Key Takeaways

- Ethereum whales added $72 million worth of ETH as the price nears a breakout, hinting at a potential rally ahead.

- Price action suggests an ETH rally is possible only if it clears the $4,600 hurdle; otherwise, it may remain sideways.

- Experts have emerged with bold predictions, noting that ETH’s next targets could be $6,800 and $7,331.

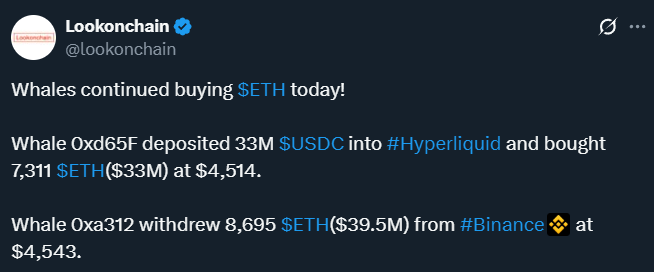

Ethereum whales’ accumulation has soared as the ETH price nears a breakout level, suggesting that a major rally could be on the horizon. On-chain analytics platform Lookonchain recently revealed that whale wallet addresses 0xd65F and 0xa312 together withdrew a massive 16,006 ETH, worth over $72 million.

The post further disclosed that the whales used Hyliquid and Binance to purchase these ETH at an average price of $4,514 and $4,543, respectively.

Whales’ Impact on Ethereum (ETH) Price

The impact of this accumulation has started to become evident in the ETH price, which jumped 1.80% and is now trading near the $4,590 level, according to TradingView data. Despite the price increase, market participants remain hesitant; as a result, ETH’s trading volume has dropped by 25% to $31.02 billion.

You might be wondering what’s making investors and traders so fearful right now. Well, the answer seems to lie in the current price action.

Also Read: Bit Digital Plans $100M Convertible Note Offering to Expand Ethereum Treasury

Technical Outlook: Key Levels to Watch

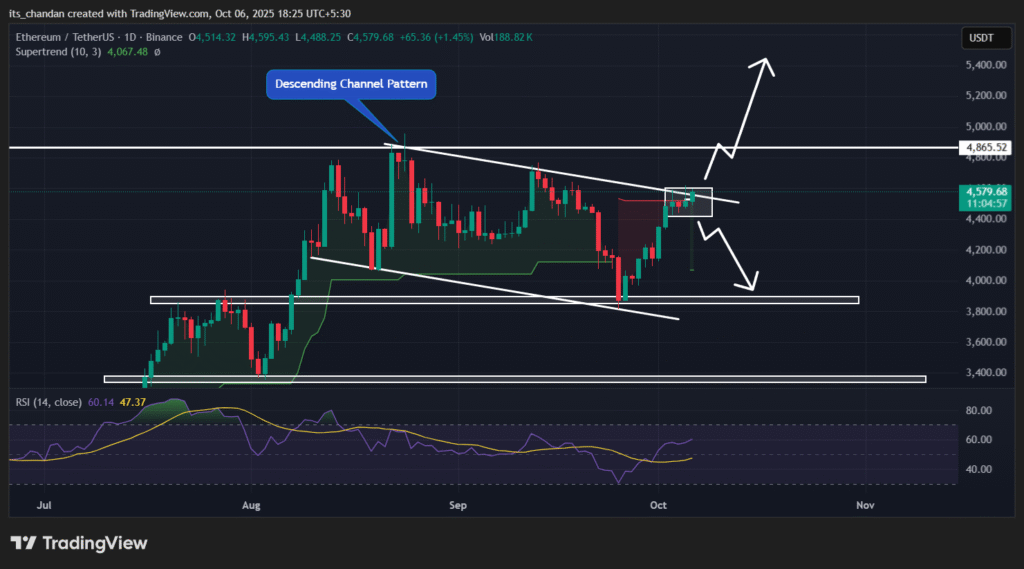

According to TradingView’s daily chart, ETH has been moving within a descending channel pattern between its upper and lower boundaries since August 2025.

During this period, whenever the ETH price reached the upper boundary, it faced strong selling pressure and a significant price drop, which led to a lack of market participation.

So far, it’s still unclear whether ETH will break out of this pattern, as the price has been consolidating near this level for the past five days within a narrow range.

Based on the current price action, if the momentum continues and ETH breaks out of the pattern and closes a daily candle above the $4,600 level, it could trigger a massive rally, potentially pushing ETH to a new all-time high.

On the other hand, if the asset fails to break out and falls below the $4,400 level, there’s a possibility that history could repeat itself once again.

Technical Indicators and Experts’ Prediction

However, the Supertrend indicator has turned green and is positioned below the price, indicating that the asset is in an uptrend with strong buying pressure.

Meanwhile, the Relative Strength Index (RSI) has reached 60.09, suggesting that the asset is approaching overbought territory but still has enough room to continue its upward momentum in the coming days.

Looking at the current market outlook, several bold predictions have recently emerged while strengthening the asset’s bullish outlook. In a post on X, an expert shared that ETH has formed a textbook-style bull flag, suggesting a potential target of $6,800, while another expert predicted that ETH could reach $7,331 in the coming days.

So far, these predictions on X have gained widespread attention from crypto enthusiasts and highlight the asset’s long-term potential.