Key Takeaways

- A Bitcoin whale made $190 million by betting before the market crash, hinting at a potential insider advantage.

- Hyperliquid DEX reported a total of 6,300 wallets losing $1.23 billion in the crypto crash.

- Over the past 24 hours, crypto liquidations have reached $18.68 billion.

On Friday night, when the overall cryptocurrency market was bleeding, a Bitcoin whale made a profit of around $190 million and $200 million. This was one of the rare trades that came as the whale opened a short position on Bitcoin just 30 minutes before U.S. President Donald Trump’s 100% China tariff announcement.

Bitcoin Whale’s Perfect Short Earns $190 Million

According to the report, this Bitcoin whale initially closed 90% of his BTC short position and fully closed his ETH short position, both of which were opened on Hyperliquid. The report, which stunned the entire crypto market, noted that this whale played a major role in today’s market events.

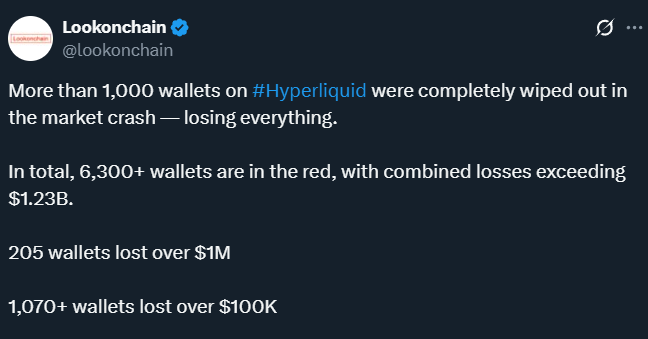

It appears that this is the only whale that made multi-million-dollar profits, unlike other whales who lost billions in liquidations on the same exchange. On-chain analytics platform Lookonchain recently shared a post on X, revealing that more than 1,000 crypto wallets on Hyperliquid were completely wiped out in today’s crash.

The post further revealed that a total of 6,300 wallets are in the red, with combined losses exceeding $1.23 billion. Among them, 205 wallets lost over $1 million, while more than 1,070 wallets lost over $100,000. Amid this, four traders were completely liquidated.

• 0x1a67 lost $18.73 million, account wiped out

• 0x1d52 lost $16.43 million, only $140 left

• 0x0a07 lost $15.69 million, only $104 left

• 0xb2ca lost $13.72 million, account wiped out

Now the question arises that who is this Bitcoin whale? Was it pure luck, or did he have insider information before the tariff announcement?

Also Read: Future of U.S. Crypto Policy Hangs in the Balance After Senate Clash

Current Market and Overall Liquidation

At press time, the overall crypto market cap is down by 8.45% to $3.75 trillion. Meanwhile, major assets Bitcoin (BTC) and Ethereum (ETH) have recorded price dips of 6.5% and 8.75%, respectively, over the past 24 hours, according to CoinMarketCap data.

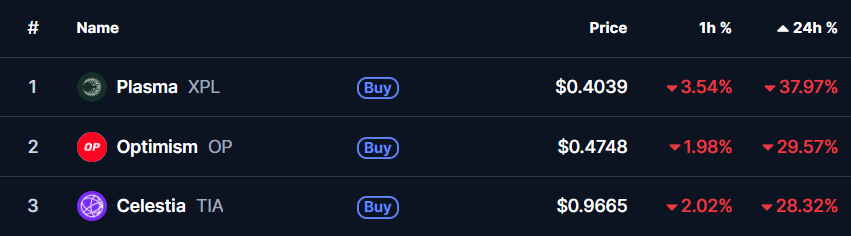

Among the hardest-hit tokens are Plasma (XPL), Optimism (OP), and Celestia (TIA), which have dropped by 28%, 30%, and 28.75%, respectively, during the same period.

With these declines, over the past 24 hours, 1.5 million traders were liquidated, with total liquidations reaching $18.68 billion. The single largest liquidation occurred on Hyperliquid for the ETH-USDT pair, valued at $203.36 million.

Also Read: Canary Capital Updates XRP & Solana ETF Filings, Cuts Fee to 0.50%