Key Takeaways

- DeFiLlama reveals that Pump.Fun’s (PUMP) TVL, DEX volume, revenue, and even fees have plummeted significantly.

- Despite weak fundamentals, PUMP’s price action hints at a potential 40% price uptick on the horizon.

- PUMP’s bullish outlook will be invalidated if it fails to holds the 61.8% Fibonacci level.

The past week has been unfavorable for Pump.Fun (PUMP), with the token recording nearly a 40% price dip. However, a recovery has begun today as the crypto market climbs 0.20% to $3.90 trillion. Following this trend, PUMP has also registered an impressive price uptick.

Pump.Fun (PUMP) Shows Signs of a Price Rebound

Today, PUMP has recorded a 6% price uptick and is currently trading near $0.006080. Despite the impressive recovery, investors and traders remain hesitant to participate, as indicated by falling trading volume. Data from CoinMarketCap shows that PUMP’s 24-hour trading volume has dropped 7.5% to $578.80 million.

Pump.Fun Fundamentals Signal a Cooling Market

Declining trading volume during a price uptick indicates that market participants are not interested in pushing PUMP’s price to higher levels.

The key catalyst behind the lack of investor and trader participation seems to be Pump.Fun’s weak fundamentals.

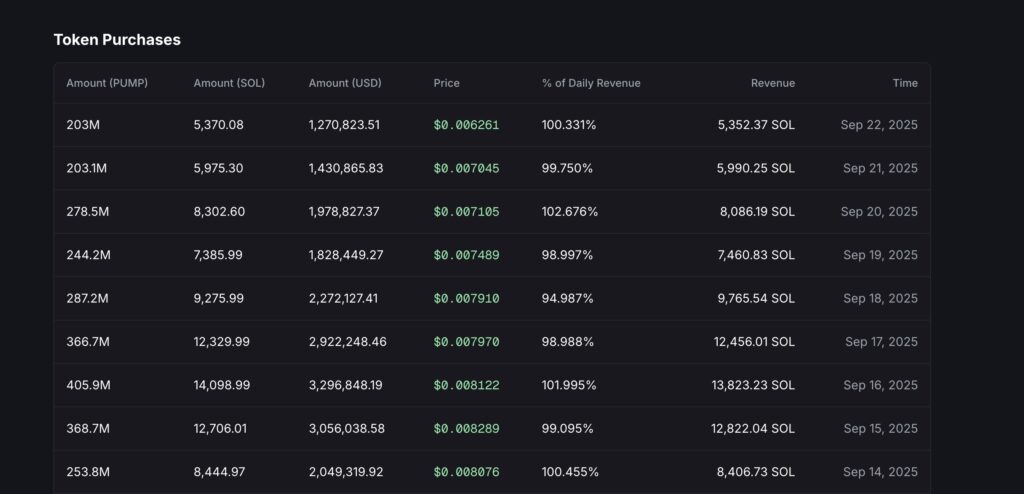

A well-followed crypto expert reveals that Pump.Fun’s daily revenue has continued to decline for 10 consecutive days. This has caused PUMP buybacks to drop by 50%, from 405.9 million PUMP to 203 million PUMP, as recorded on September 14, 2025.

