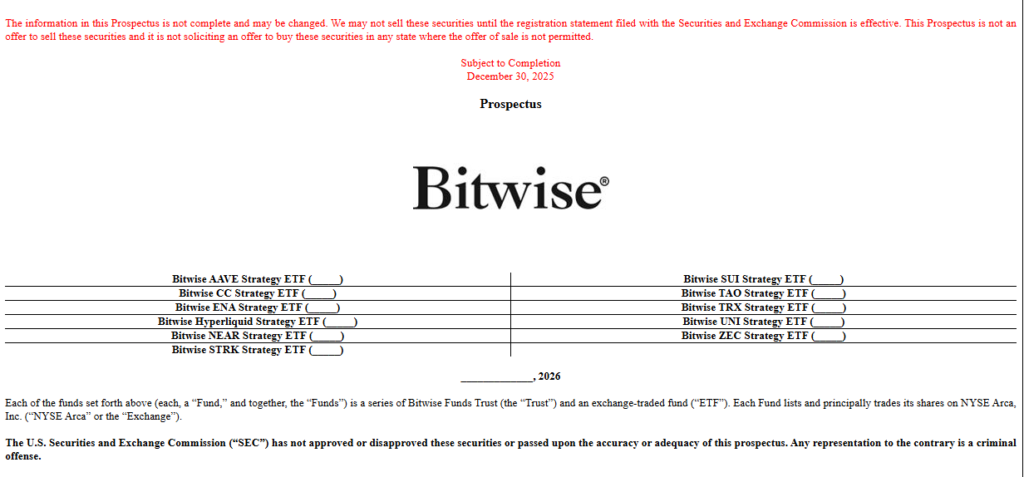

Bitwise ETFs: Bitwise Asset Management has announced an aggressive expansion into Exchange Traded Funds by registering 11 (eleven) new ETF registrations for various alternative digital currencies including AAVE, UNI, and TAO.

A New Way to Obtain Exposure to Altcoins Using Hybrid Funds

Bitwise Asset Management has taken the next step forward by creating a large new suite of hybrid strategy funds with investments in unique and innovative ways to invest in multiple alternative digital currencies.

For example, under the proposed name of “Bitwise AAVE Strategy ETF,” Bitwise will create a series of ETF funds with each ETF focused on a single digital currency but strategically structured as a hybrid strategy fund to create greater flexibility for investors.

Includes “Hybrid” Approach to Altcoins

The fund structure will allow the Investor to hold (up to) 60% of their total investment amount directly in the underlying digital token with the other 40% of the fund representing long-term investment products (ETPs) or financials (future contracts) combined with the same digital token the Investor is investing in.

Read also: Grayscale Files for Landmark U.S. Bittensor ETP (GTAO) with SEC

Developing a Full Crypto Suite

This huge filing shows that Bitwise has made a strategic investment to create a full suite of ETFs for an investor looking for regulated investment opportunities, which go beyond Bitcoin or Ethereum.

These Bitwise ETFs would allow investors to focus on four prominent areas of crypto investment:

- Decentralized Finance (DeFi) projects like AAVE and UNI

- Decentralized Artificial Intelligence (AI) such as TAO

- Layer 1 Blockchain Networks like NEAR and SUI

- Privacy-enhancing projects like ZEC.

The filing builds on Bitwise’s strong performance so far in the ETF space in the form of their successful launches of Solana, XRP and Dogecoin ETFs within a short time frame, and strongly positions the firm at the forefront of providing investment vehicles for institutional users across the wide spectrum of the crypto asset ecosystem.

Read also: Coinbase 2026 Outlook: Crypto’s Future Hinges on Derivatives, Prediction Markets, and Stablecoins

Breaking Down the Barriers

With these ETFs, Bitwise will put the next step of developing institutional crypto investment products into practice.

The hybrid structure will allow Bitwise to navigate the difficulties of operating in a regulated environment, create an efficient way to invest, and increase the number of single asset cryptos available to traditional brokerage accounts, thereby creating a closer link between the digital currency ecosystem and the traditional investment portfolio.

FAQs

What does a “Strategy ETF” mean in this context?

It refers to a hybrid structure where the fund can invest both directly in crypto and indirectly through other financial instruments. In this case, and for these Bitwise ETFs, this means up to 60% in the actual token (like AAVE) and the rest in other ETPs or derivatives that track that token’s price.

Which crypto assets are included in the Bitwise ETFs filings?

The 11 filings target: Aave (AAVE), Canton (CC), Ethena (ENA), Hyperliquid (HYPE), NEAR Protocol (NEAR), Starknet (STRK), Sui (SUI), Bittensor (TAO), Tron (TRX), Uniswap (UNI), and Zcash (ZEC).

When will these ETFs start trading?

There is no set date. The filings are the first step in a process that requires SEC review and approval, which can take several months and is not guaranteed. The funds would list on NYSE Arca if approved.

Read also: Mirae Asset Group Pursues Major Crypto Foray with $100 Million Korbit Acquisition