- Bitcoin’s lack of yield is raising questions about its place in corporate treasuries, a Sentora report says.

- Rising interest rates and flat prices are increasing the cost and reducing the appeal of leveraged Bitcoin strategies.

- Firms relying on BTC price appreciation face higher financing risks and potential investor pushback.

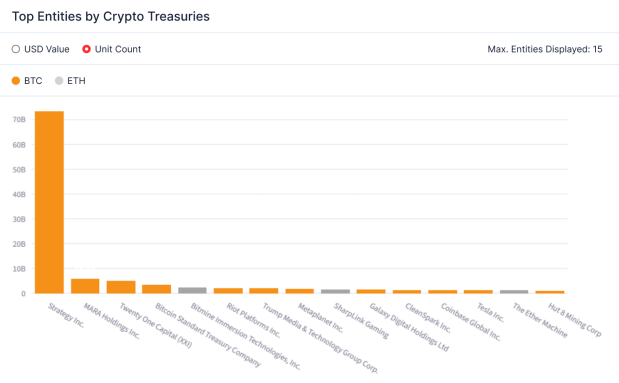

- About 268 entities hold 1.86 million BTC, over 9% of supply, with holdings concentrated in a few firms.

- P2P estimates corporates are missing nearly $5 billion annually by not staking assets on yield-bearing blockchains.

Bitcoin’s role on corporate balance sheets is under renewed scrutiny as rising interest rates and limited cash flows expose the structural risks of using the digital asset as a treasury reserve, according to a report released this week by research firm Sentora.

The report warns that unless Bitcoin evolves into a productive asset capable of generating yield, its long-term viability as a corporate financial instrument may decline.

Corporate Holdings Concentrated in a Few Entities

According to the report, 268 public and private entities globally now hold a combined 1.86 million BTC, representing more than 9% of total circulating supply.

Valued at over $231 billion, these holdings are largely concentrated among a small group of companies, with publicly listed firms accounting for 60% of total reserves, followed by private companies and government-linked entities.

This strategy, which began gaining traction in 2020, involves replacing fiat reserves, which are typically held in money market funds or short-term treasuries, with Bitcoin. While initially viewed as a hedge against inflation, some firms have shifted to a more aggressive model, using capital markets to gain leverage and increase exposure to Bitcoin’s long-term price potential.

Strategy Inc. Leads in Scale and Structuring

Strategy Inc., formerly known as MicroStrategy, holds the largest corporate Bitcoin position with 628,791 BTC as of August 2025. The company financed its holdings through multiple rounds of zero- and low-interest convertible bonds, high-yield preferred equity, and at-the-market common stock offerings.

The value of its Bitcoin assets now exceeds the company’s total reported balance sheet assets, creating a leveraged structure that closely tracks Bitcoin’s market movements.

Its capital stack includes $3.7 billion in convertible notes, $500 million in secured senior debt, and approximately $5.5 billion in preferred equity across four tranches.

Much of the funding was raised during favorable market cycles, locking in low rates and avoiding dilution during Bitcoin bull runs. However, a significant portion of dividend obligations is still serviced through new capital raises rather than operating cash flow.

Distinctions Emerging Between Treasury Strategies

The report draws a distinction between firms that use Bitcoin defensively as a reserve asset and those that treat it as a form of digital capital.

Defensive positions involve limited exposure, typically using excess cash to hold a small percentage of Bitcoin. In contrast, more aggressive firms borrow capital, often through debt or equity issuance, to purchase large Bitcoin positions, relying on appreciation rather than income.

While traditional corporate treasury strategies prioritize liquidity and yield, Bitcoin treasury strategies rely primarily on price action. The lack of income generation makes these positions costly to maintain over time. Without sustained upward movement, firms may struggle to cover financing costs or retain investor confidence.

Financial Health Dependent on Market Cycles

According to the report, several companies with significant Bitcoin holdings remain unprofitable when Bitcoin-related gains are excluded. This includes both newly listed firms and established miners, whose core operations are only marginally profitable or entirely dependent on favorable crypto price cycles.

Mining companies, such as Marathon and Riot, are described as highly exposed to Bitcoin market swings, with BTC accounting for up to 80% of their total assets. Their ability to meet obligations is closely tied to market prices, leaving them vulnerable in periods of stagnation.

Others, such as stablecoin issuer Tether and SPAC-backed entities like Twenty One Capital, hold large BTC positions financed through earlier capital surpluses, but may lack consistent income streams to support long-term sustainability.

Vulnerability to Market and Liquidity Stress

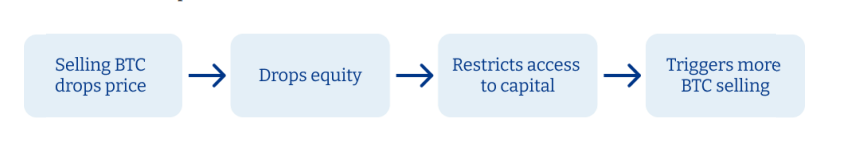

The report also warned of the possibility of rapid deterioration in firms using Bitcoin-backed strategies during adverse market conditions. In what the report calls the “panic zone,” companies may face compounding pressures as stock prices fall, bond rollovers become more expensive, and capital raises turn dilutive.

