Key Takeaways

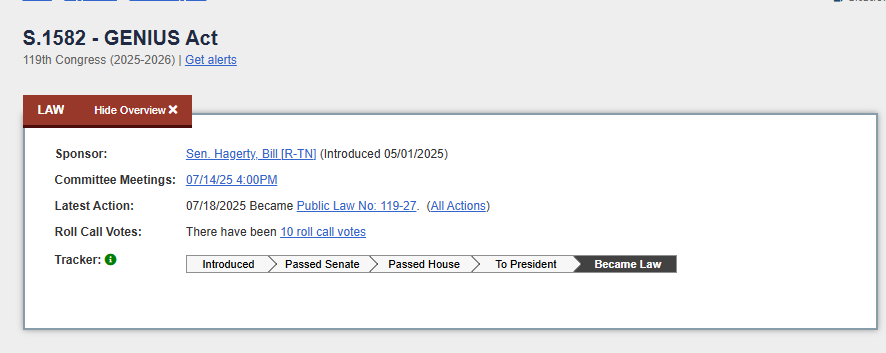

- The Federal Deposit Insurance Corporation (FDIC) is finalizing its first set of rules to implement the new Genius Act, the U.S. stablecoin law.

- Initial proposals will focus on application frameworks and prudential standards like capital and liquidity.

- The rules aim to create a clear, secure environment for regulated stablecoin issuance, separating it from securities law.

Table of Contents

Turning Legislation into Regulation

The United States’ Federal Deposit Insurance Corporation (FDIC) is working steadily to implement the new Genius Act legislation, which was signed into law in July. As the U.S. Department of the Treasury has stated, it will submit its first rule proposals by December 31, marking a key milestone in transitioning the Genius Act into an actionable set of Federal regulations.

The initial phase of the new Genius Act implementation will involve establishing an application process and the necessary constitutional foundations, such as the requirements for capitalization, liquidity, and reserve standards for banks to offer payment stablecoin products to customers.

Read also: U.S. Launches Scam Center Strike Force to Combat $10B Crypto Fraud Epidemic

Clarity for a Nascent Industry

The core mandate of the new Genius Act is to create a secure, federal framework for stablecoins, which are digital assets pegged to a fiat currency like the U.S. dollar in a 1-to-1 ratio. Therefore, under the law, only licensed “permitted issuers“, which can be banks, federal nonbank issuers, or state-qualified issuers, can offer stablecoins to U.S. persons.

To this point, stablecoin issuers must back their tokens with high-quality, liquid reserves and provide regular transparency reports accordingly. One of the most important aspects of the new Genius Act clarifies that compliant payment stablecoins are not considered securities, thus resolving a long-standing legal ambiguity.

Read also: World Federation of Exchanges Demands Crackdown on Crypto “Mimic” Stocks

Building the Foundation for Digital Dollars

Regulatory guidelines provided by the FDIC will be the basis (plumbing) for a regulated U.S. stablecoin ecosystem. The FDIC will provide additional regulations to create protections for financial stability and consumers, thereby encouraging further innovation and improving many of the problems that have developed as a result of the lack of supervision of stablecoins.

At the same time, other regulatory bodies (such as the Treasury Department) are moving forward with rules as well, developing a framework for competition that creates clarity for stablecoin issuers and security for stablecoin users that positions the dollar for the future of digital finance.

FAQs

What is the GENIUS Act?

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act is a U.S. federal law passed in July 2025 that creates a regulatory framework for payment stablecoin issuers, detailing who can issue them and the reserve and transparency requirements they must follow.

Who will be allowed to issue stablecoins under the new Genius Act rules?

Only “permitted issuers” will be allowed, which include insured banks, federally licensed nonbank issuers, and state-qualified issuers (for issuances under $10 billion). All must maintain full reserves and be regulated by a federal or state agency.

When will the rules take effect?

The FDIC plans to issue its first proposed rules for public comment by the end of December 2025, with a follow-up proposal on prudential requirements expected early next year. The final rulemaking and implementation will follow the standard regulatory process.

For more regulation-related stories, read: Americans to Pay Taxes in Bitcoin Under New Congressional Proposal