Ethereum’s validator queues now favor new entrants, with more nodes waiting to join than to exit, a shift investors see as improving the backdrop for a potential bullish turn in Ether (ETH).

Staking Flows Reverse After Months of Withdrawals

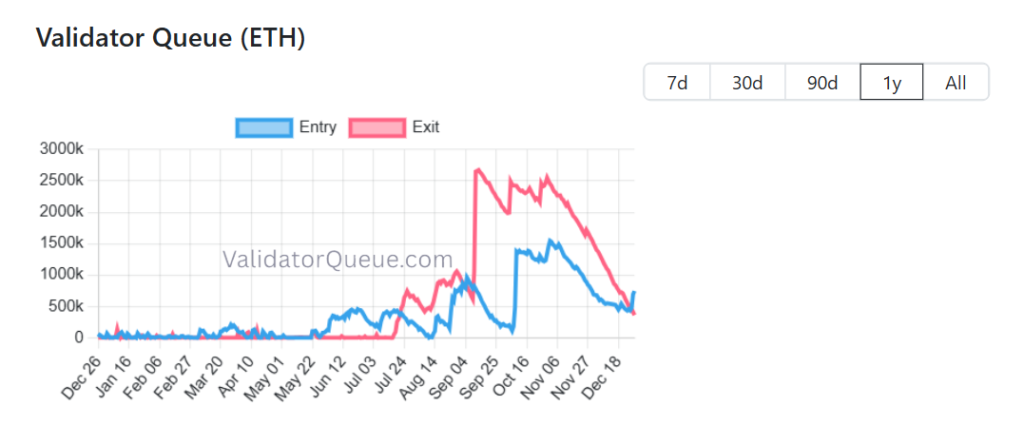

Data from ValidatorQueue show a clear shift after roughly three months of investors exiting staking positions, during which unstaking regularly added extra Ether to circulating supply and contributed to higher volatility. At the height of the exit wave in September 2025, the queue of validators waiting to leave rose to around 2.6 million Ether, while the entry queue remained much smaller.

The last time a similar higher-entry pattern was recorded was in July 2025, when the staking queue for new validators stayed ahead of the withdrawal line for several weeks. In the aftermath of that shift, Ether witnessed a bullish rally, climbing from around $2,500 in late June and early July to an all-time high near $4,950 by the end of August, before volatility returned.

Wait Times Shrink as Queues Clear

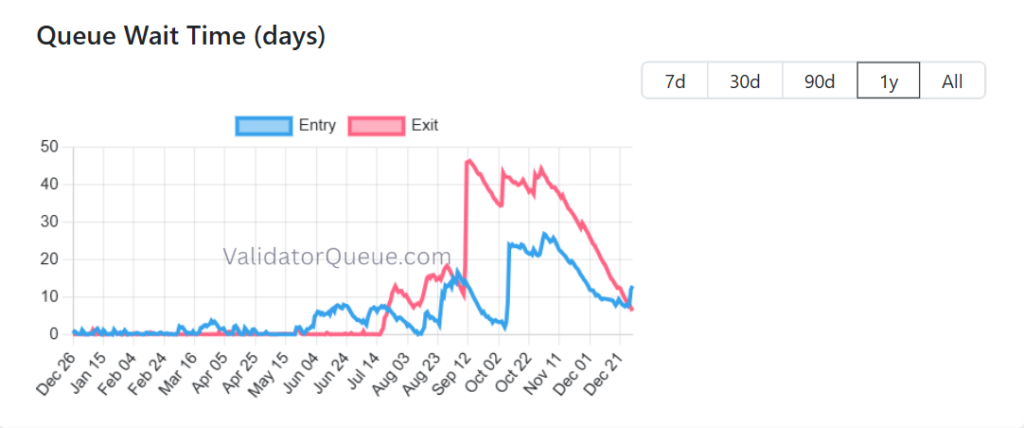

The same pattern is visible in the validators’ wait times. Earlier in the fourth quarter, validators seeking to exit faced delays of more than 40 days, underlining how congested the system had become at the peak of the unstaking wave, while entry times were much shorter during that period, reflecting the imbalance.

Now both entry and exit waits have fallen back to a matter of days, with new validators waiting slightly longer than those leaving. That shift suggests the network has cleared most of the earlier exit backlog and is handling deposits and withdrawals in a more normal rhythm again.

Impact on Supply and Pricing

The balance between the entry and exit queues offers a rough guide to how Ether supply may evolve in the coming months.

When far more validators are lined up to leave than to join, a larger share of staked coins is due to be released and can eventually move to exchanges, adding to potential selling pressure and often coinciding with weaker or more fragile price action.

When the opposite is happening and the entry queue is larger, more Ether is being locked into staking and taken out of everyday trading, which generally supports a tighter effective supply and can make it easier for fresh demand to push prices higher, provided broader market conditions are not turning risk-off at the same time.

However, queue dynamics on their own do not determine the price, but they remove one important source of pressure. With no large withdrawal line visible, the market is less exposed to a constant, mechanically driven increase in available Ether.

What to Expect and What Could Go Wrong

The current queue pattern has consistently been followed by stronger Ether performance in past cycles.

The last time new staking demand clearly outpaced exits, in mid-2025, the shift was followed by a sustained bullish move, as tighter effective supply made it easier for fresh demand to show up in the price.

However, that optimistic path is still vulnerable to setbacks. A technical or security issue at a major staking provider, a sudden need for cash among large holders, or a broader risk-off move in global markets could all trigger a new wave of exits, rebuild the withdrawal queue, and reintroduce steady selling pressure. In that case, the same queue mechanism that now helps absorb supply would once again act as a channel for additional Ether to come back into circulation.

For now, the validator data suggest Ethereum has moved beyond the most intense wave of unstaking, with more validators lining up to join than to leave.

Read More: Bitcoin Outshines Gold and Silver This Decade; Is It Ready to Replace Them?