The Clarity Act, a long-awaited United States crypto bill, is losing momentum in Congress, raising the risk of a prolonged period of uncertainty for the crypto industry, according to Matt Hougan, chief investment officer at Bitwise Asset Management.

Hougan said the proposed Clarity Act, which supporters see as the main path to stable and predictable rules for crypto in the United States, no longer looks like a near certainty. That shift, he warned, could leave the sector exposed to policy reversals and a tougher stance from a future administration.

The measure, often referred to as the market structure bill, outlines who regulates what in crypto, as it draws a line between tokens treated as securities and those treated as commodities and sets basic rules for trading platforms, custodians, and stablecoin issuers.

Hougan Warns of Policy Reversals and Investor Caution

Hougan said the loss of momentum leaves the industry exposed to political shifts in Washington. “The Clarity Act would cement the current pro-crypto regulatory environment into law. Without it, a future administration could reverse today’s pro-crypto push,” he said.

Additionally, if the Clarity Act stalls or fails, the sector would face a period in which it must prove that crypto infrastructure is essential to everyday finance, not just to speculative trading.

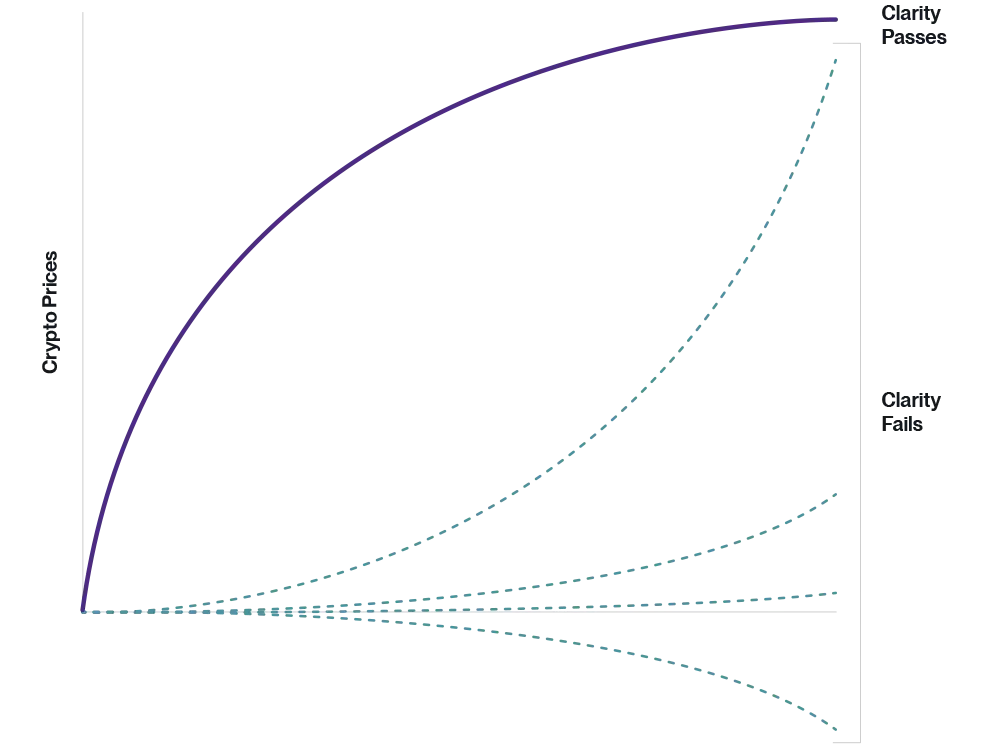

The bill’s outcome would also shape how investors treat the sector. A version of the Clarity Act that the industry is comfortable with would, in his view, start a sharp rally as investors assume that growth in areas such as stablecoins and tokenization is secure and begin to reflect that future in prices.

If the bill ultimately fails, Hougan said, investors are likely to wait for clear evidence of real-world adoption before assigning higher valuations, leaving crypto in a more cautious “wait and see” market dominated by regulatory skepticism.

Progress on the Clarity Act Stalls in the Senate

The market structure bill has run into a series of political setbacks in the Senate. First, Senate Banking Committee chairman Tim Scott said his panel would hold a markup after more than six months of work on the legislation, presenting it as part of a push to lower costs and widen access to crypto under clearer rules.

A separate version in the Senate Agriculture Committee was also scheduled for a markup, with Chairman John Boozman saying the updated draft would give the Commodity Futures Trading Commission more authority over digital commodities. That session was later pushed to the final week of January as negotiators asked for more time to finalize the text and secure bipartisan backing.

Coinbase Pushback Adds Pressure on Lawmakers

The effort came under further pressure when Coinbase chief executive Brian Armstrong said he could not support the Banking Committee bill in its current form, arguing it contained too many problems and that the industry would be better off with no law than a flawed one. After that, the Banking Committee put its markup on hold while talks with senators and industry groups continue.