DerivaDEX has launched its licensed derivatives trading platform following the Bermuda Monetary Authority’s approval of its T license. This is the first DAO-governed derivatives exchange to operate under formal regulatory oversight while still preserving the core benefits of decentralization.

DerivaDEX Bridges DeFi and TradFi

The new platform will integrate off-chain order matching with on-chain settlement, allowing users to always have non-custodial access to their funds during the entire trade lifecycle. DerivaDEX also provides performance at centralized exchange level, including sub-5 millisecond order acknowledgment, rapid deposits and withdrawals to Ethereum, and real time price feeds. Encrypted order handling and trusted execution environments incorporate front-running resistance.

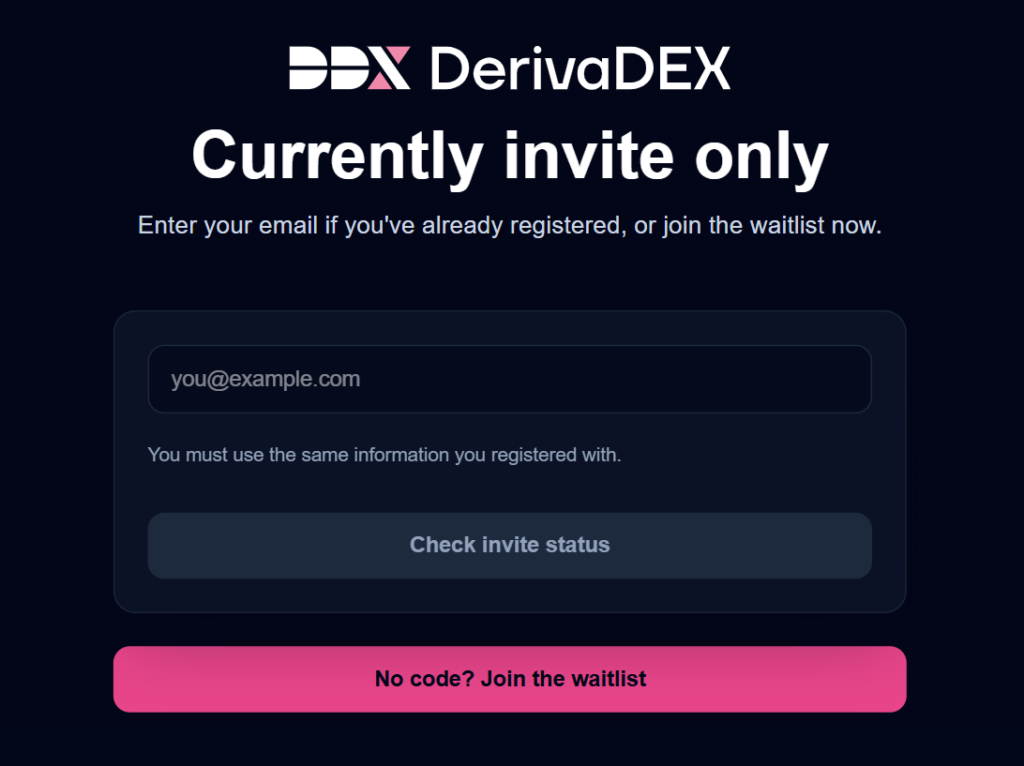

At launch, major crypto perpetual products can be traded via the DerivaDEX platform; initially limited to a small number of sophisticated traders. Over time, the company plans to expand available product offerings to prediction markets and traditional securities.

Why This Matters for Institutional DeFi

“Today’s DerivaDEX launch marks a milestone in the relationship between traditional finance and decentralized trading,” said DEXLabs Founder Aditya Palepu. “As the first decentralized exchange to receive a regulatory license, we’re proving that decentralization and institutional standards are not mutually exclusive,” he added.

The launch comes at a time when traditional asset managers are already actively engaging with decentralized finance (DeFi) infrastructure. As an example, BlackRock’s recent listing of their tokenized Treasury assets on Uniswap and Apollo Global Management acquiring governance tokens from the leading lending protocol, Morpho.