Key Takeaways:

- A $300 million wallet associated with Lido’s co-founder borrowed $85 million USDT to purchase ETH

- Stakers of ETH sit at unrealized profits, but if profit-taking ramps up, there may be pressure to sell

- Even while declining exchange balances are a sign of optimism, historical trends indicate that price declines are still possible

At the time of reporting, ETH has dropped over 2% in a single day, from a top of $3,938 to $3,763, according to CoinMarketCap, at the time of reporting. Moreover, Arkham Intelligence has reported several transactions from a $300 million wallet labelled as Konstantin Lomashuk, one of the co-founders of Lido Finance. Lido Finance is the biggest liquid staking platform in the cryptocurrency space, with more than $33 billion in staked assets across Ethereum and other chains.

Konstantin Lomashuk is also a co-founder and serves as the managing partner of Cyber Fund, a venture firm that focuses on Web3, Artificial intelligence (AI), and robotics. He also serves as an active member of the Lido DAO and founded the staking firm P2P.org.

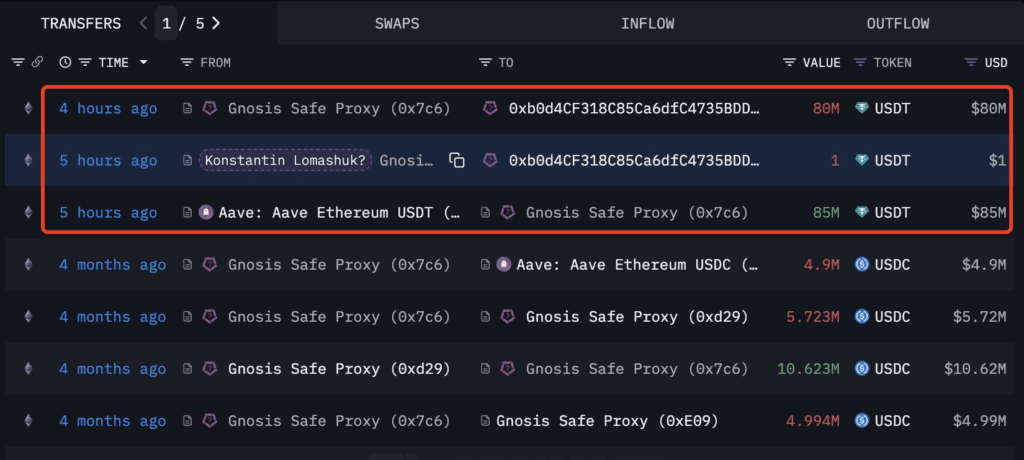

According to the on-chain trail, the wallet borrowed $85 million Tether (USDT) from Aave, which was subsequently transferred to Amber Group’s wallet. Amber Group offers crypto financial services to high-net-worth and institutional investors worldwide. Additionally, Aave functions as a decentralized bank, enabling you to borrow money against your cryptocurrency holdings or lend your cryptocurrency to earn interest.

On-Chain Transactions of the $300M Wallet

Here is a clear picture and step-by-step flow of funds that unfolded over the last 24 hours:

- The wallet publicly linked to Lomashuk, first borrowed 85 million USDT from the DeFi lending protocol Aave

- Shortly after, 80 million USDT was transferred from Lomashuk’s wallet to a deposit address associated with the Amber Group

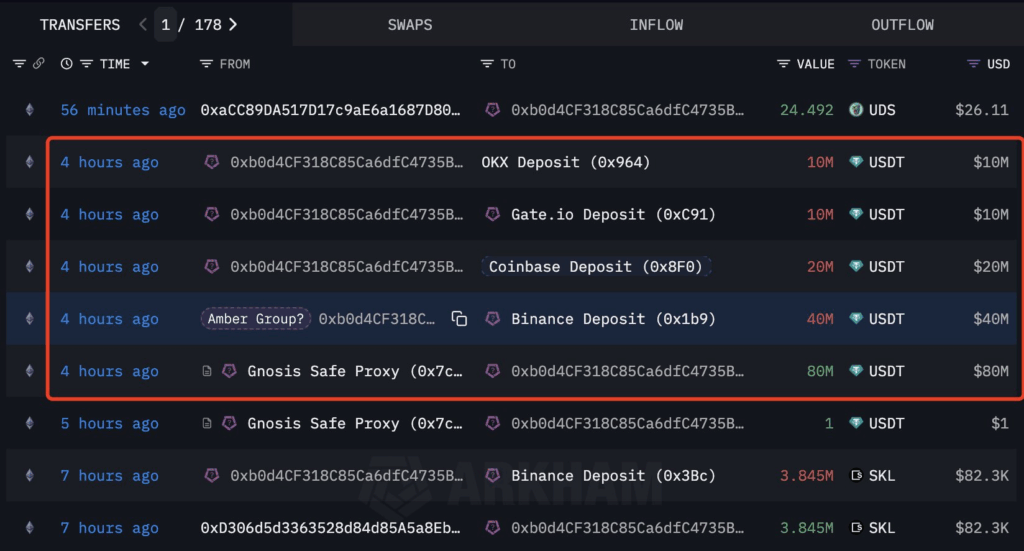

- Amber Group then deposited these stablecoins onto various exchanges such as Binance, Coinbase, OKX and Gate.io

