Key Takeaways

- Ethereum co-founder Jeffrey Wilcke dumps 1,500 ETH worth $5.99 million.

- Ethereum price action hints that a potential 12% dip could occur if ETH fails to hold the $3,860 level.

- A crypto expert shared that ETH is now entering the buy zone.

Ethereum price trades sideways on Friday with a neutral bias. The ETH price made a high of $3,975, but failed to sustain the momentum. Investors are concerned about whether there will be more downside or if recovery is possible from here

At press time, the asset is trading near $3,880, down, with a 44% surge in trading volume recorded.

Ethereum Co-Founder Dumps $6 Million of ETH

Amid the price decline, Ethereum co-founder Jeffrey Wilcke’s recent transaction has garnered the attention of crypto enthusiasts. Crypto transaction tracker Lookonchain revealed that Wilcke deposited 1,500 ETH worth $5.99 million into the Kraken exchange. Such a transaction typically hints at a sell-off.

This marks Wilcke’s third transaction in 2025; recently, he dumped 500 ETH worth $2.1 million and another 500 ETH worth $2.2 million in August 2025.

Looking at the price decline and the recent dump by Ethereum’s co-founder, you might be considering offloading ETH.

Technical Outlook and Key Levels to Watch

On the daily timeframe, TimesCrypto’s technical analysis reveals that ETH has lost a key support at $4,065 and is now testing another critical support at $3,860, which is on the verge of breaking.

Based on the current price action, if the asset breaks this support and closes the daily candle below $3,830, it could decline by 12% and potentially reach $3,350. On the other hand, if ETH holds this support, it could trigger a price reversal and further upside rally.

At press time, the technical indicator Supertrend has turned red and is moving above the ETH price, indicating that the asset is in a downtrend and may continue to see downward pressure.

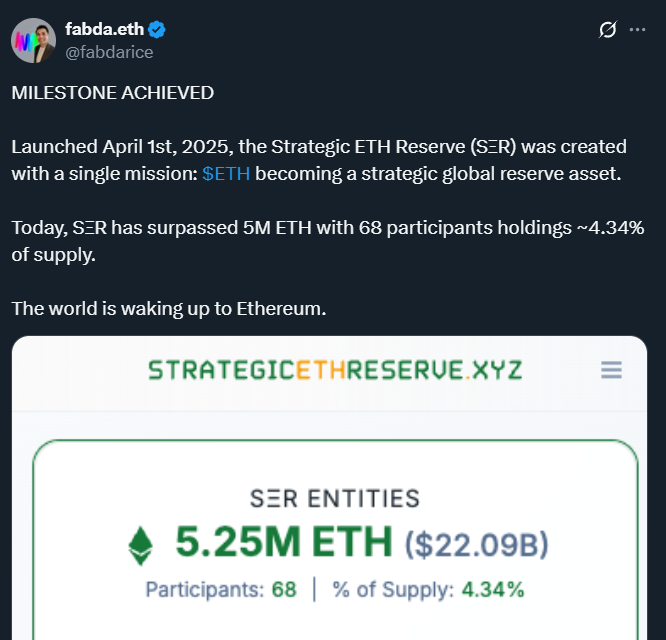

Strategic ETH Reserve (SER) Holding

A crypto expert recently revealed that the Strategic ETH Reserve (SER), launched in April 2025, now holds 5.25 million ETH worth $22.09 billion, with 68 participants controlling 4.34% of the total supply.

In this, Bitmine (BMNR) holds 2.416 million ETH worth $10.16 billion, controlling over 2% of the total ETH supply, and appears to be the largest ETH holder. The firm also seems to be heavily accumulating ETH these days, similar to Michael Saylor’s strategy (MSTR).

Looking at these data, it appears that only the short-term sentiment is bearish, while the long-term outlook remains bullish with strong potential.

In addition, another expert shared a bullish outlook. In a post on X, the expert stated that ETH is now entering the buy zone. According to the post, the asset is moving toward the 100-day Simple Moving Average (SMA).

The last time this happened, in late June 2025, the asset thereafter recorded a significant upside rally.