Key Takeaways

- Ethereum exchange reserves dropped by 400,888 ETH in the past 48 hours, indicating mass accumulation.

- With a 5% dip, ETH price action is shifting toward the bearish side, hinting at a potential 10% decline on the horizon.

- ETH’s major liquidation levels stand at $4,258.4 on the lower side and $4,469.9 on the upper side.

Today’s 5% dip in Ethereum (ETH) not only wiped out six days of gains but also raises doubt on a new all-time high. Amid this, whales and investors are showing strong interest in the asset, which is now raising the question; whether this is an ideal time to buy ETH, or is a price reversal still on the cards?

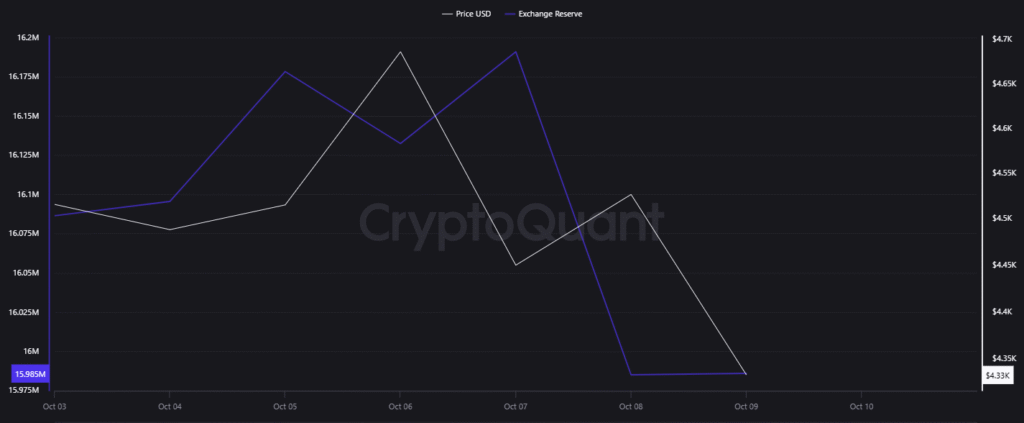

Ethereum Price and Exchange Reserves Decline

At press time, ETH is trading near the $4,330 level, down 5%, according to TradingView data. The decline has sparked significant market activity, with trading volume jumping 10% to $46.9 billion.

Despite the shift in market sentiment, on-chain metrics tell a different story, indicating mass accumulation. According to the on-chain analytics platform CryptoQuant, exchange reserves across the crypto landscape have dropped by a massive 200,888 ETH over the past 48 hours.

Such a substantial outflow of ETH from exchanges hints at potential accumulation and may indicate an ideal buying opportunity. However, the current price action after the 5% dip opens the door for a possible downside continuation.

Also Read: Grayscale Debuts First-Ever Ethereum, Solana Staking ETPs in US

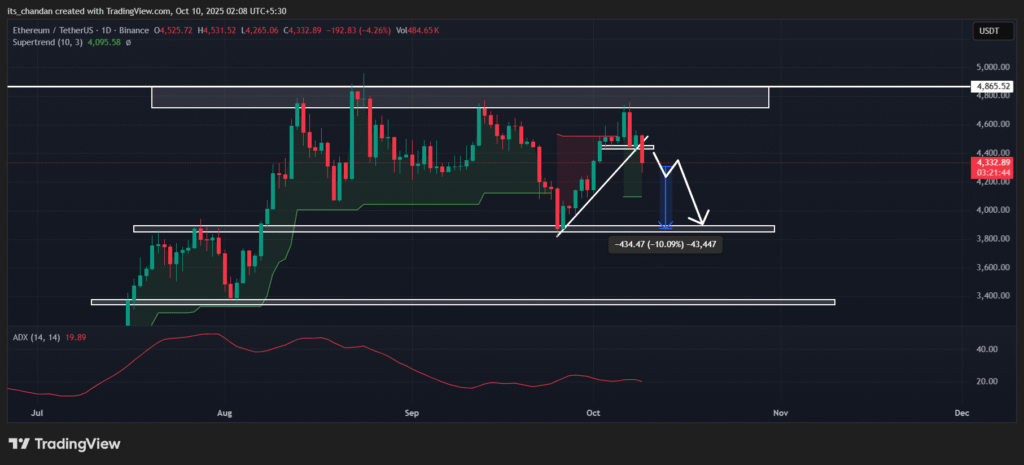

Technical Outlook and Key Level to Watch

According to TimesCrypto technical analysis, Ethereum sentiment is shifting toward the bearish side, as it has broken a key support level of $4,430, which it had held for the past six trading days.

However, this could only be confirmed if ETH closes a daily candle below $4,430; otherwise, the bearish outlook could be invalidated.

Based on the current price action, if ETH sustains below the key support level, it could see a price drop of 10% and may reach the $3,870 level. However, there is also a possibility that ETH could reverse from $4,100 due to the presence of local support.

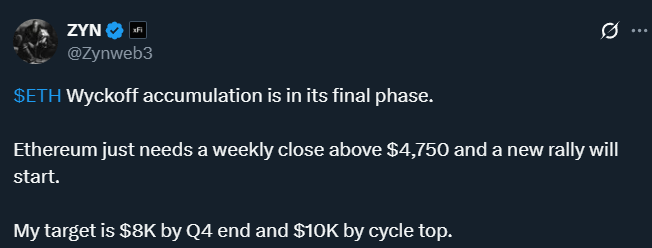

Amid this, a crypto expert made a bold prediction in a post on X, noting that ETH’s Wyckoff accumulation is in its final phase. It just needs to close a weekly candle above the $4,750 level; if it does, ETH could hit $8K by the end of Q4 and $10K by the cycle top.

Despite the price decline and bearish outlook, ETH’s Supertrend indicator remains in a green trend, moving above the asset price and indicating that the asset is in an uptrend. Meanwhile, the Average Directional Index (ADX) has reached 19.89, signaling weak directional momentum for the asset.

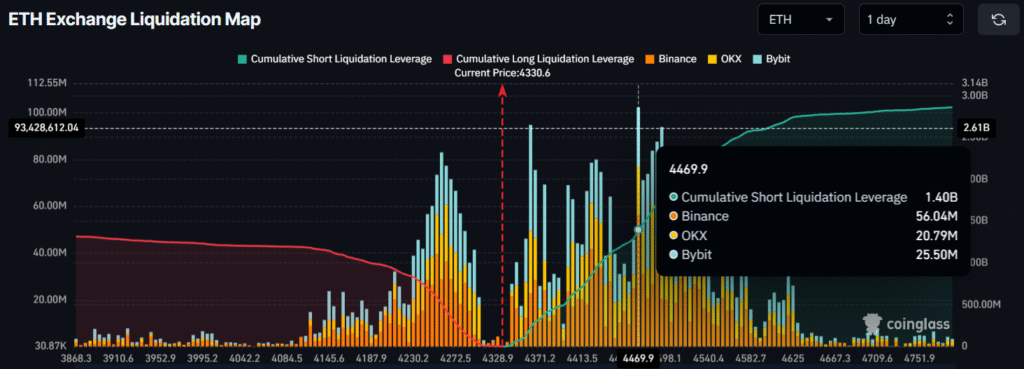

Traders Built $1.40 billion Worth Short Positions

Given the current market sentiment, traders have begun favoring short positions. According to Coinglass data, traders are strongly betting on $4,258.4 on the lower side and $4,469.9 on the upper side.

At these levels, it was recorded that traders have built $514.28 million in long positions and $1.40 billion in short positions, indicating a strong bearish view for ETH at the moment.