Key Takeaways

- Whales and institutions have purchased $788 million worth of Ethereum (ETH) over the past 24 hours.

- Despite the massive purchases, ETH price has risen a modest 0.95%.

- Ethereum price action suggests that a significant rally may occur only if ETH crosses the $4,500 mark.

It seems that whales and institutions have gone crazy for Ethereum (ETH). Over the past 24 hours, they have purchased $788 million worth of ETH from various exchanges, including Binance, Kraken, and others, according to the crypto transactions tracker Lookonchain.

$788 Million Worth of Ethereum (ETH) Accumulation

The institutions that participated in the buying are Trend Research and Bitmine, which purchased 9,377 ETH worth $41.37 million and 46,255 ETH worth $200.43 million, respectively.

Amid the buying spree, SharpLink transferred 379 million USDC to Galaxy Digital. However, it is not yet confirmed whether these funds were used, though speculation suggests they may have been used to purchase more ETH.

Besides institutional activity, seven newly created crypto wallets purchased 124,576 ETH worth $546.4 million during the same period, according to Lookonchain data.

Looking at this accumulation, it is clear that whales’ and institutions’ interest and confidence in Ethereum have reached the next level.

However, the question still raises concern, why are these whales and institutions aggressively accumulating ETH? Is there any positive announcement expected in the near future?

Adding to this bullish momentum, a crypto expert revealed that since August 2025, Ethereum ETF inflows have been higher than Bitcoin’s and continue to be so in September 2025. The expert suggests this could be a potential signal that ETH may outperform BTC.

Current Price Action

At press, Ethereum trades at $4,420, having climbed a modest 0.95% over the past 24 hours. This slight surge in price feels like the calm before a major rally.

According to CoinMarketCap data, trader and investor participation continues to increase. Over the past 24 hours, ETH trading volume has jumped 18% to $40 billion.

Ethereum Technical Outlook and Key Levels to Watch

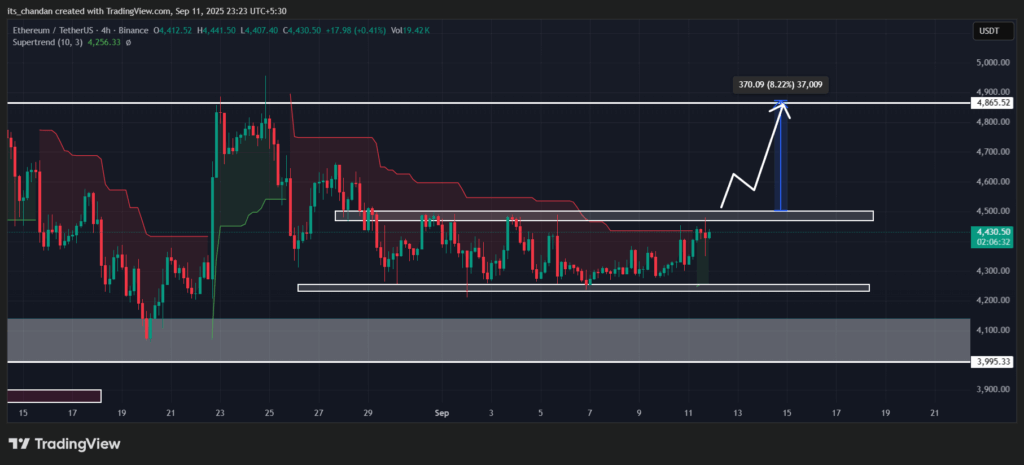

Ethereum technical analysis on the four-hour chart reveals that it is currently trading within a parallel channel pattern between $4,250 and $4,500. At present, the asset appears to be hovering near the upper boundary.

TimesCrypto technical analysis reveals that if ETH manages to break out of this upper boundary and closes a four-hour candle above the $4,500 level, there is a strong possibility that the asset could see an 8% price jump and reach the $4,865 level.

On the other hand, if it fails to do so, history may repeat itself with strong downside momentum.

At press, the technical indicator SuperTrend has turned green and is positioned below the ETH price. This suggests that the asset is in an uptrend with strong buying pressure.

What’s Next for ETH?

Considering the activity of whales and institutions alongside Ethereum’s price action, ETH appears bullish, with bulls dominating the asset. Meanwhile, it also seems that ETH may break out of the upper boundary, ending its prolonged consolidation.