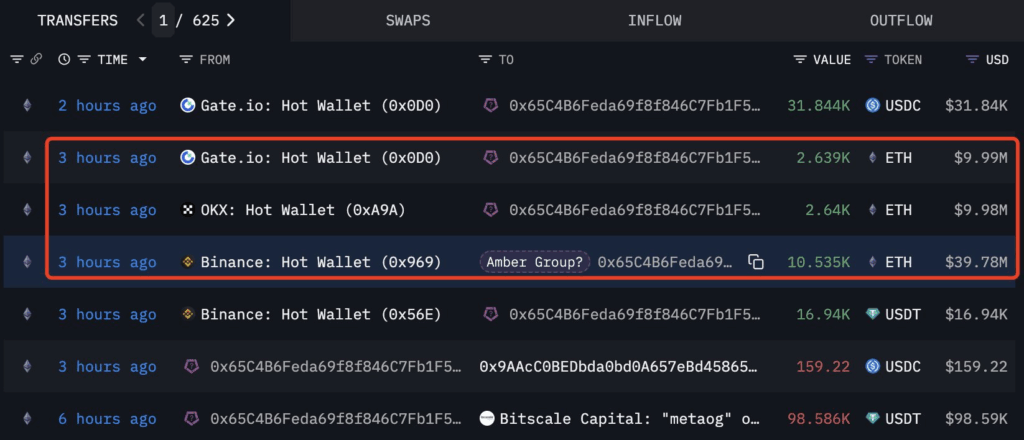

- Moreover, on-chain investigator Lookonchain reported that the wallets linked to Amber Group withdrew 15,814 ETH (valued at approximately $59.75 million at the time) from these same exchanges

- ETH being withdrawn could strongly suggest a move to accumulate and secure the ETH in self-custody, potentially for staking or deployment in DeFi infrastructure

On-Chain Signals: What Do They Indicate?

The average unrealized profit or loss for all current Ethereum stakers over one year is displayed by the ETH 2.0 Stakers MVRV. Stakers are users who lock up their cryptocurrency to contribute to network security and generate returns similar to fixed deposits. According to Santiment’s data, the Stakers MVRV (365 days) shows a positive change of 36.39% flipping from a negative MVRV since early July. This is consistent with the recent surge in ETH prices, which rose by more than 50% at the time of reporting, according to CoinMarketCap.

The positive Stakers MVRV at 36.39% indicates that ETH stakers are currently sitting on unrealized profits. However, these staked ETH are effectively held off the market in DeFi or staking protocols. But in order to sell, stakers must first withdraw their ETH and then send it to an exchange. This action moves a large volume of previously unavailable ETH into the “for sale” category, flooding the market with new supply. In contrast, if the demand for ETH does not match the new supply, this could create downward pressure on ETH prices. Nevertheless, the actions of the stakers who are currently sitting on realized gains would determine whether this occurs.

In addition to MVRV, the price of ETH should normally increase with a decline in exchange balances, which is a classic bullish trend. If exchange flows remain negative and sentiment remains positive, the shortage of supply may lead to an increase in ETH prices, which could be a reason for Lomashuk to buy ETH from the spot market. Currently, the exchange flows balance is over negative 5K ETH.

However, the graph below demonstrates that the price of ETH does not always rise when the exchange balance falls; in fact, there have been cases where the price of ETH has decreased following negative exchange flows, such as on 20th June, 2025.

A Powerful Signal of Bullish Conviction

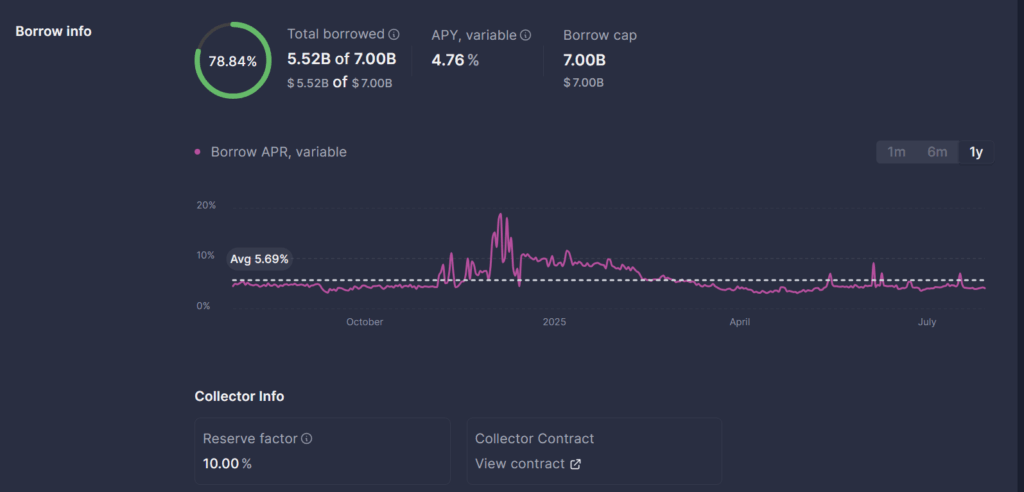

The on-chain activity of Konstantin Lomashuk’s wallet, which has over $300 million, suggests that he is bullish on ETH. Since the buyer is responsible for custody and finance expenses. The borrowing rates ranged from 4.10% to 4.76% at the time Lomashuk borrowed from Aave. The decision to buy ETH on the spot rather than through derivatives shows long-term conviction by Lomashuk.

While this move by Konstantin Lomashuk’s labelled wallet serves as a strong bullish indicator for ETH, it is crucial for investors to conduct their own research. Despite this, traders and investors should be very mindful of this pattern since the on-chain information presents a prominent DeFi founder placing an important bet on the Ethereum ecosystem.