Key Takeaways

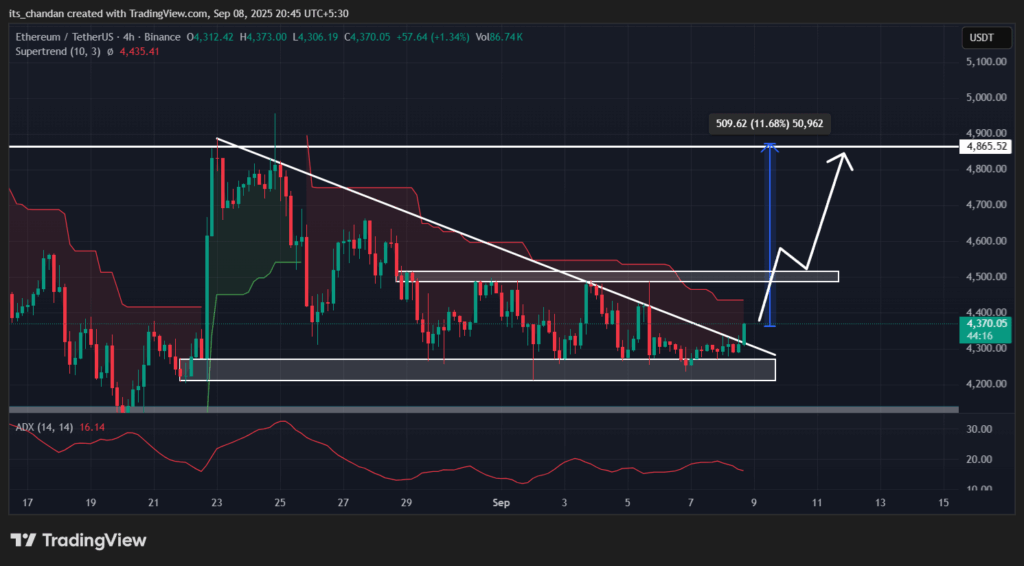

- Ethereum (ETH) has broken out of a descending triangle after multiple attempts.

- Price action hints that Ethereum is on the path to reach the $4,865 level.

- An expert commented that the $4,500 level acts as a sell wall due to ETH’s past performance.

A crypto whale, known for buying assets at low levels and selling them at higher levels, has bet millions on Ethereum (ETH).

Whales Go Big: $74 Million Ethereum (ETH) Accumulation

A blockchain-based transaction tracker, Lookonchain, shared that Longling Capital, known for buying low and selling high, purchased 5,000 ETH worth $21.57 million. With this accumulation, the firm’s current holdings have reached 88,589 ETH, valued at $383 million.

In addition, another prominent crypto whale, Tom Lee (a renowned financial analyst and businessman), along with the whale wallet address “0x19bA” purchased 8,001 ETH worth $31 million and 5,000 ETH worth $21.77 million in the past few hours.

These accumulations by crypto whales show strong confidence in the world’s second-largest asset and also hint at ETH’s long-term potential, which is already evident in the asset’s price.

Ethereum Price and Its Rising Volume

At press time, the asset’s price has jumped 1.45% over the past 24 hours, crossing the $4,350 mark. Despite the modest price uptick, ETH’s trading volume during the same period has soared by 49% compared to the previous day, indicating heightened participation among traders and investors.

You might be wondering why a small rally in the asset triggered a massive surge in participation. The answer to this is the breakout.

Ethereum (ETH) Technical Analysis: Breakout in Progress

According to TimesCrypto’s technical analysis, ETH has turned bullish after breaking out of a descending triangle pattern. On the four-hour chart, the asset has made multiple breakout attempts in the past but failed to execute; however, this time it appears to be succeeding.

At press time, the breakout isn’t yet confirmed and can only be validated if a four-hour candle closes above the $4,355 level. Based on the current price, if this happens, there is a strong possibility that ETH could see a price uptick of 11.50% and may reach the $4,865 level in the future.

Indicators & Expert Alerts: Caution Ahead

Despite the bullish breakout, the technical indicators Supertrend and Average Directional Index (ADX) are still raising concerns.

On the four-hour chart, Supertrend remains in red and hovers above the ETH price, suggesting the asset is in a downtrend with strong selling pressure. Meanwhile, the ADX on the same timeframe stands at 16.37, indicating that Ethereum is currently in a weak trend and may struggle to sustain its momentum.

Looking at the current market conditions, a crypto expert shared a post on X noting that Ethereum’s price is heading toward a sell wall. The expert continued, stating, “This sell wall exists until $4.5k.”