Key Takeaways

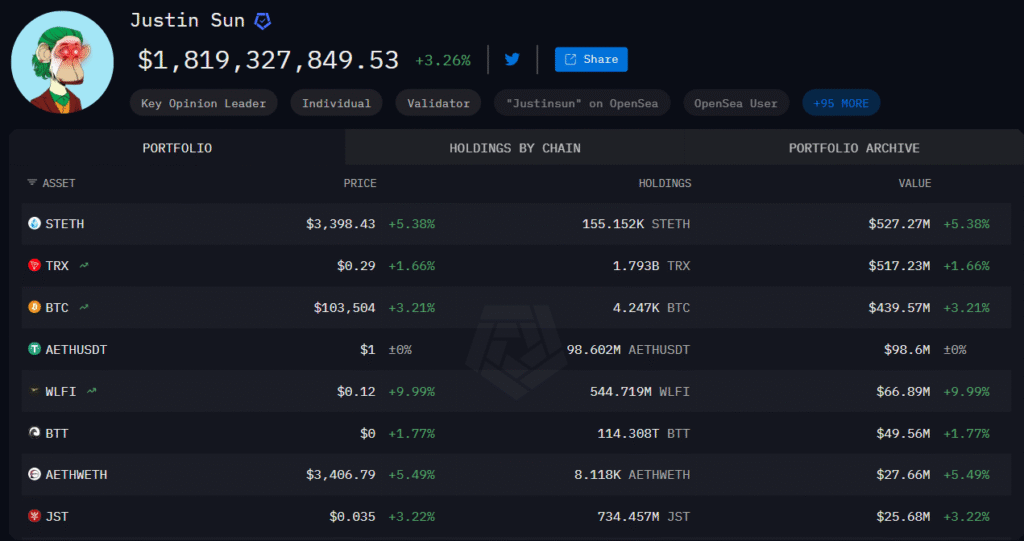

- Justin Sun staked 45,000 Ethereum (ETH) worth $154.5 million through Lido during a market crash.

- His Ethereum holdings now total $534 million, surpassing his $519 million TRX position.

- Sun’s move occurred when overall Ethereum staking activity had plummeted to multi-month lows.

Table of Contents

A Major Portfolio Pivot by Justin Sun

In a striking display of conviction, Justin Sun has executed a massive $154.5 million Ethereum staking move that has reconfigured his entire investment portfolio. The Tron founder withdrew 45,000 ETH from the Aave lending protocol and staked it right back into Lido’s liquid staking protocol.

This well-planned action has brought Justin Sun’s total ETH holdings to $534 million, now surpassing the value of his native TRX tokens for the first time.

Read also: Tron Price News: TRX Bounce Fails to Deter Bears Targeting $0.2600; Find Out Why!

Contrarian Move Amid Market Panic

The timing of Justin Sun’s accumulation is quite interesting. The billionaire founder moved his nine-figure position into staking right as Ethereum price was dropping 12% to about $3,093 (trading at $3.433 at the time of writing), and while the broader crypto market was losing around $230 billion of value.

While retail investors were capitulating, the TRON founder was methodically building his position, exhibiting the type of counterintuitive action that typically signals market bottoms.

Read also: $3.4B in Ethereum Lost Forever: The Staggering Cost of Crypto Mistakes

Implications for Ethereum and Broader Market

Justin Sun’s significant investment is about more than just a personal portfolio adjustment; it signifies that institutional confidence is backing the proof-of-stake ecosystem.

This case shows that by choosing liquid staking through Lido, Sun maintains flexibility with stETH tokens that can be used across decentralized finance (DeFi) protocols while earning approximately 3-4% annual yield.

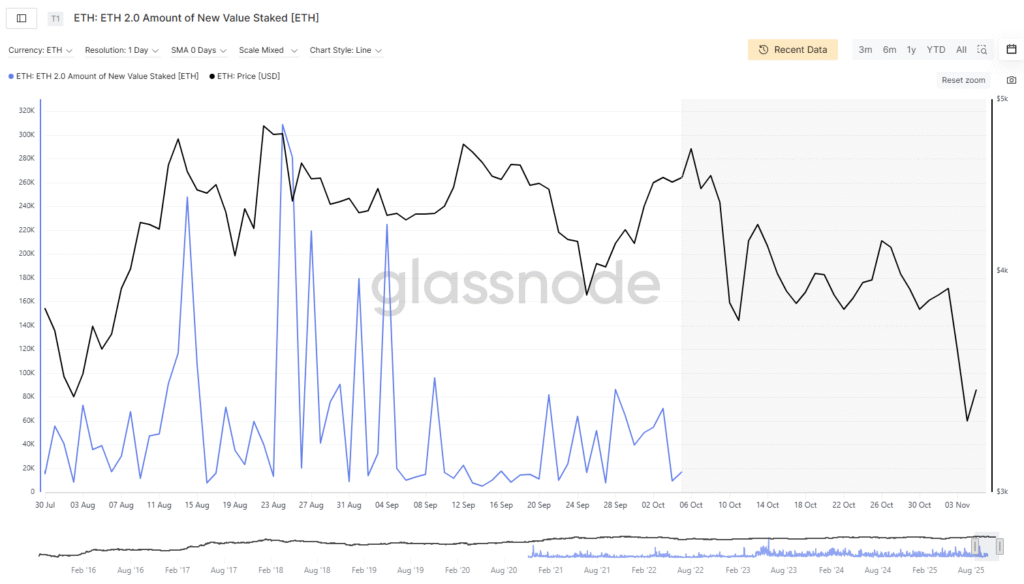

Furthermore, the move also enhances Ethereum’s supply dynamics, as reduced staking participation typically means less future selling pressure from validators. Daily deposits for new Ethereum staking plummeted from a range of 250,000 to 325,000 in August, collapsing to approximately 9,000 by early November, as shown below.

Read also: Ethereum Foundation Launches dAI Team to Power AI Agent Economy

A Strategic Bet on Ethereum’s Future

So far, Justin Sun’s smart move is a strong vote of confidence in Ethereum’s long-term value proposition. By strategically transferring capital during fear-driven market conditions and choosing a yield-generating strategy, the Tron founder has not only potentially bottom-ticked the market in moments like this but also signaled that even blockchain founders and other important figures see compelling value in Ethereum’s ecosystem alongside their own creations and financial methodologies.

FAQs

Why did Justin Sun stake his Ethereum through Lido?

Justin Sun probably selected Lido for its liquid staking feature, which provides stETH tokens that can be used across DeFi protocols while still earning staking rewards, offering greater capital flexibility.

What does this move mean for TRON?

Although Justin Sun still maintains significant TRX holdings, his greater Ethereum position suggests a diversified strategy that recognizes Ethereum’s more mature ecosystem and yield opportunities alongside his own blockchain.

How does this affect Ethereum’s market dynamics?

Justin Sun’s massive stake during low participation periods reduces liquid ETH supply and could signal to other institutional investors that current prices provide an entry for accumulation.

For more Ethereum-related stories, read: Ethereum Kohaku Roadmap Unveils Privacy-First Wallet Solutions