Key Takeaways

- BlackRock deposited 59,607.8 ETH worth $206 million into Coinbase Prime.

- Ethereum’s price action hints at a potential 16% rally on the horizon.

- ETH’s major liquidation levels stand at $4,064 on the lower side and $4,213 on the upper side.

The asset management giant BlackRock could be preparing to sell some of its Ethereum (ETH) holdings. On Monday, crypto transaction tracker Lookonchain revealed that the firm deposited 59,607.8 ETH worth $206 million to Coinbase Prime.

BlackRock Dumps $206 Million of ETH

This move by BlackRock comes as Ether hovers near a local support level of $4,100. Typically, whales, institutions, and long-term holders transfer assets to exchanges ahead of a potential sell-off, but this has not yet been confirmed.

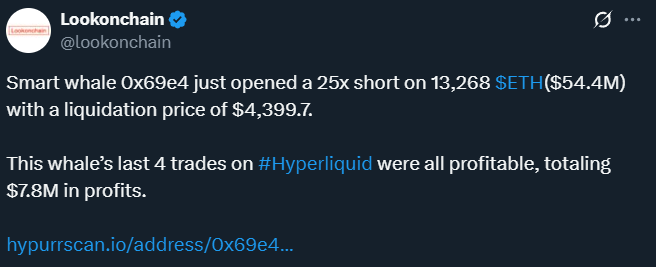

In addition, a smart trader was also found betting on the short side, hoping that ETH’s price could drop.

Lookonchain highlighted that a smart whale’s wallet address, 0x69e4, recently opened a 25x short position on 13,268 ETH worth $54.4 million, with a liquidation price at the $4,399.7 level. The report also revealed that the whale’s last four trades on Hyperliquid were profitable, generating a total profit of $7.8 million.

Current Price Action and Rising Volume

Despite the massive transfer, ETH’s price continues to shine, jumping 3.95% over the past 24 hours, according to CoinMarketCap data. At press time, the asset is trading near $4,170, with strong market participation also recorded.

Data further reveals that ETH’s 24-hour trading volume has surged by 75% to $29.94 billion.

Also Read: Bitcoin Climbs to 112K as AI Flows Rise and Geopolitics Weigh on Markets

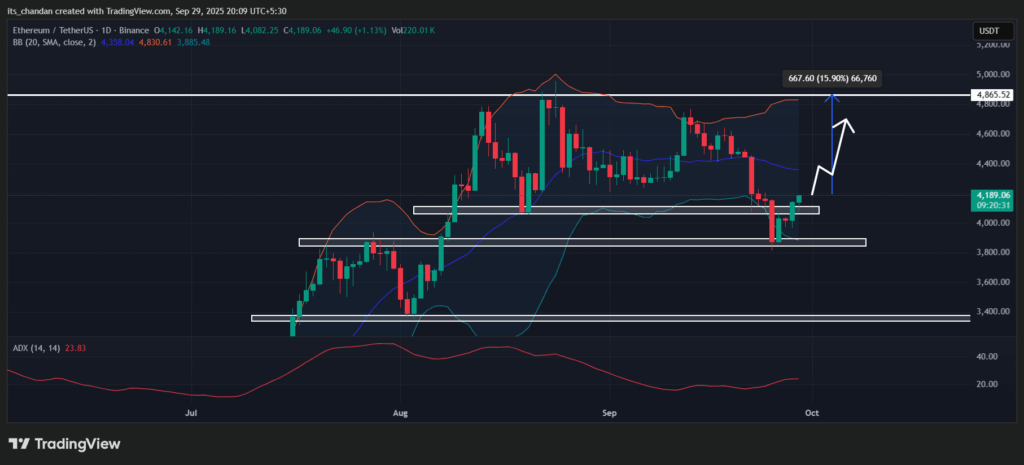

Ethereum Technical Outlook: 16% Rally on Horizon?

TimesCrypto’s technical analysis reveals that ETH has successfully reclaimed its bullish outlook, which it lost on September 25, 2026, when the price dropped 8%. Now, with two consecutive green candles on the daily chart, price action shifts completely and suggests a major price reversal could be on the horizon.

Based on the current price action, if ETH continues to hold above the $4,100 level, there is a strong possibility that the asset could see a 16% price jump and reach the $4,865 level in the future. However, there is a hurdle at the $4,230 level, which may pose resistance to further price growth.

At press time, ETH is at the lower boundary of the Bollinger Bands, indicating that the asset is in oversold territory but could soon see a notable price recovery, as reflected in its recent price action.

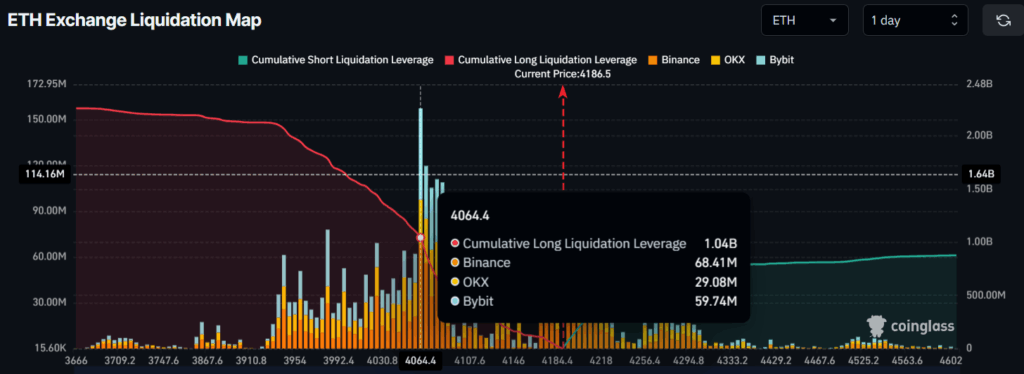

Bulls in Action Built $1.04 Billion Worth of Long Positions

Given the current market sentiment, it appears that traders are closely following the trend. Data from the on-chain analytics tool Coinglass reveals that traders are heavily betting on long positions.

At press time, ETH’s major liquidation level stands at $4,064 on the lower side, with strong trader interest recorded, and $4,213 on the upper side. At these levels, traders have built $1.04 billion worth of long positions and $397.52 million worth of short positions.

This makes it clear that bulls are currently dominating. If the upside momentum continues and ETH crosses the $4,213 level, $397.52 million worth of short positions could be liquidated.