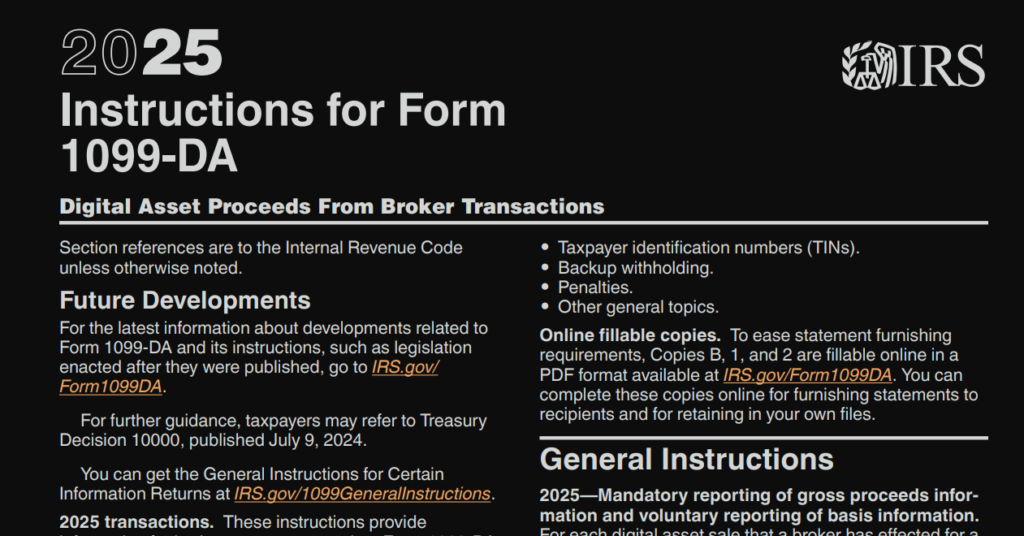

IRS (Internal Revenue Service) officially released Form 1099-DA, which is now the accepted standard for reporting on taxation of digital assets domestically. This form is to be used by brokerage firms as documentation of their clients’ transaction proceeds that occurred during 2025, with filings to the IRS and forms sent to taxpayers beginning in early 2026.

What the New IRS Form will do for Crypto Tax Filings

The IRS New Form 1099-DA (“Digital Asset Proceeds From Broker Transactions”) is intended to address the growing lack of clarity regarding the proper reporting for digital assets, including crypto, over the past few years. The IRS has now established a standard that the majority of U.S. brokerage firms, including centralized exchanges (CEX) as well as some wallet providers, must provide the same method of reporting client transactions regarding buying and selling crypto and the exchange of tokens for fiat.

The first version of the 1099-DA will only provide clients with the gross amount of the asset that they purchased (minus any fees or commissions). However, it will not include the clients’ basis of the asset or net gain/loss of each asset that was purchased and/or sold. In other words, you’ll receive a document stating “you sold $X worth of assets,” but clients are still responsible for tracking their original investment costs and tax liability with respect to their digital assets.

A Double-Edged Sword for Compliance

This looks like a monumental achievement in the financial industry that changes how we navigate our taxes. For the IRS, the new Form 1099-DA creates an automated paper trail that makes it significantly harder for taxpayers to underreport or omit crypto income.

For the average taxpayer, having a summary of each account’s activity at tax time will help with meeting their tax obligations. But they will also need to be very proactive in keeping accurate records of their transactions, as discrepancies between the total amount reported on their 1099-DAs and their tax returns will raise red flags for audit algorithms.