Key Takeaways

- Ethereum price is showing positive signs as analysts expect a rally to $5,000.

- The Fusaka upgrade, scheduled on December 3, is one of the factors behind the anticipated surge.

- Into 2026, the ETH price is expected to rally beyond $6,000.

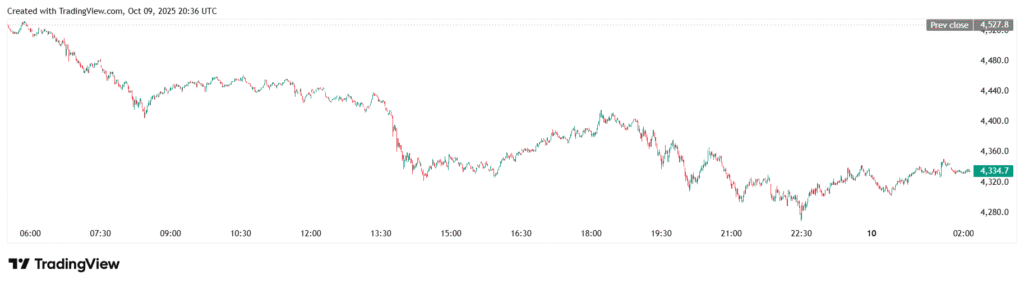

Ethereum (ETH) is on a roll in October, with its price soaring to above $4,300 and demonstrating strong stability regardless of changes in the overall crypto market. Trading about $4,349 on October 9, 2025, ETH hit a high of $4,555 intra-day and a low of about $4,314. The gradual upward trajectory indicates rejuvenated investor confidence before the next major network overhaul for Ethereum, the Fusaka upgrade that is scheduled to be implemented on December 3, 2025.

Table of Contents

Ethereum’s Fusaka Upgrade Stimulates Expectation

The Fusaka upgrade will introduce a radical technical change to the Ethereum network, the purpose of which is to make the network faster, more efficient, and scalable. One of the modifications is that the block gas limit, which was 45 million, will be increased to 150 million, a decision that is likely to threefold the number of transactions processed by Ethereum and decrease overload.

The other significant characteristic is Peer Data Availability Sampling (PeerDAS), which proposes an approach that enables nodes to validate only a bit of data rather than downloading complete blocks. This is an efficient use of bandwidth and an increase in the performance of Layer-2 rollups like Arbitrum and Optimism. Fusaka will also introduce Verkle Trees, which is a cryptographic enhancement that will shrink data structures in order to make verification relatively light and quick for mobile and low-power users.

All the mentioned improvements are intended to help Ethereum increase its throughput up to 40-60 transactions per second, improve the performance of the validators and lower development and user costs. The Ethereum Virtual Machine (EVM) is also refined by several Ethereum Improvement Proposals (EIPs) contained in Fusaka and allows executing larger smart contracts and optimized processes.

Market Confidence Strengthens by Institutional Demand

The current trend in Ethereum is highly associated with increasing institutionalization. BlackRock and VanEck asset management giants have been reported as increasing their exposure to ETH, which serves as an indicator that conventional finance is beginning to consider Ethereum as a part of long-term investments.

This institutional adoption has been accompanied by the emergence of Ethereum-based ETFs and other regulated investment products, making ETH more available to institutional professional investors, who prefer investments that are not direct. According to analysts, the combination of network upgrades and mainstream adoption of financial utilization is enhancing the market fundamentals of Ethereum.

Increased Staking and DeFi Performance Boost Price

Simultaneously, on-chain activity has been heightened. The amount of ETH that is put into staking contracts has been steadily increasing and it has the effect of taking a part of the supply out of circulation. This loss of liquid ETH will have added to price pressure.

Ethereum’s dominance in the decentralized finance (DeFi) ecosystem is also an influential growth factor. As the network of protocols, decentralized exchanges, and liquidity pools continues to run on the Ethereum platform, the demand of ETH as gas and collateral is also strong.

Technical Indicators Point to Strong Support Levels

Technically, ETH is above the major support levels despite minor intraday losses. Comments from the traders, the ability to keep the strength at over $4,300 could open the path to another breakout.

A breakout over $4,500 can lead to short-run goals of between $4,700 and $4,900 with the aid of positive momentum indicators and consistent trading volume. According to market followers, Ethereum tends to track the direction of Bitcoin, yet its stimulants, such as future network upgrades and effective staking, can enhance its own output.

Projections Indicate Future Uptrend

Analysts who have been following the path of Ethereum believe that even in the near future, the asset would hit the mark of $4,800-5,000, should the positive trend continue. Projections of the next few months indicate that the ETH will reach an average of about $5,800 in October 2025, and about $6,000 in December, should the institutional inflows be consistent and the Fusaka rollout be successful.

The current predictions for Ethereum in early 2026 indicate that ETH will continue its growth trend, reaching $6,400 and $6,700 mid-year. Also, it boasts potential for further appreciation by year-end, depending on global market conditions and technological progress.

Read More: Analyst Spots Red Flags on Bitcoin Chart as Price Stalls at $122K