Ethereum currently trades at a value that sits slightly beneath the $3000 threshold, which now serves as a market test for on-chain yield assessment after previously functioning as a breakout point. The market shows unpredictable risk behavior while exchange-traded fund (ETF) investments exhibit no signs of returning, which leads to a base case prediction that Ethereum (ETH) will remain between $2,400 and $3,600 for the next six to twelve months, except when market liquidity shifts toward risk-taking.

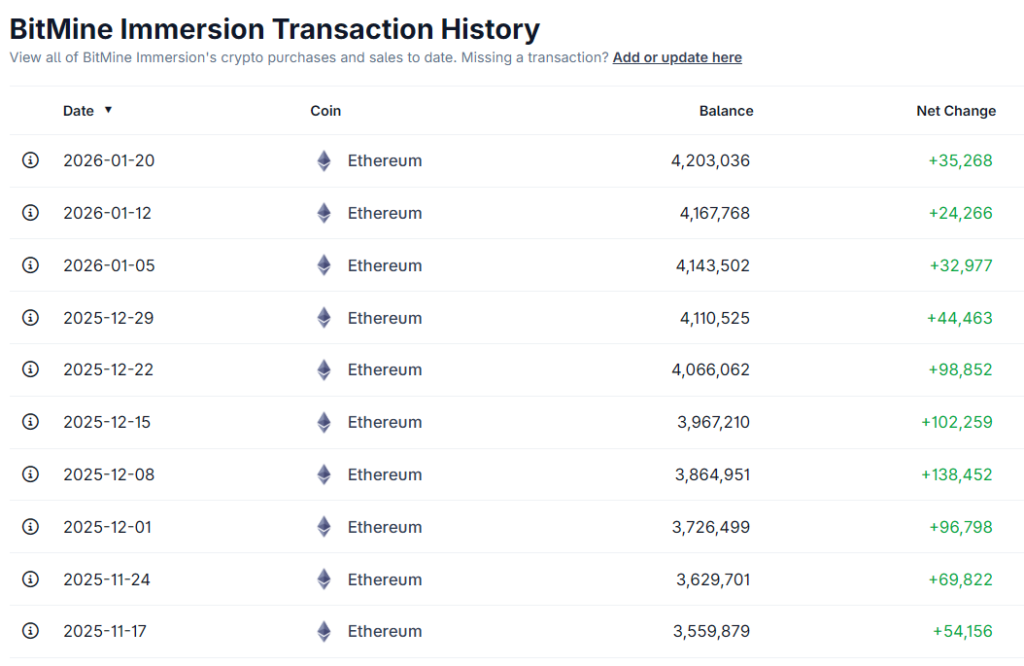

Against that subdued price action, one signal stands out for its scale and conviction. BitMine Technologies continues to deepen its exposure to Ethereum through aggressive accumulation and staking.

BitMine’s Ethereum treasury as a balance sheet thesis

BitMine has added another 171,264 ETH to staking, lifting its total staked balance to roughly 1.94 million ETH, valued near $5.7 billion at current prices. Including unstaked holdings, the firm now controls 3.48% of the circulating supply, which totals 4,203,036 ETH, with a stated long-term target of reaching 5%.

This is not a passive treasury allocation. In a recent shareholder update, Tom Lee positioned the ETH holdings as a yield-generating asset, projecting more than $400 million per year in staking income. The strategy effectively reframes BitMine as a leveraged exposure to Ethereum’s yield curve rather than a simple proxy for spot price appreciation.

In practice, the company is treating ETH less like a speculative asset and more like productive financial infrastructure.

Staking as the on-chain risk-free rate

That framing is increasingly echoed by independent research. Altcoin Vector estimates that roughly 30% of the total ETH supply is now staked, calling it a structural milestone for the network. Their viewpoint is that Ethereum has reached a phase of security, capital lock-up, and predictable yield that is comparable to foundational layers of traditional financial systems.

DeFi users consider ETH staking as a risk-free rate, that establishes a digital economic benchmark despite the asset’s ongoing price fluctuations. DeFi protocols and rollups in combination with tokenized assets now use Ethereum staking returns as their standard reference point, just as traditional markets use sovereign bond yields.

BitMine’s strategy reflects a belief that this benchmark status will ultimately matter more to valuation than short-term price fluctuations.

Price stagnation versus structural accumulation

So far, the market has not rewarded that thesis. After failing to sustain a move above $3,300, ETH has drifted back below $3,000, while Bitcoin trades near $89,000 and Solana around $128. Analysts note that failure to reclaim the $3,050 to $3,100 zone leaves downside risk open toward the mid-$2,600 range, while sustained strength above $3,250 and $3,650 would be needed to confirm renewed upside momentum.

BitMine’s equity reflects this tension. Equity investors show more concern for current market prices than for the company’s existing product yield and its market asset distribution, which results in BMNR underperformance despite the growing ETH treasury.

This divergence raises a broader question. Is Ethereum being mispriced because it is still treated as a high beta asset, even as large holders increasingly treat it as yield-bearing infrastructure?

The compressed Ethereum narrative

Some traders argue the current setup represents compression rather than deterioration. The combination of tightening weekly ranges together with higher lows on longer-term charts and early momentum shifts has created a situation where people believe that Ethereum is currently absorbing its supply while its dedicated investors keep buying more.

Whether this resolves higher depends less on technical structure and more on macro alignment. Ethereum’s upside is now tied to three variables: global liquidity conditions, sustained institutional inflows, and the market’s willingness to value staking yield as a durable cash flow rather than incidental income.

Until those align, ETH may remain range-bound, even as entities like BitMine continue to accumulate as if the outcome is already decided.

Bottom line

Ethereum’s current price does not reflect a lack of long-term conviction. Instead, it reflects a market still undecided on how to value an asset that sits at the intersection of technology, money, and yield. BitMine’s aggressive staking strategy is a high-conviction wager that Ethereum’s role as core digital financial infrastructure will eventually outweigh near-term macro hesitation.

For now, the disconnect persists. Heavy accumulation keeps on going beneath the surface, meanwhile price action remains stubbornly muted.