Key Takeaways:

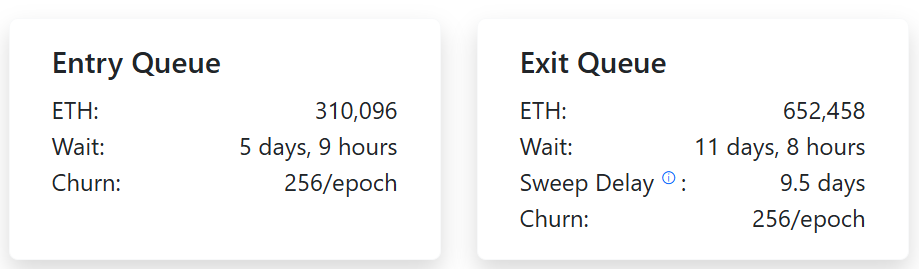

- Ethereum’s validator exit queue reached an 18-month high, with over 652,000 ETH valued at $2.39 billion queued to leave.

- Entry queues remain active, with more than 310,000 ETH waiting to join the validator set despite the ongoing exits.

- Everstake described the movement as routine validator rotation, not a signal of panic or network instability.

- Ethereum has pulled back from its July high, but technical indicators show neutral momentum with early signs of a possible rebound.

Ethereum’s validator exit queue has hit its highest level in over a year, with 652,458 ETH worth approximately $2.39 billion now lined up to leave. The queue is expected to take just over 11 days to fully clear.

The validator exit queue reflects the number of stakers requesting to withdraw from Ethereum’s proof-of-stake system. This mechanism is central to the network’s decentralized security model, where validators lock up ETH to help process and verify transactions. A surge of this size signals a huge shift in validator behavior and could indicate evolving sentiment across the Ethereum ecosystem.

The spike was brought into focus by staking platform Everstake, which flagged the sharp increase in a post on X. At that time, the projected wait period stood at 19 days. While the wait time has since dropped to just over 11 days, the total amount of ETH in the queue has continued to rise, now reaching 652,458 ETH.

Despite the concern the spike might have stirred, Everstake was quick to clarify that this does not signal a mass exit. In follow-up posts, the team framed the activity as part of regular network dynamics, with validators likely rotating operators, restaking, or realizing profits, rather than stepping away from the Ethereum ecosystem.

At the same time, interest in joining the validator set remains strong. The entry queue has now surpassed 310,000 ETH, with a waiting period of more than five days. This points to continued engagement with Ethereum’s staking infrastructure and suggests confidence in the protocol, even amid short-term reshuffling.

ETH Holds Steady After July’s Dip, Technicals Signal Cautious Optimism

Ethereum has shown resilience in the face of the validator exit surge. Despite falling from July highs around $3,860 earlier this week, the spike, while significant in volume, has not triggered any notable sell-offs.

On the technical front, the Relative Strength Index (RSI) holds near 52.56, signaling neutral momentum. Meanwhile, the MACD line has crossed above its signal, and the histogram has flipped slightly positive, pointing to tentative bullish momentum.

Market participants appear to be treating the recent withdrawals as a rotational shift within the staking ecosystem, rather than a broader vote of no confidence.

Read More: MoonPay Enters Crypto Yield Game With 8.49% Solana Staking