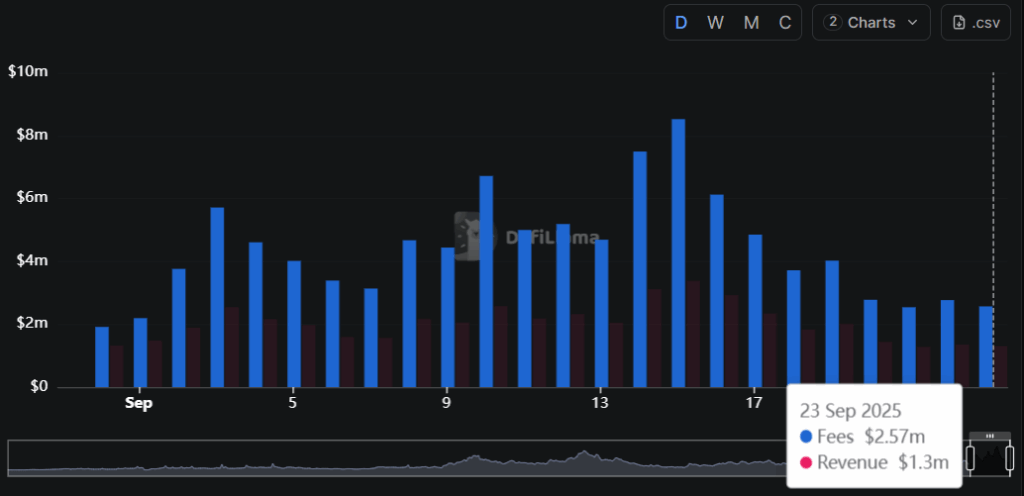

Data from the on-chain analytics tool DeFiLlama reveals that from September 15, 2025, project’s revenue and fees have plummeted from $8.52 million and $3.38 million to $2.57 million and $1.30 million, respectively.

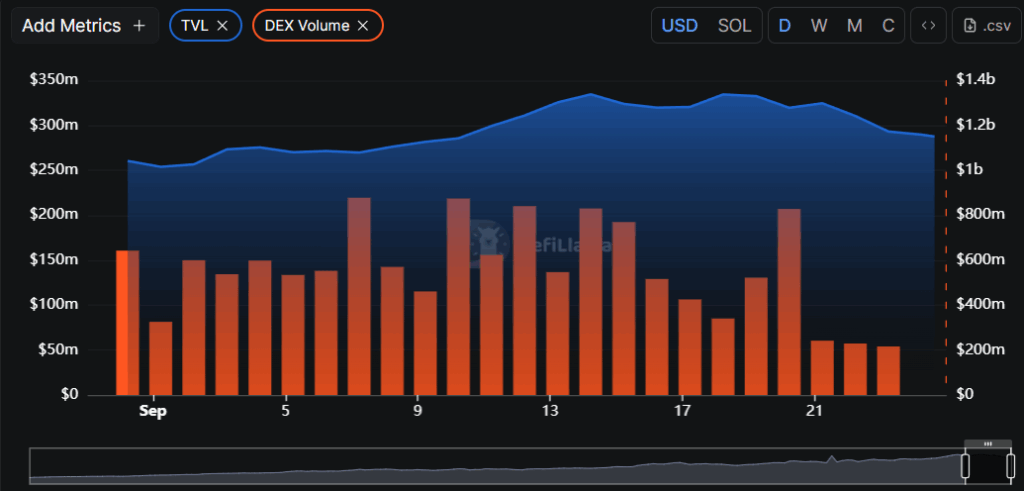

In addition, the project’s Total Value Locked (TVL) and DEX volume have also plummeted notably. DeFiLlama reveals that TVL and DEX volume, which were $334.81 million and $830.52 million on September 14, 2025, have now dropped to $293.39 million and $216.18 million, respectively.

These fundamentals suggest that Pump.Fun’s native token is weakening.

You might be wondering whether PUMP can continue its upside momentum or if a decline is on the horizon.

PUMP Technical Outlook: Upcoming Levels to Watch

TimesCrypto’s technical analysis suggests that PUMP is in an uptrend despite the recent decline and is poised for a price recovery. On the daily chart, the asset appears to have formed a descending trendline resistance while falling from $0.0087 to its current level, which now acts as a barrier to an upside rally.

The level where PUMP has begun recovering is the 61.8% Fibonacci level, which has a history of reversals.

Based on the current price action, if PUMP breaches this trendline and closes a daily candle above the $0.0062 level, it could see a price uptick of 40% and may reach $0.0088.

On the other hand, if PUMP fails to hold the 60% Fibonacci level, it could experience a notable price decline.

At press time, the Average Directional Index (ADX) value has reached 38, above the threshold of 25, indicating strong upside momentum in the asset, which could help it continue its upward trend.