Key Takeaways:

- Google Cloud’s Universal Ledger (GCUL) offers a neutral Layer 1 chain with Python smart contracts and 24/7 settlement for institutions.

- Circle’s Arc embeds USDC as its core, enabling instant stablecoin settlement but limiting neutrality.

- Stripe’s Tempo targets payments, leveraging its $1.4 trillion merchant base to rival Visa and Mastercard.

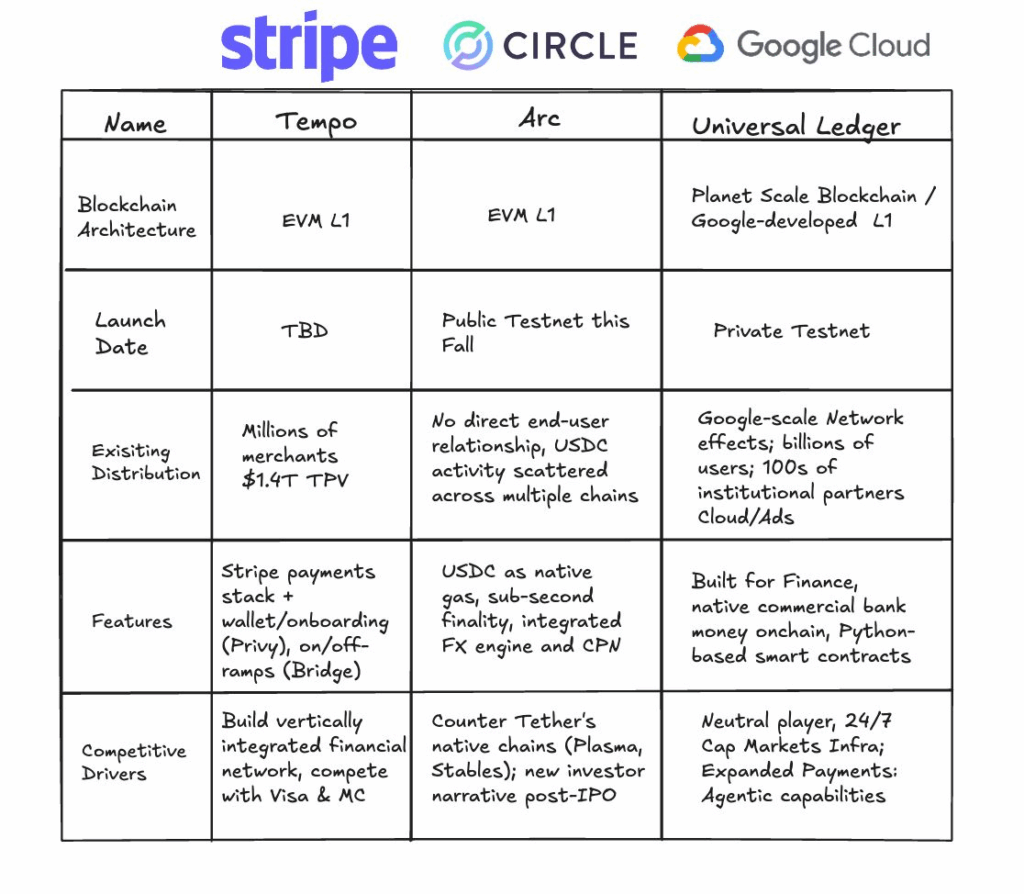

The Layer 1 blockchain race is heating up with Google Cloud, Circle, and Stripe each building infrastructure to bring payments, tokenization, and financial services on-chain. While all three projects share ambitions to reshape finance, their strategies differ sharply.

Google Cloud Universal Ledger (GCUL): Neutral Infrastructure

According to a LinkedIn post by Rich Widmann, head of web3 strategy at Google, he says that –

GCUL brings together years of R&D at Google to provide financial institutions with a novel Layer 1 that is performant, credibly neutral and enables Python-based smart contracts.

Unlike Stripe or Circle, Google Cloud’s Universal Ledger (GCUL) does not rely on a single stablecoin or payments network. GCUL has positioned itself as a neutral-based blockchain offering Python-based smart contracts, on-chain banking rails, and 24/7 capital markets infrastructure designed to handle tokenization, wholesale payments, and settlement.

Widmann says that because of these reasons, one of the world’s largest commodities exchanges, the Chicago Mercantile Exchange Group (CME) has partnered up with GCUL to test tokenized collateral and low-cost settlement.

GCUL’s objective, supported by Google’s global distribution and cloud capabilities, is to serve as the foundational layer on which financial institutions can rely, regardless of their loyalty to stablecoins or payment networks.

Circle’s Arc: USDC at the Core

Circle is planning to launch its own layer-1 chain called the Arc, embedding USDC as its native gas token. The public testnet is scheduled for this fall; the main objective of Arc is to allow stablecoins to settle immediately, swap between currencies on-chain, and confirm transactions in less than a second.

Since Arc would use USDC as its native gas token, this restricts its neutrality, as institutions that do not adopt USDC might not use Arc at all.

Stripe’s Tempo: Payments First

Stripe, on the other hand, plans to launch Tempo blockchain, focusing solely on payments. Stripe has processed over $1.4 trillion in yearly transaction volume for millions of merchants. The Tempo blockchain aims to create an integrated ecosystem with its merchants’ providing wallets and on/off ramps services. They aim to compete directly against Visa and Mastercard.

GCUL vs Others

- Google Cloud’s GCUL offers neutrality, aiming to be the backbone for institutions needing compliance, flexibility, and scale.

- Circle’s Arc is a stablecoin-first chain, betting on USDC’s expansion.

- Stripe’s Tempo leverages its payments empire to embed blockchain into everyday commerce.

As competition heats up, the question is whether neutral infrastructure (GCUL) or ecosystem-driven strategies led by Arc and Tempo will dominate the next phase of institutional blockchain adoption.