Key Takeaways

- Exchange XRP reserves soar by 25.673 million over the past week.

- XRP whales have offloaded 200 million tokens over the past two weeks.

- Price action suggests further downside is likely if XRP fails to hold $2.94.

XRP, the world’s third-largest cryptocurrency by market cap, is garnering significant attention from crypto enthusiasts. On September 17, several bearish data points have emerged, signaling a potential price dip in the coming days.

Exchanges XRP Reserve Soars, Time to Sell?

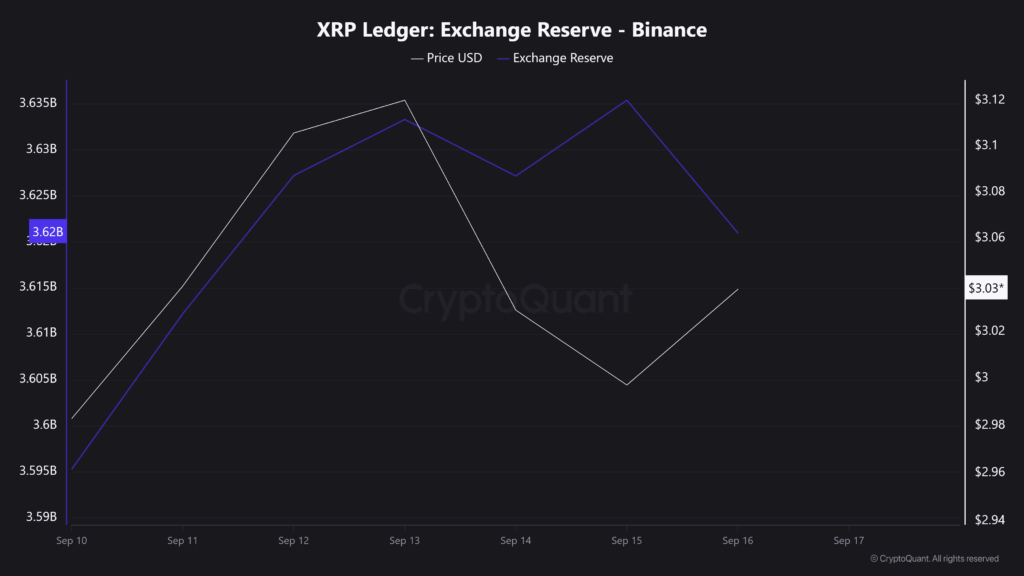

These bearish outlooks have appeared ahead of the Fed meeting scheduled for today. On-chain analytics tool CryptoQuant shows a massive surge in exchange XRP reserves, indicating potential dumps by investors and whales.

Data reveals that exchange reserves have increased by 25.673 million XRP, rising from 3.595 billion to 3.620 billion over the past week. Such a metric often creates selling pressure, which can cause the asset’s price to dip.

Whales Offload 200 Million XRP

Adding to the bearish outlook, an expert shared Santiment data on X, revealing that whales holding 1 million to 10 million XRP have offloaded around 200 million XRP in the past two weeks. However, during that period, XRP’s price has shown an upside rally.

Traders Believe XRP Won’t Cross $3.08 Level

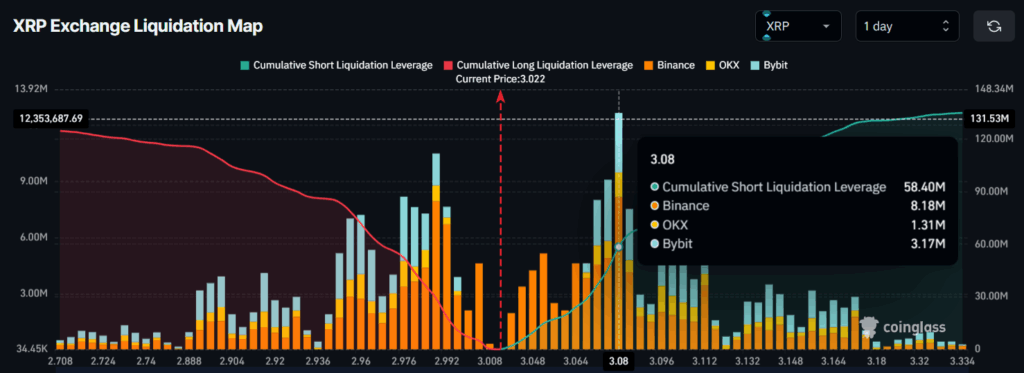

Looking at market sentiment, traders also seem to be following the broader market trend, appearing to bet on the bearish side.

Data from on-chain analytics tools Coinglass reveal that XRP’s major liquidation levels are at $2.988 and $3.08 on the lower and upper sides, respectively. At these levels, traders are over-leveraged, holding $29 million worth of short positions and $58.4 million worth of long positions.

This further strengthens the bearish outlook, as it shows that bears are dominating the asset and strongly believe that XRP’s price won’t cross the $3.08 level anytime soon.

Now, when combining both CryptoQuant, Santiment, and Coinglass data, it appears that whales have a bearish view on XRP, raising the question of whether this is the end of XRP’s top.

Price Action and Technical Analysis

At press time, XRP is priced at $3.02, having slipped 0.55% over the past 24 hours. However, investor and trader participation during the same period has fallen, resulting in a 22% drop in trading volume compared to the previous day.

Besides whale activity and expert commentary, XRP’s price action seems different. According to TimesCrypto’s technical analysis, XRP is still in an uptrend as it holds local support at $2.94, along with the 50-day Exponential Moving Average (EMA), indicating that the asset still has potential to rebound.

Based on the current price action, if selling pressure continues and the price fails to hold the $2.94 level, XRP could drop 7%, potentially dropping to $2.72.

XRP’s technical indicator, Supertrend, is flashing a bearish signal as it remains red and hovers above the asset’s price. This indicates that the asset is in a downtrend with significant selling pressure.

The expert shared that XRP could find support at the $2.78 level, indicating that not only whales but also the expert sees potential for a downside.