Key Takeaways

- Ethereum (ETH) price action suggests the asset has opened the path for a 4% price uptick.

- Amid a sentiment shift, a crypto whale added 15,200 ETH worth $70.44 million from Binance.

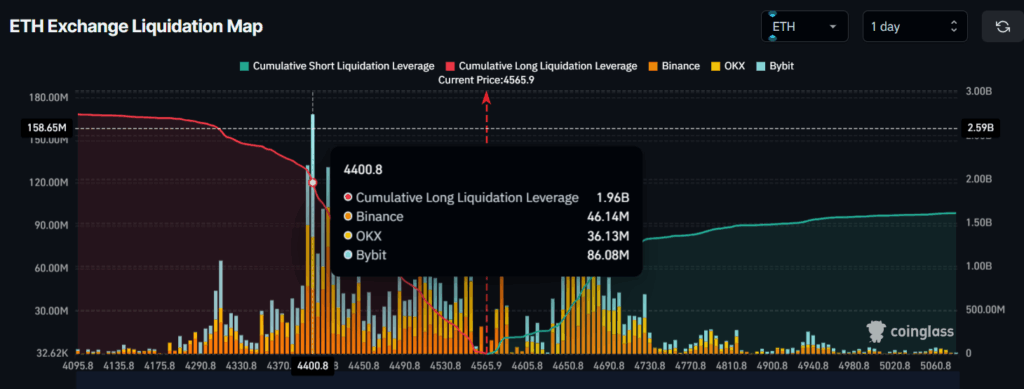

- Coinglass reveals that ETH’s major liquidation levels are at $4,400.8 on the lower side and $4,665.8 on the upper side.

Volatility has reached its peak as Ethereum (ETH) breaks out of a long-awaited resistance level following the Fed’s 25 bps rate cut. This breakout has opened the path for an upside move, which is evident on the chart.

Ethereum (ETH) Price Momentum

Currently, ETH is trading above $4,570 after climbing a modest 0.75% over the past 24 hours. Meanwhile, investors and traders have shown strong interest in the asset, resulting in a 45% surge in trading volume compared to the previous day.

This spike in volume follows the recent breakout, as market participants appear more eager to push ETH’s price to higher levels.

Given the current market sentiment, whales have begun accumulating ETH. Crypto transaction tracker Lookonchain revealed that the wallet address “0x96F4” added 15,200 ETH worth $70.44 million from Binance.

Traders’ Major Liquidation Levels

Meanwhile, traders’ market sentiment has also shifted, as billions of dollars worth of long positions have been spotted. Data from the on-chain analytics tool Coinglass reveals that ETH’s major liquidation levels are at $4,400.8 on the lower side and $4,665.8 on the upper side. At these levels, traders are over-leveraged, holding $1.96 billion worth of long positions and $751.52 million worth of short positions.

This metric clarifies that bulls’ domination over ETH has begun, as they believe the price will not fall below the $4,400.8 level anytime soon. Additionally, this level could now act as a key support for ETH.

ETH Price Action and Upcoming Levels

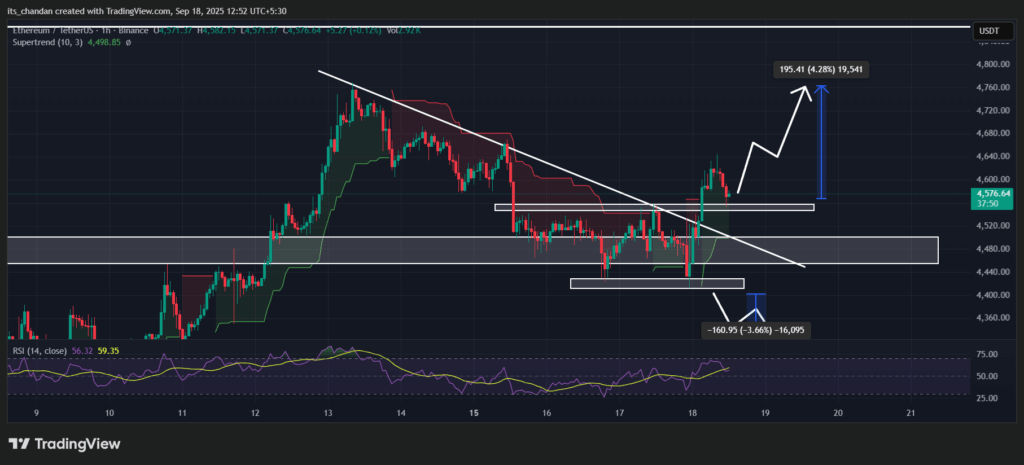

According to TimesCrypto’s technical analysis, ETH appears bullish as it has not only broken out of the key resistance level at $4,560 but also a descending trendline that had been acting as a hurdle for the past week.

On the hourly chart, ETH’s price seems to be consolidating at the breakout level. Based on the current price action, if the asset holds above $4,560, a strong 4% price uptick could be possible, pushing the price toward $4,763.

Moreover, the Supertrend indicator, which was previously in red and below the asset price, has now turned green and is hovering below ETH’s price. This suggests that the asset is in an uptrend with strong buying pressure.

Whereas, the asset’s Relative Strength Index (RSI) reached 56, indicating a neutral market sentiment with neither overbought nor oversold conditions, suggesting that ETH could move in either direction in the short term based on the buying activity.