Key Takeaways

- Crypto whales purchased 820,000 ETH, worth $3.8 billion, over the past 72 hours.

- Price action hints at a potential 4.45% rally on the horizon if it holds the $4,550 level, otherwise, the bullish outlook could be invalidated.

- An expert shared a post noting that the TD Sequential Indicator is now flashing a sell signal for Ethereum.

The crypto market appears to be heating up, especially for Ethereum (ETH), the second-largest digital asset by market capitalization. This comes after the Fed’s 25 bps rate cut, a bullish breakout, and notable whale accumulation.

Crypto Whales Add $3.80 Billion of ETH

Recently, crypto transaction tracker Lookonchain shared on-chain data revealing that Ethereum whales holding 10,000 to 100,000 ETH have purchased 820,000 ETH, worth $3.8 billion. This substantial accumulation was recorded over the past 72 hours, or three days.

The impact of this substantial ETH accumulation is evident in the asset’s price, which has soared 4.50% over the past three days.

At press time, ETH is priced at $4,590, marking a 1.85% gain over the past 24 hours. Despite the price uptick and bullish outlook, investor and trader participation during the same period has dropped by 8% compared to the previous day.

This decline in ETH trading volume, even as the price shows strength, suggests that market participants are not actively pushing the price higher.

Ethereum (ETH) Price Action and Technical Analysis

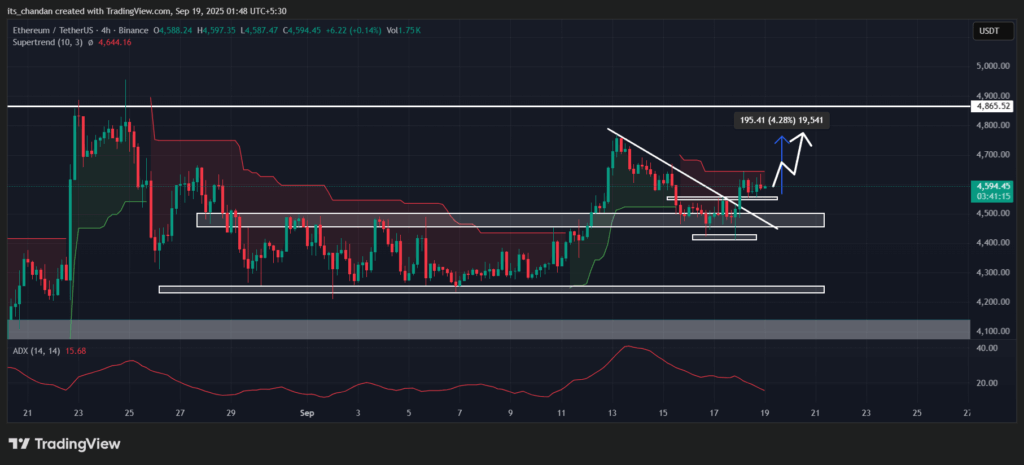

TimesCrypto’s analysis of Ethereum suggests that ETH appears bullish, having broken out of a descending trendline along with the horizontal level of $4,550. In addition, the asset has successfully retested the breakout area, partially confirming that a massive upside rally may be on the horizon.

Based on the current chart structure, if the ETH price sustains this breakout, it could see an impressive 4.45% price uptick and may reach the $4,750 level. However, this bullish outlook could be invalidated if the asset price falls below the $4,550 level.

Besides this price action, the expert who shared the whale accumulation also shared data stating that the TD Sequential Indicator is now flashing a sell signal for Ethereum.

Despite this price action, ETH’s Supertrend indicator still flashes a bearish signal, shown in red, suggesting that the asset remains in a bearish trend and reinforcing the overall bearish outlook.

The Average Directional Index (ADX) has fallen to 15, indicating a weak trend and a lack of strong directional momentum in the market.

Traders Strong Bets on Sell Positions

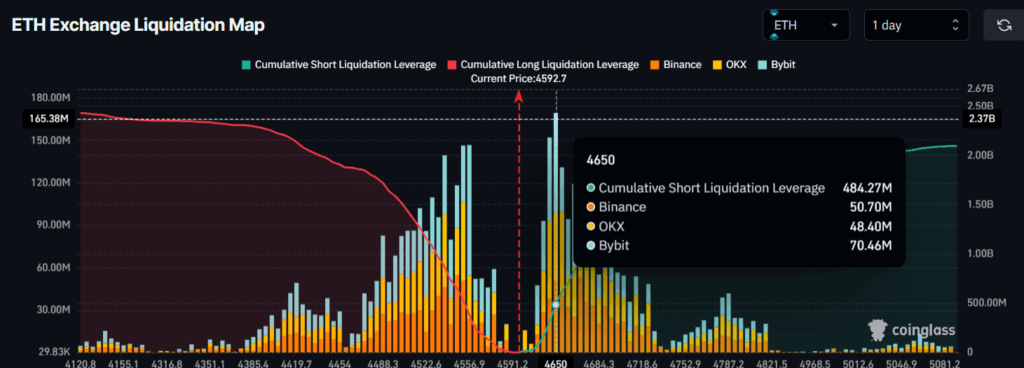

Given the current market sentiment, traders have begun betting on short positions, as revealed by the on-chain analytics tool Coinglass.

Data from the ETH Exchanges Liquidation Map shows that ETH’s major liquidation levels stand at $4,556.9 on the lower side and $4,650 on the upper side. Over the past 24 hours, traders have built $385.05 million worth of long positions and $484.27 million worth of short positions.

This indicates strong demand and interest in short positions, hinting at bearish dominance in the market.