Key Takeaways:

- Regulation Meets Blockchain: ERC-3643 embeds Know Your Customer (KYC) checks and transfer restrictions directly into tokens, solving crypto’s compliance paradox.

- $28B and Counting: Over 28 billion in assets—from luxury apartments to private equity—already tokenized using this standard.

- Institutional Gateway: Bridges traditional finance with Ethereum, offering banks and funds a blueprint for blockchain adoption.

The $400T Opportunity Crypto Was Missing

Picture this: A Tokyo pension fund invests in a Miami office tower via a digital token. A Dubai startup tokenizes its carbon credits for global traders. A New York gallery sells fractional Picasso ownership to verified collectors worldwide. This isn’t Web3 fantasy; it’s happening now through ERC-3643, the Ethereum token standard that turns illiquid Real World Assets (RWA) into programmable, borderless investments.

Born from Luxembourg’s Tokeny Solutions (formerly branded as T-REX), ERC-3643 tackles crypto’s elephant in the room: How do you marry blockchain’s openness with real-world regulations? The answer lies in its DNA – a suite of smart contracts that act like bouncers at a VIP club, letting only pre-approved investors trade tokens tied to regulated assets.

ERC-20’s Law-Abiding Sibling

While ERC-20 tokens thrive on permissionless trading (think memecoins or utility tokens), ERC-3643 flips the script. Imagine ERC-20 as a public park – anyone can enter. ERC-3643? A gated community with biometric checks.

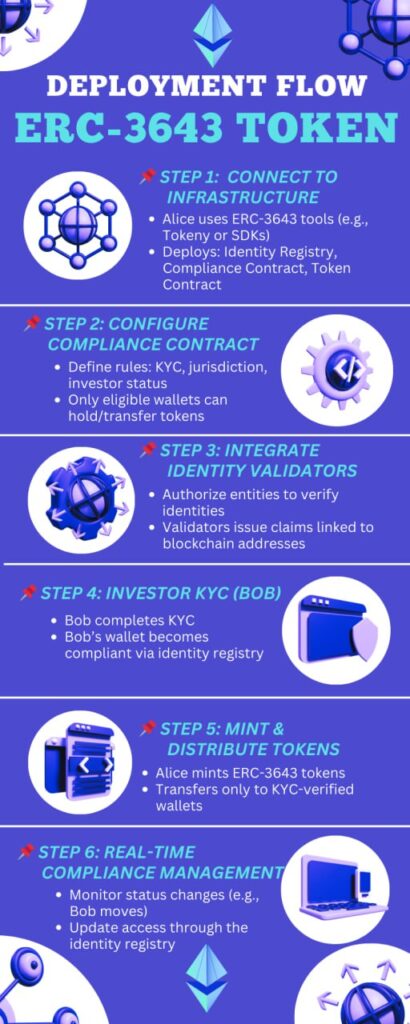

How It Works:

- Identity Layer: Every investor gets an on-chain ID (via systems like OnchainID) verified by trusted validators: banks, governments, or licensed KYC providers.

- Compliance Engine: Tokens automatically block transfers to unverified wallets or restricted jurisdictions.

- Real-Time Updates: Revoke access instantly if an investor’s status changes (e.g., sanctions, expired accreditation).

This architecture lets institutions tokenize assets without fearing regulatory blowback. Want to issue shares in a hedge fund? ERC-3643 ensures that only accredited investors in permitted countries can buy them, even on public blockchains.

From Art to Atoms: Tokenizing Everything

ERC-3643’s early adopters reveal its versatility:

- Real Estate: Fractionalize skyscrapers, enabling micro-investments with built-in ownership laws.

- Private Equity: Trade startup shares 24/7 while locking out unaccredited buyers.

- Carbon Markets: Tokenize offsets with anti-fraud features to prevent double-counting.

- Collectibles: Sell limited-edition sneakers as NFTs, but only to verified resellers.

The standard’s modular design allows custom rules. A vineyard might restrict tokenized wine barrels to buyers over 21, while a music label could limit royalty tokens to fans in specific regions.

“Tokenization is an inevitable transition in finance, but for permissioned tokens like tokenized securities, custody isn’t really about wallets. Unlike cryptocurrencies, ownership and control rely on smart contracts like ERC3643” – Luc Falempin, Tokeny’s CEO.

Why Wall Street Cares

Traditional finance spends $120 billion annually on settlement and compliance. ERC-3643 slashes these costs by automating checks:

- Faster Settlements: Trades finalize in minutes, not days.

- Lower Fees: Cuts intermediaries like custodians and transfer agents.

- Audit Trails: Every transaction is immutably logged on Ethereum.

Goldman Sachs’ recent tokenized bond issuance and BlackRock’s digital fund experiments hint at where this is headed. As Tokeny CEO Luc Falempin notes, “We’re not disrupting finance—we’re upgrading its OS.”

The Road Ahead

Critics argue ERC-3643 undermines crypto’s permissionless ethos. Proponents counter that you can’t tokenize a $300 trillion real-world asset market without playing by regulators’ rules. With giants like Siemens, Hamilton Lane, and Hedera Foundation already using the standard, the verdict leans toward pragmatism.

What’s Next

- Interchain Expansion: Bridging ERC-3643 tokens to Cosmos and Polkadot for cross-chain compliance.

- AI Integration: Machine learning models are automating risk assessments during token transfers.

- CBDC Synergy: Central banks exploring the standard for digital currency interoperability.

Summing Up

By proving blockchain can enforce real-world rules, the ERC-3643 token standard unlocks markets previously deemed too complex or risky for tokenization. The result? A future where buying a piece of a Picasso or a Parisian apartment is as simple—and compliant—as sending an email. ERC-3643 isn’t just another token standard—it’s a peace treaty between crypto and regulators. And the Real World Assets market seems to be thankful for it.