Key Takeaways

- New bill would let Americans to pay taxes in Bitcoin starting 2025.

- All Bitcoin tax payments would fund U.S. Strategic Bitcoin Reserve.

- Proposal aims to accumulate 2.6 million BTC through voluntary taxpayer contributions.

Table of Contents

Legislative Push for Bitcoin Tax Payments

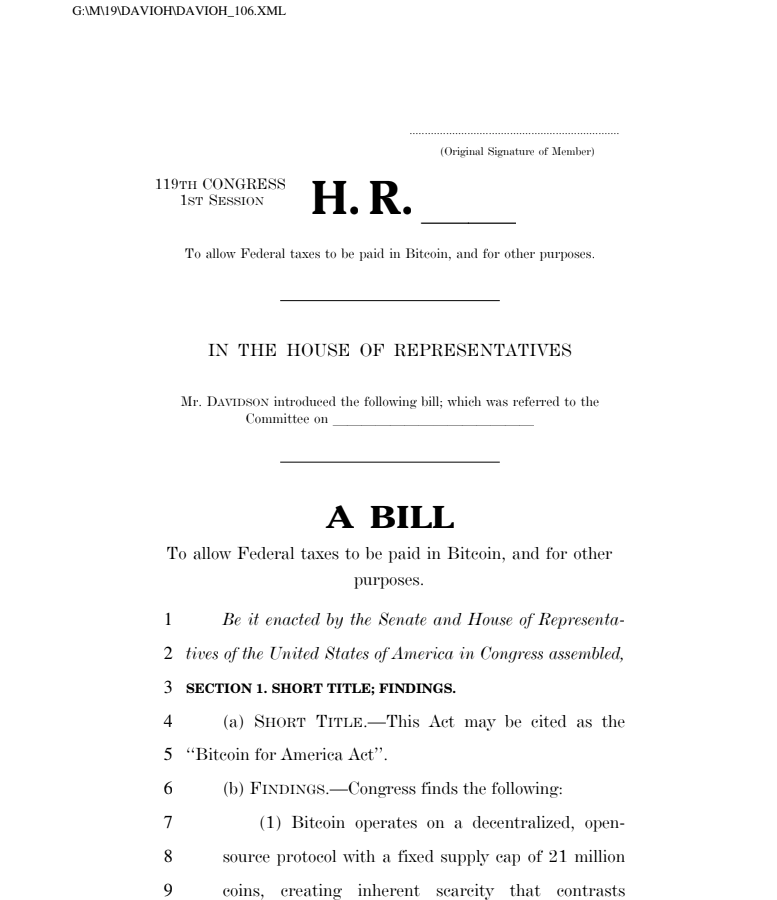

In a move that could be a game-changer in Congress, the new Bitcoin for America Act, introduced by Rep. Warren Davidson (R-OH), will allow Americans to pay tax obligations in Bitcoin.

The tax bill would give individuals and corporations the ability to make payments to satisfy their federal tax obligations in Bitcoin, with all crypto payments directed to the U.S. Strategic Bitcoin Reserve.

This initiative represents the most significant legislative effort to date, integrating crypto into the national finance system, which could change how the government interacts with digital assets going forward.

Read also: Breaking: U.S. Gov Shutdown Nears End as Senate Advances Funding Deal – Crypto & Stock Markets Surged

Building National Bitcoin Reserves Through Voluntary System

Allowing Americans to pay taxes in Bitcoin would allow them to adopt a citizen-driven approach to building national reserves of crypto without massive purchases by the government.

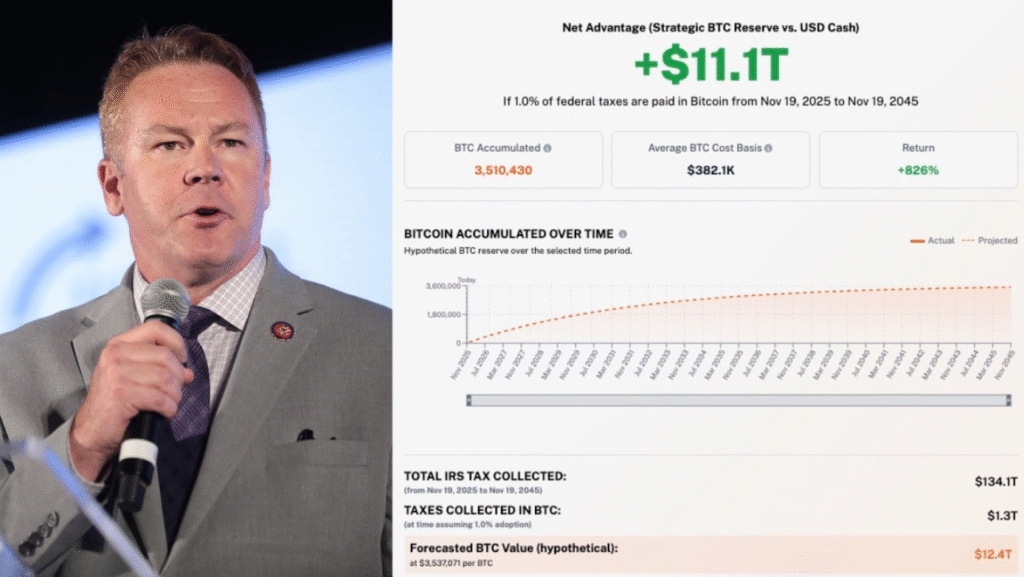

According to projections by the Bitcoin Policy Institute, if 1% of federal taxes are paid in Bitcoin between 2025 and 2030, this would yield more than 2.6 million BTC worth approximately $230 billion for the strategic reserve.

This is a significantly better approach than previous proposals that involve direct purchases of Bitcoin by the government; instead, it creates an organic accumulation method as Americans pay taxes in Bitcoin voluntarily.

Read also: Bealls Retail Crypto Payments Launch at 660+ Stores Nationwide & 99+ Cryptos Accepted

Strategic Positioning in Global Digital Asset Race

The push to allow Americans to pay taxes in Bitcoin comes at a time of increasing competition with countries such as China and Russia actively accumulating digital assets. According to Representative Davidson, using Bitcoin to pay taxes would put the U.S. on the map as an innovator in the digital space, while diversifying the country’s holdings away from inflationary currencies.

The proposal builds on President Trump’s executive order establishing the Strategic Bitcoin Reserve as a sustainable funding source, as more Americans pay taxes with Bitcoin over time.

FAQs

How would Americans pay taxes in Bitcoin under this bill?

The bill would create a system where Americans pay taxes in Bitcoin through voluntary opt-in, with payments converted and allocated directly to the U.S. Strategic Bitcoin Reserve rather than general government funds.

What happens to Bitcoin after Americans pay taxes in BTC?

When Americans pay taxes in Bitcoin, the crypto would be transferred to the Strategic Bitcoin Reserve, creating a national store of value that appreciates independently of traditional currency fluctuations.

Why do supporters want Americans to pay taxes in Bitcoin?

Proponents argue that letting Americans to pay taxes in Bitcoin strengthens national financial resilience, embraces innovation, and positions the U.S. competitively in the global digital asset industry while giving taxpayers more flexibility.

For more Bitcoin-related stories, read: Quantic Bitcoin ‘BTCQ’ Emerges as Quantum-Resistant Crypto Challenger