Key Takeaways:

- Beijing is putting the final touches on a framework to launch yuan-backed stablecoins, signaling a clear shift from its 2021 ban on cryptocurrency activity

- Hong Kong and Shanghai will pilot the rollout, drawing on new regulatory infrastructure and digital yuan initiatives to support cross-border stablecoin deployment.

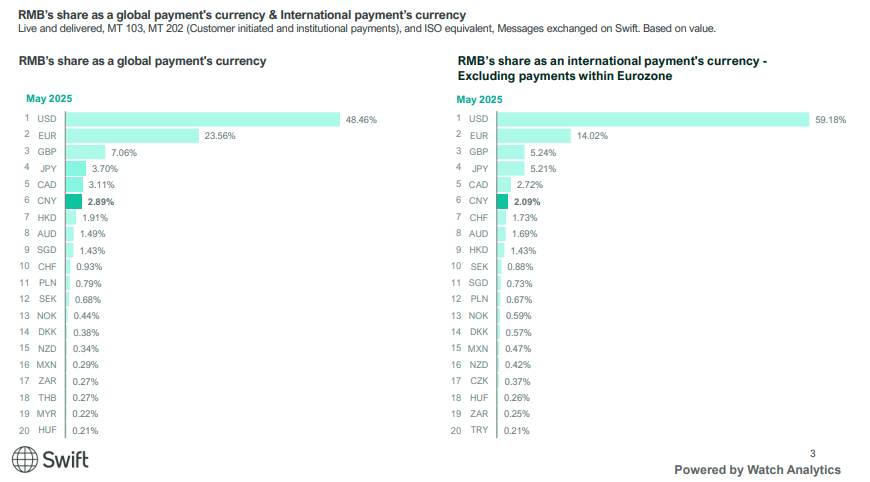

- The move aims to counter U.S. dollar dominance, as yuan use in global payments remains low at 2.88%, compared to the dollar’s 47.19% share, per SWIFT data.

Table of Contents

China is finalizing a policy roadmap to introduce yuan-backed stablecoins as part of a broader effort to increase the currency’s international use, Reuters reported, citing sources familiar with the matter.

The State Council is expected to review the proposed framework later this month, marking a significant policy shift from China’s 2021 ban on cryptocurrency trading and mining.

Policy Roadmap and Regulatory Coordination

The plan will define adoption targets for the yuan in global markets, assign supervisory roles to domestic regulators, and introduce guidelines for risk management.

Under the new framework, Chinese authorities are to accelerate institutional coordination, with the People’s Bank of China expected to play a central role in regulatory oversight.

Additionally, Officials will hold a leadership meeting later this month to discuss the potential uses, boundaries, and regulatory approach of stablecoins across both domestic and international markets.

Hong Kong and Shanghai to Lead Stablecoin Implementation

According to the report, Hong Kong and Shanghai have been chosen to be the primary launch sites for the initiative, with each city taking on a distinct role in advancing the rollout.

In Hong Kong, authorities implemented a new stablecoin ordinance on August 1, enabling the regulated issuance of fiat-backed tokens under a formal licensing framework.

Meanwhile, Shanghai is developing a cross-border operations center for the digital yuan, designed to support broader implementation and facilitate international transactions.

China Eyes Stablecoins to Boost Yuan Beyond Current 2.88% Share

The stablecoin initiative aligns with China’s broader goal of challenging the U.S. dollar’s dominance in global payments, as the yuan represented only 2.88% of international transactions in June, compared to the dollar’s commanding 47.19% share, according to SWIFT.

Why Now and What to Expect

China has maintained a cautious and skeptical stance toward cryptocurrencies in recent years.

In 2021, authorities imposed a nationwide ban on crypto trading and mining, citing financial risk, capital outflows, and energy consumption concerns. The crackdown pushed major crypto activities offshore and reaffirmed Beijing’s preference for centralized financial systems, including its state-run digital yuan project.

The policy shift reflects changing global dynamics, with China responding to the increased stablecoin usage among domestic exporters and the rising influence of U.S.-backed digital currencies in cross-border trade.

If adopted, the stablecoin framework could lay the foundations for broader yuan usage in global trade and cross-border settlements, with regulatory clarity and infrastructure developments in Hong Kong and Shanghai enabling international adoption while preserving capital controls and ensuring oversight through state-backed mechanisms.

Read More: Wyoming’s FRNT Stablecoin Goes Live: Spend State-Backed Crypto Like Cash