Key Takeaways

- Publicly traded companies now hold more than 1 million bitcoin, equal to about 5% of total supply, led by Strategy Inc. with 636,500 coins.

- Corporate ether holdings have climbed to 3.2 million ETH, worth roughly $14 billion, with BitMine Immersion controlling nearly 1.9 million.

- Solana is entering the scene, as DeFi Development Corp has accumulated over 2 million SOL, valued at about $427 million.

- Analysts say institutional buying boosts liquidity but also heightens sensitivity to sentiment, with concentrated holdings posing both opportunity and risk.

Publicly traded companies now hold more than 1 million bitcoin, equal to roughly 5% of the total supply that will ever exist, highlighting the growing role of corporate balance sheets in the cryptocurrency market.

Strategy Inc. remains by far the largest holder, with about 636,500 coins, followed by other significant accumulators such as MARA Holdings with more than 52,000, Twenty One Capital with 43,500, and mining firms with trading platforms including Riot, Bullish and CleanSpark.

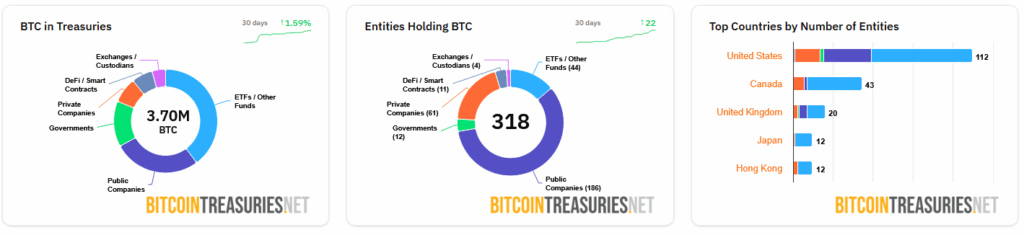

The corporate buildup comes as part of a wider trend of institutional accumulation. In total, about 3.7 million bitcoin are now held in treasuries worldwide, spread across public companies, private firms, funds, exchanges and governments. Furthermore, data shows 318 entities collectively control these holdings, including 186 listed firms, 61 private companies, 44 funds, 12 government entities and a number of exchanges and custodians.

The United States dominates the scene, accounting for 112 of the entities, followed by Canada with 43 and the United Kingdom with a smaller but growing presence.

Despite the increased exposure to bitcoin and improved liquidity these companies offer, analysts say the concentration of holdings in a handful of listed firms also heightens sensitivity to sentiment. A shift in market mood or negative news around these companies could quickly draw liquidity and trigger sharp price swings, highlighting the double-edged nature of concentrated holdings.

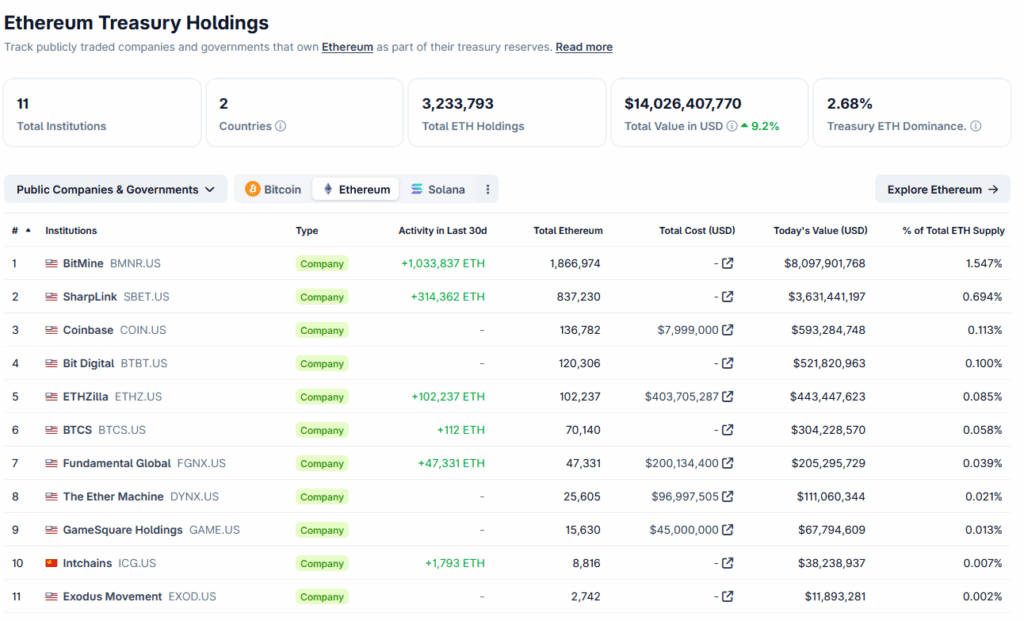

Ethereum Corporate Holdings Climb to $14 Billion

Ethereum is following bitcoin’s lead, with publicly traded companies now holding more than 3.2 million ether worth about $14 billion.

BitMine Immersion leads the accumulation race with nearly 1.9 million coins, equal to around 1.5% of total supply. SharpLink follows with more than 800,000, while Coinbase, Bit Digital, BTCS and a range of corporate treasuries add several hundred thousand more coins to the total.

Solana: DeFi Development Corp Takes the Lead

In addition to the crypto giants, Bitcoin and Ethereum, Solana is also drawing institutional interest.

DeFi Development Corp, the first listed company to adopt a treasury strategy built around Solana, disclosed the purchase of 196,141 SOL at an average price of $202.76 per token. The deal raised its total holdings to more than 2 million SOL, valued at about $427 million.

The company said the newly acquired tokens will be held long-term and staked across multiple validators, including its own, to generate yield. Additionally, it reported 25.6 million shares outstanding, translating to 0.0793 SOL per share, or $16.70 in dollar terms.

The wave of corporate crypto buying mirrors earlier phases of gold accumulation by institutions, when big-ticket purchases helped establish the metal as a reserve asset. Analysts say bitcoin, ether and now solana are starting to follow the same path, shifting from speculative plays to long-term holdings on corporate balance sheets.

Read More: Ripple Predicts Major Shift in Global Finance, Expands RLUSD into Africa