Key Takeaways

- Fenwick & West denies any indirect participation in the failure of FTX.

- Fenwick & West also denied new allegations that accused the firm of assisting the introduction and marketing of FTT.

- The prominent crypto exchange FTX collapsed in early November 2022.

Silicon Valley firm Fenwick & West rejects allegations of an indirect involvement in the FTX collapse. The firm calls the allegations “facile” and “flawed” in a Monday court filing, adding that it only provided routine legal services and had no knowledge of the fraud.

Earlier this month, FTX customers updated a 2023 class-action lawsuit in a federal court in Florida, taking another step in their legal battle.

The current lawsuit claims information from FTX’s bankruptcy and Sam Bankman-Fried’s trial suggests that Fenwick & West provided legal cover, possibly aiding in the fraud.

However, Fenwick & West denied that it assisted in FTX’s fraud, calling the accusations baseless and deceptive. Silicon Valley’s law company commented in a recent filing that it had no knowledge of misconduct and just offered standard legal services.

Although identical accusations against another legal firm, Sullivan & Cromwell, were rejected for lack of evidence, the larger class-action lawsuit also targets celebrities and businesses connected to FTX.

The plaintiffs have cited Nishad Singh’s testimony, a former FTX engineer, regarding Fenwick’s role in loan structuring. However, Fenwick emphasised that Singh never charged it with concealing fraud.

Further, the firm added that several individuals connected to FTX, its solicitors and advisors, also stated in court that they were unaware of the misappropriation of client cash.

Fenwick & West Rejects FTT Promotion Claims

Fenwick & West also denied new allegations that accused the firm of assisting the introduction and marketing of FTT, FTX’s exchange token. The company claims that the allegations are unfounded and baseless.

The firm also said they were only introduced after a judge allowed similar cases against celebrity endorsers to proceed, calling them “frivolous” and “too late.”

Additionally, Fenwick has rejected the notion that its solicitors served as token boosters, calling the move a last-minute stretch.

The amended complaints are still not being accepted and are subject to further approval from the court.

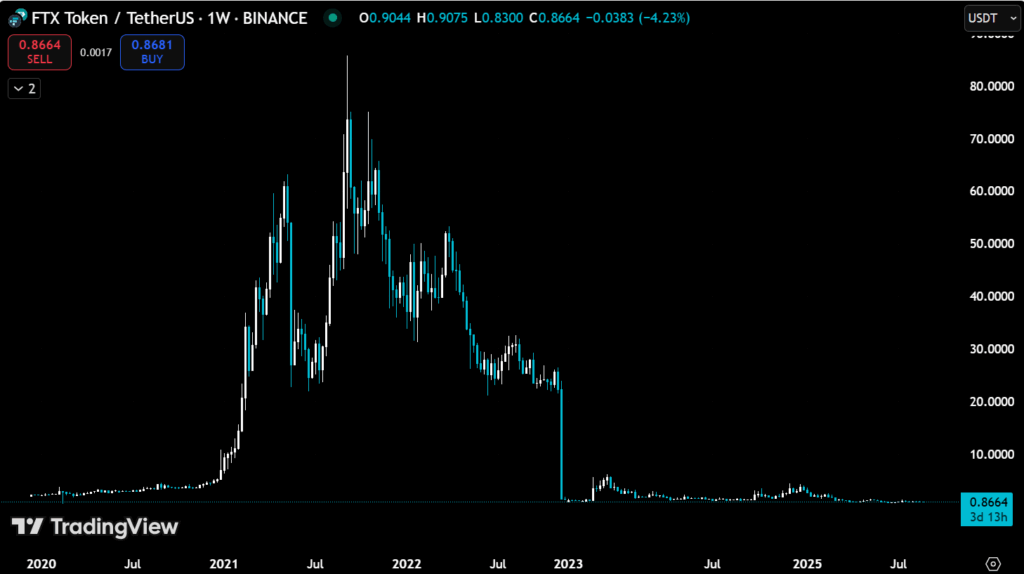

The FTX Token (FTT) was the native cryptocurrency of the now-defunct FTX exchange. The coin was created to offer consumers advantages, lower trading fees, the ability to utilise collateral, holding rewards, and promotional benefits. FTT was once essential to FTX’s ecosystem, but lost almost all of its value when the exchange’s financial issues surfaced.

The FTX Collapse: What Had Happened?

The prominent crypto exchange FTX collapsed in early November 2022. The demise began when research reports claimed that Alameda Research, its sister trading company, relied on speculative, dangerous crypto tokens to sustain its worth.

The revelation prompted customers to be alarmed by the unsteady financial arrangement and the extremely close relationship between FTX and Alameda.

A cash constraint caused by many people rushing to withdraw their money sent both businesses into bankruptcy. The collapse of one of the world’s biggest crypto exchanges shook the market.

Sam Bankman-Fried, the founder of FTX, and senior officials were eventually accused by U.S. authorities of embezzling more than $8 billion in customer deposits by December 2022.

They were also charged with violating investors’ confidence by using client money for risky wagers and personal expenses.

Bankman-Fried was extradited from the Bahamas to the United States for trial.

The court sentenced Bankman-Fried to 25 years in prison in November 2023 after finding him guilty. The judges had found him guilty of purposefully stealing billions of dollars from clients.

The FTX story has turned into a sobering reminder of the dangers in the unregulated cryptocurrency space. The collapse shows how a lack of supervision, accountability, and transparency can swiftly turn promising endeavours into cautionary tales for investors worldwide.