Key Takeaways

- Pump.Fun (PUMP) continuous price uptick at risk; expert hints it may be time to sell.

- Price action suggests a potential retest of the breakout level if momentum fades.

- Pump.Fun revealed the purchase of $12,192,383 worth of PUMP tokens in the past week.

Amid market uncertainty, Pump.Fun (PUMP) is making waves with its impressive performance. The asset has recorded six consecutive days of bullish momentum, forming green candles, but experts hint that profit-taking may be looming.

PUMP Price Momentum and Potential Sell-Off Signal

Today, while the overall crypto market remains range-bound, PUMP defied the trend and outperformed major assets, including Bitcoin (BTC) and Ethereum (ETH), with a 6% price uptick in the past 24 hours. With this impressive performance, the asset hit an intraday high of $0.00479 and is currently trading at $0.00466.

Looking at PUMP’s continuous price uptick, a prominent crypto expert shared a post on X, noting that PUMP has gained 90% in the past two weeks. However, the TD Sequential indicator now flashes a sell signal, suggesting that profit-taking could soon begin.

This post on X gained widespread attention from crypto enthusiasts, raising questions about whether the price will fall now or continue its upside rally.

PUMP Price Analysis: Upcoming Levels and Market Outlook

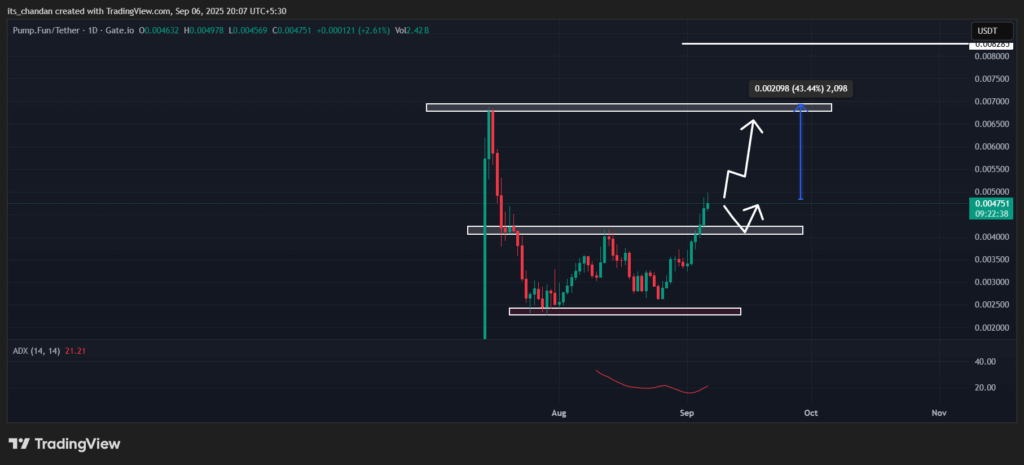

TimesCrypto’s technical analysis suggests that PUMP is in an uptrend and has recently broken out of a bullish double-bottom pattern formed on the daily chart. However, one concern beyond this bullish breakout is the continuous price uptick both before and after the breakout.

In price action, whenever an asset experiences uninterrupted price gains, it may eventually face a deep correction, a breakout retest, or enter a period of sideways momentum.

Based on the current price action, there is a strong possibility that PUMP may see a downside move to potentially retest the breakout level of $0.0041. On the other hand, if the asset closes a daily candle above $0.0047, a potential continuation of the uptrend could be possible.

However, the Average Directional Index (ADX) stands at 21, indicating that the asset has a weak trend. In such cases, breakouts often fail, and the price may plunge.

Pump.Fun Solid Fundamentals Driving Momentum

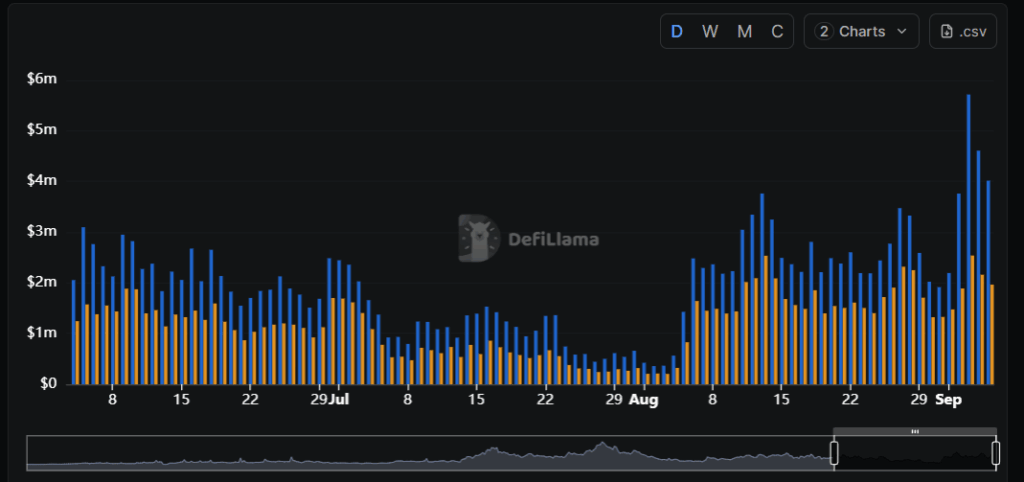

Pump.Fun’s fundamentals appear strong, which seems to be a potential catalyst for its continuous price uptick. On-chain analytics tool DeFiLlama reveals that Pump.Fun’s fees, revenues, and DEX volume have been continuously rising.

Recently, on X, Pump.Fun revealed that over the past week, they purchased $12,192,383 worth of PUMP tokens, which accounts for 98.23% of the total revenue recorded during that period (Aug 28 – Sept 3). The post further states:

Purchases have now offset the total circulating supply by 5.363%—an increase of 1.102% over the past week.