Key Takeaways

- Pump.fun (PUMP) defies the crypto market with a 13% price uptick.

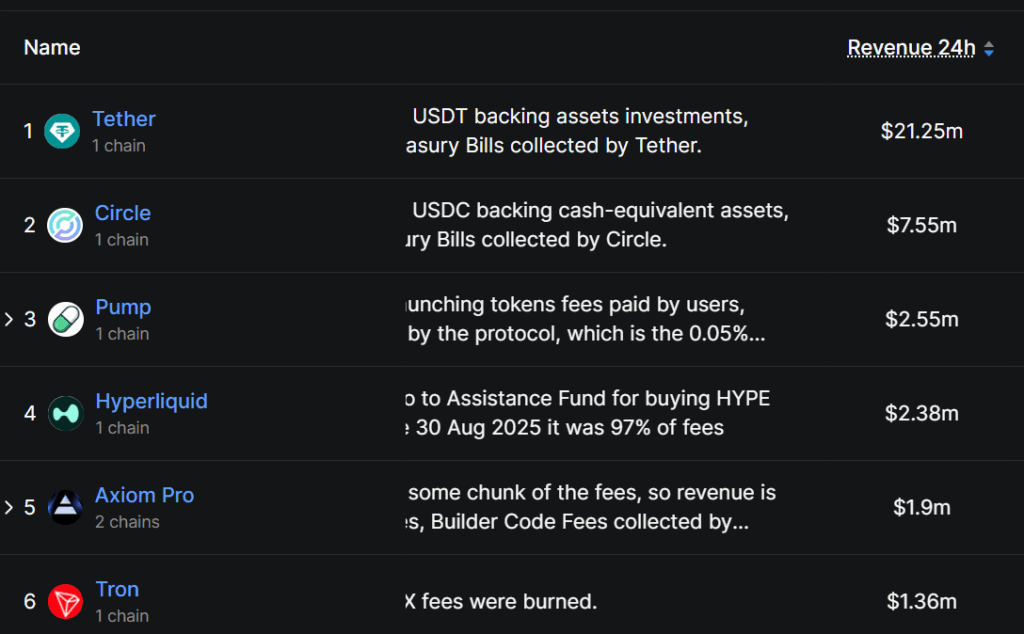

- Pump.fun surpasses Hyperliquid in 24-hour revenue.

- Price action suggests PUMP could see another 25% rally if it sustains above the $0.00425 level.

Bullish sentiment is heating up around Pump.fun (PUMP), which has outperformed major assets including Bitcoin (BTC) and Ethereum (ETH). The token’s 13% price uptick over the past 24 hours has placed it among the top gainers, defying the overall market sentiment.

Additionally, it also helped the asset reach near a key level of $0.0042.

Bullish Momentum Strengthens with Rising Volume

At press time, the Pump.fun (PUMP) has reached the $0.004198 level and attracted massive participation from traders and investors, triggering an impressive 14% jump in trading volume.

At the same time, top assets like BTC and ETH seem to be struggling to gain momentum.

Seeing this, you might be wondering why PUMP’s price is rising.

Also Read: X Suspends Pump.fun in Solana Memecoin Purge

Why is the Pump.fun (PUMP) Price Rising?

This is all happening due to bullish on-chain data, strong price action, whale interest, and a firm buyback program, which not only pushed the asset to higher levels but also strengthened investor confidence and interest.

Looking at the current market outlook, a crypto whale appears to be betting on the bullish side. Recently, blockchain-based transaction tracker Onchain Lens shared data showing that a whale deposited $2.43 million USDC into Hyperliquid and opened a long position on PUMP with 3x leverage.

This massive long position demonstrates the whale’s confidence and the asset’s long-term potential.

