The European Union will introduce new tax reporting rules for crypto trading from January 1, 2026. Exchanges, brokers, and custodial crypto-asset service providers that serve EU residents will have to collect and share data on customer activity under a regime based on the global Crypto-Asset Reporting Framework, known as CARF.

Under the new framework, crypto becomes part of the tax information exchange system that governments already use, and from the start of the 2026 tax year, platforms will begin collecting reportable data on crypto activity for later reporting and cross-border exchange between tax authorities.

What CARF Means For Exchanges and Custodians

CARF is a global standard created by the Organization for Economic Co-operation and Development (OECD) to give tax authorities a clearer view of crypto transactions that move across borders. The EU has built that standard into its own rules through an update known as DAC8, which treats many crypto platforms in a similar way to banks for tax reporting purposes.

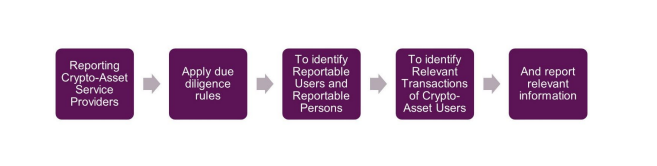

For companies, this means becoming part of a formal reporting chain. Trading venues, custodians, and custodial crypto-asset service providers that deal with EU residents will be required to know who their customers are, not just for anti-money laundering checks but also for tax. They must obtain a self-certification that is signed or otherwise affirmed and dated, setting out where each client is a tax resident, along with key details such as name, address, date of birth, and tax identification number.

Additionally, over each calendar year, firms will record how much crypto a reportable customer buys or sells for regular currency, how much is swapped between different tokens, certain types of transfers, and other reportable transactions during the year. Those totals are then sent to the tax authority in the country where the firm reports, which passes on the data relating to taxpayers in other states.

Under the new framework, providers based outside the bloc but serving EU users may still have reporting obligations, typically by registering in an EU member state for DAC8 reporting. National laws implementing DAC8 can include financial penalties for firms that fail to report or submit incomplete data.

What Will Change for Users

For ordinary users, the change will show up first in the way platforms ask questions. New customers opening an account can expect to be asked for a tax identification number and a clear statement of their tax residence alongside standard identity checks, while existing customers will receive prompts to fill in missing tax information or confirm that the details on file are still correct.

Users who ignore these requests or provide unverifiable information may face account friction, including delays in onboarding or feature limits, depending on platform policy and national implementation. In practice, using regulated services in the EU will make it much more difficult to remain anonymous for tax purposes.

Experts say users should now think of crypto in the same way as a regular investment account. That means keeping clearer records of trades, expecting that platforms will share data with tax authorities, and making sure that taxable gains or income from crypto appear in returns where local rules require it.

Read More: Italy Warns VASPs to Meet MiCA Rules or Exit Market by Year-End 2025