Key Takeaways

- 860,000 ETH worth nearly $3.7 billion, is in Ethereum’s validator entry queue.

- Price action suggests that an Ethereum upside rally could only occur if it clears the $4,420 level.

- Ethereum’s four-hour chart flashes a bullish crossover, hinting at a potential upside rally.

On September 2, 2025, Ethereum’s validator entry queue reached its highest level in two years, making waves in the cryptocurrency space.

860K ETH in Line for Staking

A crypto expert shared a post on X, revealing that over 860,000 ETH worth nearly $3.7 billion is waiting in line for staking.

This substantial amount of ETH waiting to be staked shows strong demand for Ethereum staking, despite market uncertainty. Such demand follows the 2023, Shanghai Upgrade, which enabled withdrawals.

The expert revealed that the growth in the staking queue comes at a time when investors’ interest and confidence in the asset have skyrocketed. Additionally, it highlights ETH’s long-term potential, which is driving massive participation.

Apart from this, a significant surge in institutional demand has also been recorded. So far, over 70 corporate treasury funds hold 4.71 million ETH worth $20.63 billion, equivalent to 3.90% of the total supply, according to the StrategicETHReserve.

Current Price and Rising Trading Volume

Despite the notable surge in staking queue, ETH’s price has remained sideways over the past week.

The asset is currently trading near $4,370, slipping a modest 0.45% in the past 24 hours. Meanwhile, trader and investor participation in the asset has skyrocketed.

According to CoinMarketCap data, ETH’s 24-hour trading volume has surged by 14% compared to the previous day.

Institutions and Whales Rising ETH Demands

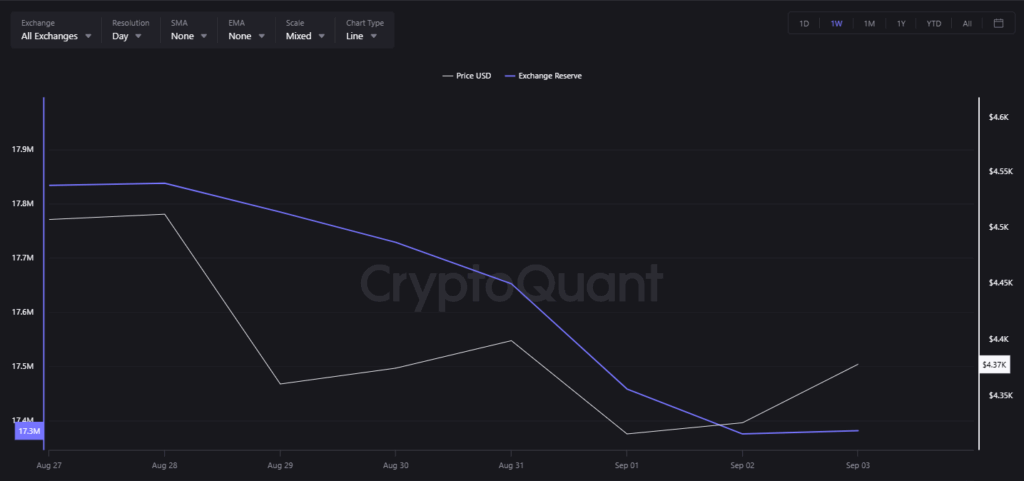

However, exchange ETH reserves have notably plummeted during this period. Data from the on-chain analytics platform CryptoQuant reveals that exchange reserves dropped by 47.1k ETH, suggesting potential accumulation by long-term holders, whales, or institutions.

Over the past few days, it appears that whales have been converting their BTC holdings into ETH, which explains the rising demand.

On September 1, 2025, blockchain transaction tracker Lookonchain shared a post on X disclosing that a Bitcoin OG sold 35,991 BTC worth $4.04 billion and bought 886,371 ETH worth $4.07 billion.

This indicates that investor and whale confidence in the world’s second-largest cryptocurrency has skyrocketed. Meanwhile, the asset remains sideways due to ongoing market uncertainty, but once sentiment shifts, ETH could see a massive price uptick.

Ethereum (ETH) Price Action and Upcoming Levels

TimesCrypto’s technical analysis reveals that Ethereum is on the verge of a bullish breakout. On the four-hour chart, ETH has formed a descending triangle pattern, with the price moving into a narrow zone that hints at a potential breakout soon.

Based on recent price action, if ETH breaks out of the descending trendline and closes a daily candle above the $4,420 level, it could trigger a 10% price uptick. The asset may reach $4,850 or even higher if the momentum continues.

At press time, the Exponential Moving Average (EMA) indicator hints at a bullish crossover, with the 9-day EMA appearing to cross above the 15-day EMA.

This is seen as a bullish sign for ETH holders, as such crossovers often precede parabolic price moves.