Amid ongoing market uncertainty, a crypto analyst shared an interesting insight from analytics platform Glassnode. In a post on X, the analyst noted that Ethereum (ETH) has two major support walls, the one at $3,150, where investors and big crypto players have accumulated 2.8 million tokens, and another at $2,800, where 3.6 million tokens have been added.

The post on X is drawing widespread attention from crypto enthusiasts, as the price of ETH is currently declining and approaching the first support wall of $3,150 level.

As of press time, ETH is trading at $3,170 and has declined 4.60%, as recorded on the charting tool TradingView. In line with price, its trading volume also plummeted 9.55% to $33.19 billion, showing lower market participation.

In crypto, when the price of the asset falls, and volume rises, it suggests market participants are interested in pushing the asset to a lower level.

But, in the current scenario, along with price, volume is also declining, which suggests participants are exhausted in driving the price downward.

However, today’s decline in ETH price may end its four-day winning streak, which began on December 6, 2025.

Also Read: Chainlink (LINK) Exchange Reserves Decline 43.2 Million, But Price not Moving!

Ethereum Exchange Reserve Continues to Decline

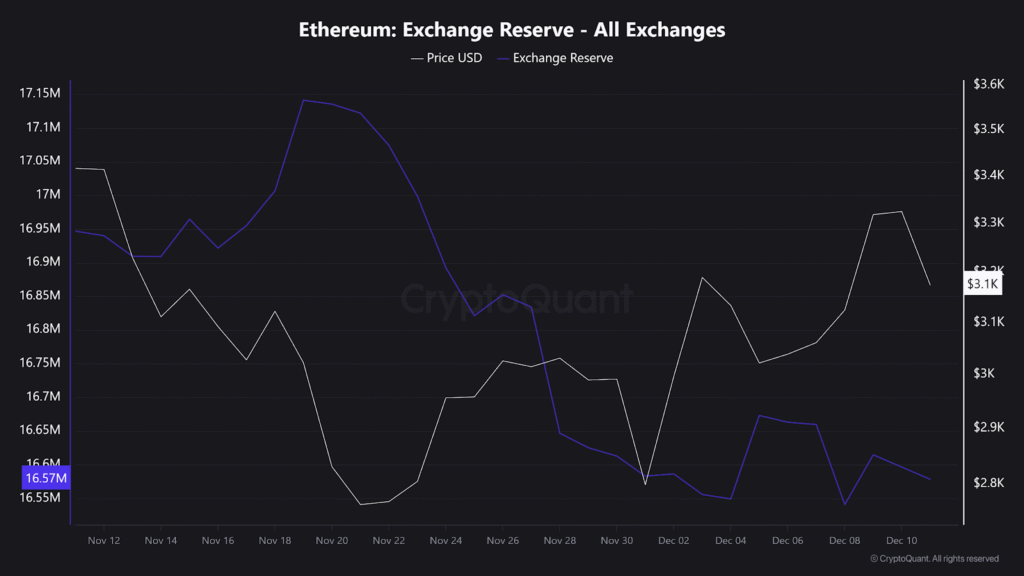

Despite the price continuing to struggle, long-term holders appear to be accumulating significantly, as reflected on the analytics platform CryptoQuant.

The Ethereum Exchange Reserve of All Exchanges shows that over the past 30 days, the ETH reserve has tanked by 381,844 ETH. During this period, prices have fallen from $3,416 to the current level of $3,170, indicating mass accumulation amid the price decline.

Exchange Reserve is an on-chain metric that reflects market activity. A declining reserve on exchanges suggests accumulation, whereas a rising reserve indicates a potential or impending sell-off.

Wall Street Pours $57.58 Million in Ethereum ETFs

Looking at other factors at the current level, it appears that Wall Street investors are also taking advantage of the recent decline. According to the analytics tool SoSoValue, U.S. Ethereum spot exchange-traded funds (ETFs) have recorded a massive inflow of $57.58 million.

The inflow suggests that fresh capital from traditional markets is entering the crypto market and also indicates growing demand for ETH on Wall Street.

Conclusion

Even after the recent dip, Ethereum (ETH) seems to be consistently buying from both long-term holders and Wall Street investors. Analyst data of 2.8 million ETH accumulation at $3,150, and $57.58 million inflow into ETFs, showing that big players are taking advantage of the recent fall.

With exchange reserves dropping and trading volume falling, selling pressure looks to be weakening. The market is showing clear signs of accumulation, pointing to potential strength for ETH soon.