In these scenarios, Bitcoin reserves, which are originally intended as long-term holdings, may be liquidated to cover short-term obligations.

The report also notes that such forced selling could amplify market volatility and undermine confidence in Bitcoin as a corporate reserve asset.

Macro and Regulatory Pressures Building

The report also points to broader macroeconomic risks, noting that rising fiat interest rates are increasing the cost of leveraged Bitcoin exposure.

Additionally, extended periods of flat or declining Bitcoin prices are weakening the investment case, making it harder for firms to justify additional issuance or expand their holdings.

Moreover, regulatory changes, particularly around accounting standards and capital adequacy, could further complicate the strategy.

The emergence of alternative instruments, such as tokenized real-world assets and interest-bearing stablecoins, may draw institutional interest away from Bitcoin if it continues to lack yield.

Corporate Use May Require Yield-Generating Models

The report also points to a growing need for institutional-grade instruments that could enable Bitcoin to generate yield, such as BTC-denominated bonds, tokenized structured products, and participation in low-risk lending markets.

These mechanisms aim to provide income while avoiding repeated reuse of collateral and limiting counterparty risk.

In the absence of such tools, firms may begin adopting mixed reserve strategies that combine Bitcoin with more traditional assets to reduce exposure while retaining some upside potential.

Spillover Effects Seen in Equities and Credit

According to the report, the influence of Bitcoin holdings is already visible in equity and credit markets. Strategy Inc., for example, now trades with over 2x beta to Bitcoin, making its stock functionally similar to a crypto-linked derivative.

Additionally, other companies with high Bitcoin concentrations are experiencing similar investor behavior, with market caps increasingly reflecting crypto exposure more than core business fundamentals.

Similarly, convertible bonds issued to finance Bitcoin purchases have begun to reflect volatility and dilution risk, as bondholders are effectively taking on exposure to Bitcoin price movements through traditional fixed income instruments. This shift may lead credit markets to adjust how they assess and price corporate debt.

Outlook Hinges on Bitcoin’s Functional Maturity

The report concludes that the long-term viability of Bitcoin as a treasury asset will depend on its ability to evolve from a passive store of value into an asset capable of generating yield.

Without the ability to generate consistent returns or integrate into corporate yield frameworks, Bitcoin’s long-term role in treasury management could be constrained.

What Are the Alternatives and What Do They Offer?

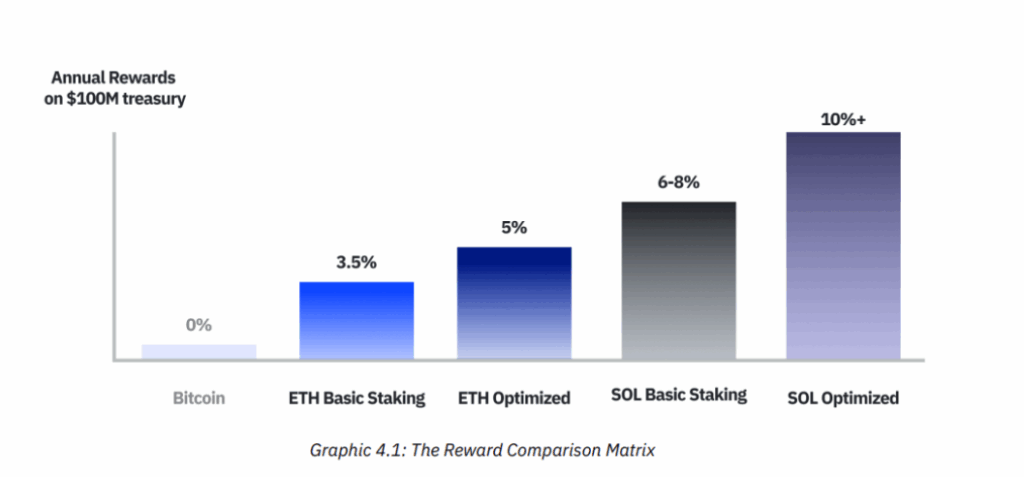

While Bitcoin remains the most widely held cryptocurrency on corporate balance sheets, other networks offer built-in yield that could address the core weakness identified in the Sentora report.

A separate study by blockchain firm P2P estimated that public companies are leaving nearly $5 billion a year in protocol rewards unclaimed by holding assets passively instead of activating them on proof-of-stake blockchains, such as Ethereum and Solana.

According to the P2P report, Ethereum currently offers rewards of around 3% to 5% annually through basic staking, with professional optimization pushing returns higher. Meanwhile, Solana yields range between 6% and 8%, with advanced strategies delivering even more.

Early adopters of Altcoin-focused strategies have demonstrated the financial impact of activation. SharpLink Gaming staked its entire 270,000-ETH treasury, valued at about $1.22 billion at current prices, and earned 322 ETH, worth roughly $1.45 million, in six weeks, lifting its share price by 71% over the same period.

On Solana, DeFi Development Corp built an 846,630-SOL reserve and began operating its own validators, while Sol Strategies raised $500 million through convertible bonds to fund SOL purchases, reporting 186% revenue growth in the first half of 2025.

According to the report, the shift toward yield-generating assets is now easier for most companies, with compliance-ready and insured staking services available to corporate treasuries.

Read More: Paxos Seeks National Trust Charter in Race for Stablecoin Dominance