Key Takeaways

- Pump.fun (PUMP) whales have accumulated a total of 1.426 billion tokens worth $11.72 million.

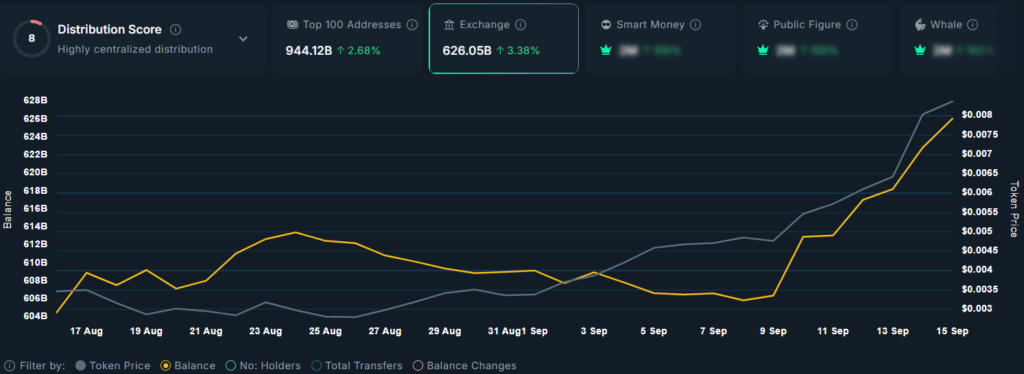

- Exchange supply jumped by 3.38%, equivalent to 3.2 billion PUMP tokens over the past 24 hours.

- Price action suggests a potential correction to $0.007 before further continuation.

Pump.fun (PUMP) seems to be witnessing a strong battle between crypto whales and profit-takers who continue offloading. This data raises questions about whether the price of PUMP will follow the same trend or face a correction ahead.

Why is the Pump.fun (PUMP) Price Rising?

Let’s understand what actually happened. Over the past 24 hours, crypto trackers Lookonchain and Onchain Lens shared multiple posts on X revealing whale accumulations.

According to the posts, whales accumulated a total of 1.426 billion PUMP tokens worth $11.72 million from multiple exchanges. This accumulation took place while the asset’s price was hovering above the $0.0075 level.

Adding to this strength, on-chain analytics tool Nansen revealed that PUMP’s top 100 largest wallet addresses increased their holdings by 2.68% over the past 24 hours. With this surge, these wallets now manage a total of 944.13 billion PUMP tokens, equivalent to 94.41% of the total supply.

Looking at on-chain data, the outlook appears bullish and signals strong PUMP demand in the market, which has been driving the price higher.

Also Read: X Suspends Pump.fun in Solana Memecoin Purge

Is Correction Looming for PUMP?

However, at the same time, both centralized and decentralized exchanges have witnessed a sharp surge in supply.

Over the past 24 hours, CEX and DEX supply jumped by 3.38%, equivalent to 3.2 billion PUMP tokens. This surge in exchange supply indicates strong profit-taking by investors and is now creating a potential sell-off or bearish signal.

PUMP Price and Surge in Trading Volume

However, the impact of the battle between whales and profit-takers is evident in Pump.fun (PUMP) price. Over the past 24 hours, the asset slipped 2.5% and is currently trading near the $0.000806 level.

Meanwhile, investors and traders appear to be supporting this price decline, as an 8% jump in PUMP’s trading volume was recorded. When the price falls while trading volume rises, it indicates that market participants are showing stronger interest in downside moves.

PUMP Price Outlook and Key Levels to Watch

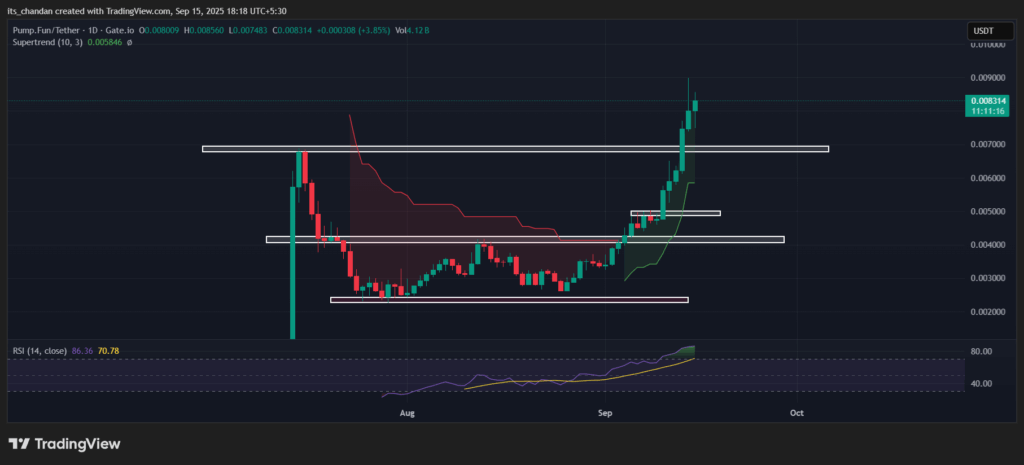

According to TimesCrypto’s technical analysis, PUMP is in an uptrend and appears likely to continue its upside momentum in the coming days.

This bullish outlook follows the recent breakout above the key resistance level of $0.0070 with a strong full-bodied bullish candle, a level that previously acted as major resistance in July 2025.

Looking at the current price action, the next resistance levels PUMP could reach are $0.0090 and $0.010, as these show a recent wick and a key psychological level.

However, the asset’s Relative Strength Index (RSI) value stands at 86.31, indicating that PUMP is in an extreme overbought zone.

PUMP’s RSI suggests that the rally remains strong and signals a potential correction. A price pullback to the $0.007 breakout level might be possible before the asset continues its upside momentum.