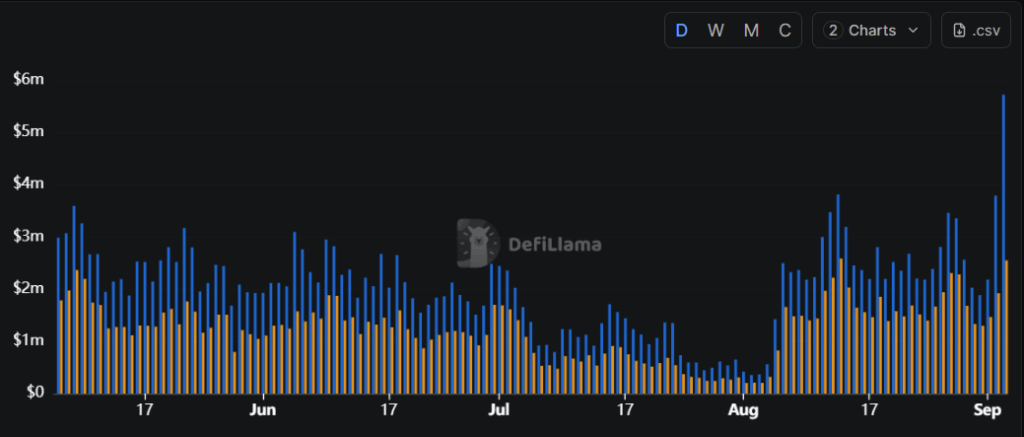

This alone is not enough to sustain PUMP’s upside momentum. DeFiLlama revealed that Pump.fun’s fees and revenue are continuously increasing, which appears to be another key catalyst behind the price uptick.

The platform uses 1% of transaction fees to buy back PUMP tokens instead of selling them on the market, which constrains supply and reduces circulation, helping the asset amplify.

Over the past 24 hours, DeFiLlama further shows that Pump.fun has outperformed Hyperliquid in terms of revenue generation. According to the data, Pump.fun recorded $2.55 million in revenue, while Hyperliquid lagged behind with $2.38 million.

All of these metrics appear to be potential reasons for driving PUMP’s price to new highs.

Looking at its current performance, you might be wondering how long PUMP can continue its upside momentum.

PUMP Price Trends and Upcoming Levels

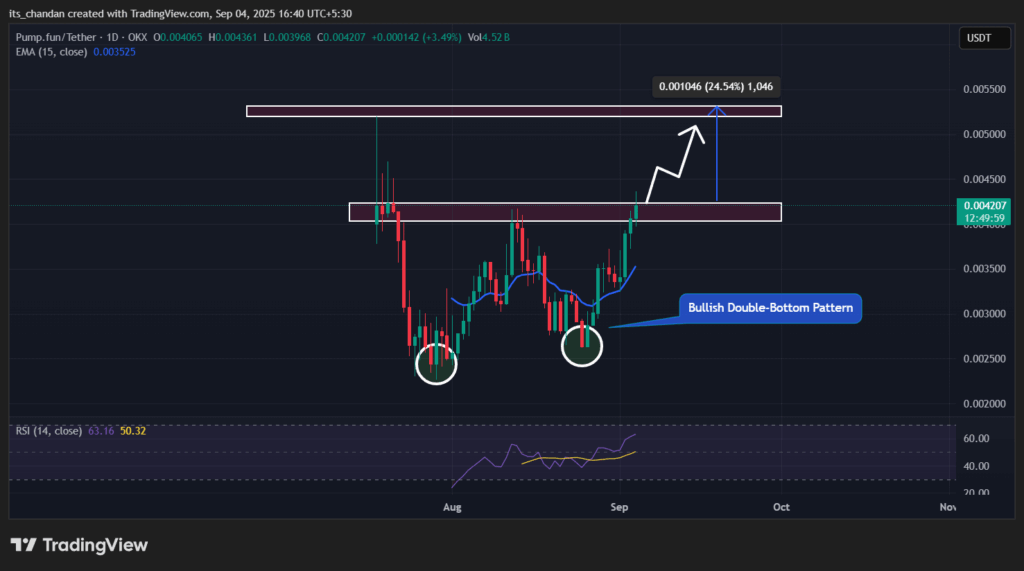

AMBCrypto’s technical analysis finds that PUMP has formed a bullish double-bottom pattern on the daily charts and appears to be breaching it. This marks the second time since August 2025 that the asset is approaching the key resistance level of $0.00415.

Based on the current market outlook, if PUMP successfully breaks out of the double-bottom pattern and closes a daily candle above $0.00425, it could trigger a 25% upside rally, with the price potentially reaching $0.0053.

However, the Relative Strength Index (RSI) currently stands at 63, suggesting that PUMP still has room to continue its upside momentum before entering overbought territory.

Key Liquidation Levels to Watch

At press time, traders appear to be following the current trend by heavily betting on long positions.

Data from Coinglass reveals that $0.00396 and $0.00442 are the two major liquidation levels, where traders are over-leveraged with $6.87 million in long positions and $2.96 million in short positions. This indicates that bulls are currently dominating the asset.