Key Takeaways

- Ethereum whales have purchased 31,430 ETH, worth $146.18 million, in the last 24 hours.

- Price action suggests ETH could see an 8% price increase if it sustains above the $4,500 level.

- On-chain metrics reveal that both traders and investors are betting on the bullish side.

Ethereum whales’ activity has skyrocketed as the ETH price experiences a short-term pullback in recent hours. Over the past 24 hours, ETH has dropped 2.35%, while whales have added millions by following a buy-the-dip strategy.

Whales Buy the Dip: Adds $146 Million of ETH

Data from the crypto transaction tracker Lookonchain reveals that whales have purchased a total of 31,430 ETH worth $146.18 million in the last 24 hours. This substantial accumulation was recorded across multiple exchanges, including Binance, Kraken, Bitget, and others.

Looking at whales’ activity, you might be wondering if this is an ideal buying opportunity, or will the price soar further from this level.

Today, with a 2.35% price correction, ETH is currently trading near the $4,520 level. Despite the price decline, the asset’s 24-hour trading volume has jumped by 35%, indicating heightened participation from investors and traders.

Ethereum (ETH) Price Action and Key Levels

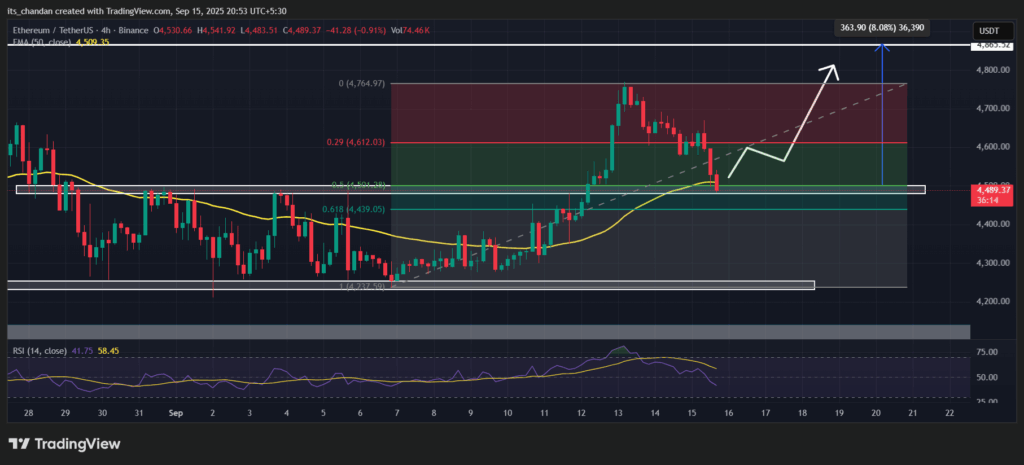

TimesCrypto’s technical analysis reveals that ETH is in an uptrend, as it continues to hold above the 50-day Exponential Moving Average (EMA) on the four-hour chart. Meanwhile, with some downside momentum, the asset appears to be retesting the breakout level of $4,500, which it recently surpassed.

Based on the current price action, if ETH holds above the $4,500 level, there is a strong possibility that the asset could see an 8% price increase and may reach the $4,865 level. This bullish thesis would only fail if ETH fails to maintain the $4,500 support.

Adding to its strength, ETH appears to have retraced 50% of the Fibonacci level, suggesting the asset may be preparing for a further upward move if buying pressure continues.

However, ETH’s Relative Strength Index (RSI) has reached 43, indicating that the asset is in a neutral to slightly oversold zone, which could support a potential rebound if buying activity picks up.

Ethereum On-Chain Metrics Point to Upside Move

On-chain analytics tool Coinglass reveals that investors and long-term holders have been accumulating the token. Over the past 24 hours, nearly $34 million worth of ETH has left the exchanges, suggesting potential accumulation.

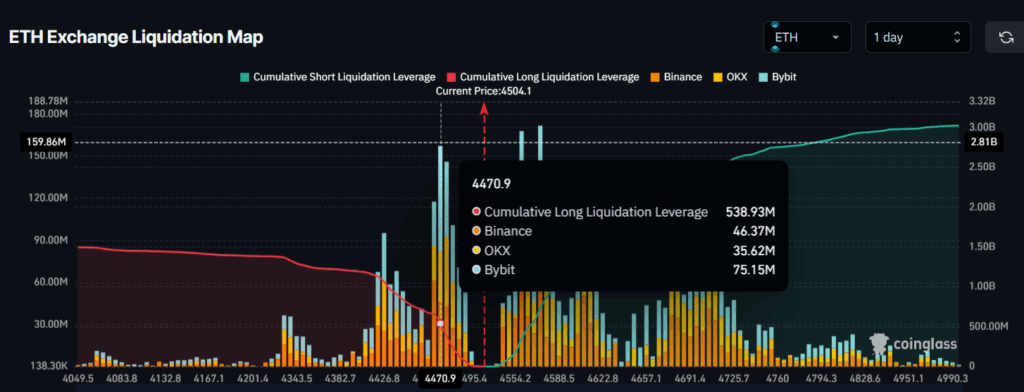

Meanwhile, traders also appear to be following investors’ path, as they seem to be betting on long positions. At present, the major liquidation levels stand at $4,470 on the lower side and $4,559.1 on the upper side.

These levels are not just key liquidation zones, here traders are over-leveraged, having built $538.9 million worth of long positions and $346 million worth of short positions.

When combining these metrics with whale accumulation and bullish price action, it appears that bulls are dominating, and there is a strong possibility of a price reversal.