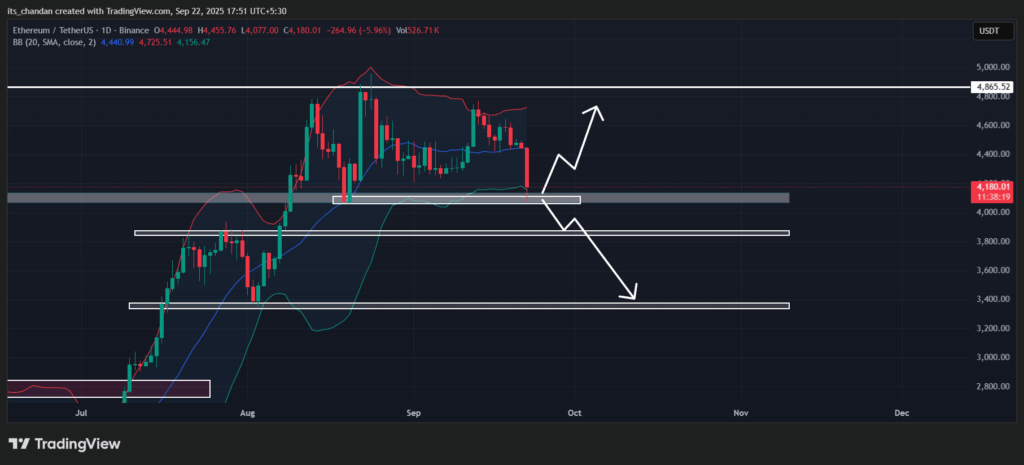

TimeCrypto’s technical analysis indicates that ETH is near a key level of $4,100, which now appears to be a make-or-break point for the asset. According to the daily chart, if ETH fails to hold this level, the next support could be at $3,860, with a further drop to $3,400 possible in the future.

At press, the technical indicator Bollinger Bands suggests that the asset is in oversold territory, with a strong possibility of a price reversal, which is being further supported by local support levels.

Expert Predictions and Accumulation Signals

However, a crypto expert also seems to be taking advantage of the current dip. On X, a well-followed expert stated that we’re seeing a big flush in the market, but that’s fine.

According to the visuals shared by the expert, if ETH fails to hold the $4,100 level, a sharp selloff could occur, and the price may drop to the $3,500 level. This could be the first region for accumulating ETH ahead of the next leg up.

However, accumulation has already begun on the exchanges, as revealed by Coinglass data. Spot inflow/outflow data shows that exchanges recorded an outflow of $216.69 million over the past 24 hours. This outflow suggests potential accumulation by investors and long-term holders.

Traders Strong Bearish Bets

Whereas, traders continue to hold a bearish outlook. Data shows that the majority of traders’ bets are recorded on the short position.

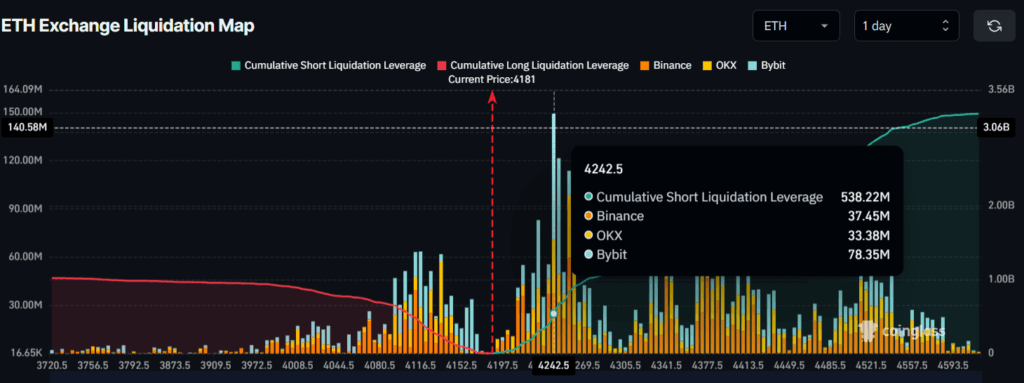

ETH’s major liquidation levels are at $4,116.5 on the lower side and $4,242.5 on the upper side, where strong interest has been recorded. At these levels, traders have built $239.2 million long and $538.22 million worth of short positions.

These metrics also hint that traders believe ETH’s price won’t cross the $4,242.5 level anytime soon.