Key Takeaways

- TD Sequential flashes a buy signal for Dogecoin (DOGE), says an expert.

- Price action suggests that DOGE’s bullish outlook could be invalidated if the price falls below the $0.212 level.

- Even as DOGE’s price dips, on-chain metrics hint that bulls are dominating the meme coin.

Dogecoin (DOGE) faces strong selling pressure after its breakout, pushing the price down to a key support level. Despite this downside momentum, the bullish outlook remains intact as the coin holds above the breakout zone.

Crypto Expert Flags Dogecoin Buy Opportunity

The expert also shared bullish comments on X, which strengthens DOGE’s bullish outlook.

Recently, a well-followed crypto analyst stated that Dogecoin’s technical indicator, TD Sequential, flashed a buy signal on the hourly time frame. The post on X also revealed that the last time this indicator gave a signal, Dogecoin’s price followed the same trend.

Price Momentum Weakens as Trading Volume Drops

At present, Dogecoin’s price stands strong at the $0.214 level but has slipped 2.15% over the past 25 hours. This sudden decline following the breakout has dampened investor and trader participation, resulting in a 10% drop in trading volume compared to the previous day.

Dogecoin Price Trends and Technical Outlook

TimesCrypto’s technical analysis hints that Dogecoin may invalidate its bullish descending triangle breakout if the selling pressure continues. On the four-hour chart, the meme coin stands at a make-or-break point at the $0.212 level.

Based on recent price action and historical patterns, if DOGE’s price holds the support level at $0.212, there is a strong possibility of a price reversal.

On the other hand, if this momentum continues and the price falls, closing a four-hour candle below the $0.205 level, it could trigger a sharp sell-off, with the price potentially dropping by 8% or even lower.

This ongoing price decline has already pushed the meme coin below the 50-day Exponential Moving Average (EMA), suggesting potential further downside and a shift in short-term market sentiment toward bearish territory.

On-Chain Data Points to Bullish Outlook

Amid this selling pressure, investors and long-term holders appear to be seizing the market dip by following a buy-the-dip strategy. Coinglass’s spot inflow/outflow metric reveals that $24.36 million worth of DOGE has left exchanges over the past 24 hours. This negative flow of DOGE hints at potential accumulation and may help reduce selling pressure.

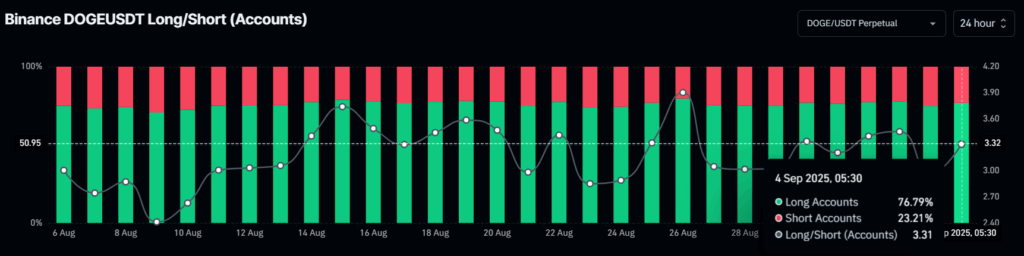

On the other hand, traders on Binance appear to be strongly betting on long positions. Coinglass’s Binance DOGEUSDT Long/Short ratio has reached 3.31, suggesting strong bullish sentiment among traders. Furthermore, this metric reveals that currently 76.79% of traders on Binance hold long positions, while 23.21% hold short positions.

When combining these on-chain metrics, it appears that bulls are dominating the meme coin despite notable selling pressure. Additionally, it also hints at a potential price recovery soon.