Key Takeaways

- Plume Network secures SEC registration as a transfer agent, enabling compliant management of tokenized securities.

- The approval enables Plume to automate shareholder records and connect directly with the Securities and Exchange Commission (SEC) and Depository Trust and Clearing Corporation (DTCC) systems.

- Following the announcement, the PLUME token climbed more than 25%, indicating excitement for the regulatory milestone.

Table of Contents

A Key Regulatory Development for On-Chain Finance

In an important development moment for the tokenization of real-world assets (RWAs), Plume Network secures SEC registration as a transfer agent, granting the project legal authority to manage digital securities. Through this regulatory green light, the Layer-2 (L2) blockchain can also serve as a compliant conduit for bringing traditional finance (TradFi) instruments on-chain.

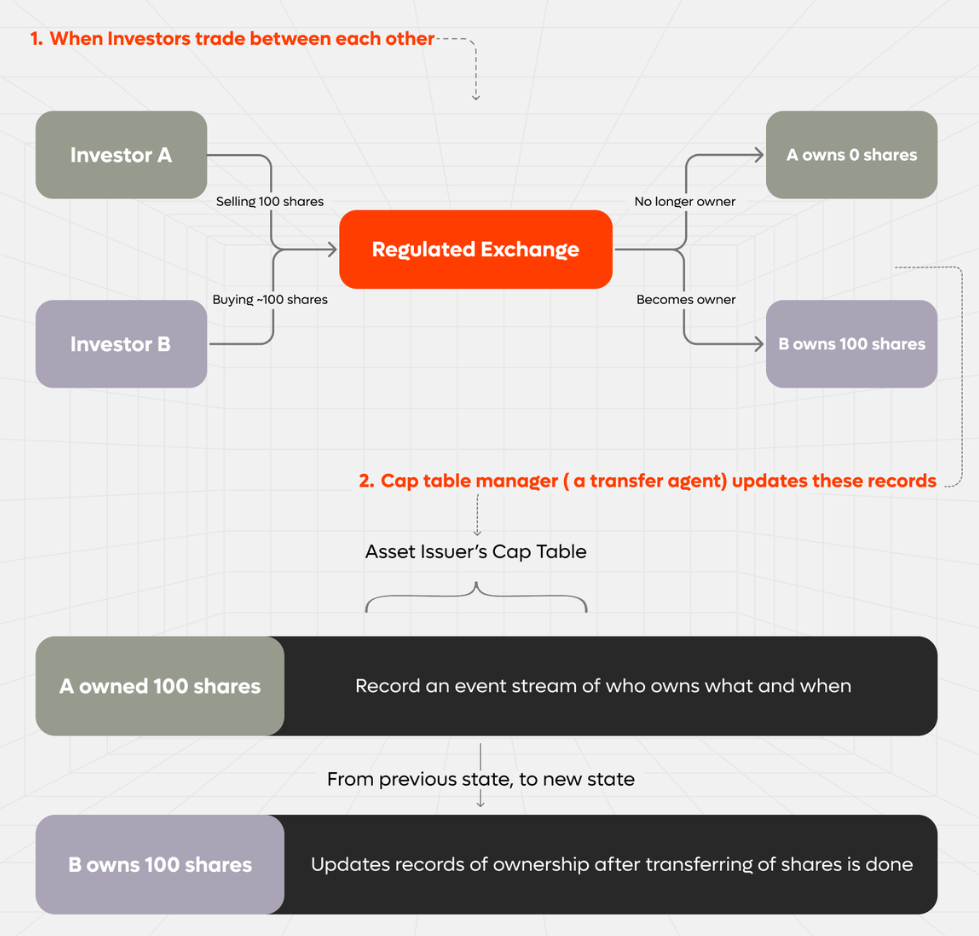

The designation enables Plume to perform critical back-office functions, including maintaining shareholder registries, recording ownership transfers, and managing corporate actions, all through blockchain technology while maintaining regulatory compliance.

Read also: Telegram Wallet Listing Tokenized U.S. Stocks Starting this October

Connecting Traditional Financial Services and Blockchain

The registration means Plume Network secures SEC registration, which fundamentally transforms how securities can be managed. Transfer agents have traditionally relied on heavy paperwork processes in an off-chain environment, while Plume is automated and based on the blockchain, which creates immutable transparency. The platform is now capable of connecting on-chain capitalization tables directly to SEC reporting and the Depository Trust & Clearing Corporation (DTCC). Bringing TradFi infrastructure into decentralized technology.

Read also: Chainlink Tokenized Fund Workflows Get SWIFT Integration for UBS

Accelerating the RWA Ecosystem

This regulatory milestone comes as Plume Network secures SEC registration amid bullish institutional interest in tokenized assets. So far, the platform has already onboarded well over 200,000 RWA holders and has facilitated more than $62 million worth of tokenized assets through its institutional vaults. The market reacted immediately, with PLUME token spiking over 25%, as investors realized the importance of the compliance breakthrough to connect this multi-trillion dollar securities market with the efficiencies of blockchain.

FAQs

Why is the SEC’s registration of Plume Network important?

It provides regulatory legitimacy for Plume to handle tokenized securities under U.S. law, creating a compliant bridge between traditional markets and blockchain.

What does a transfer agent do?

Transfer agents maintain shareholder records, process ownership transfers, and manage corporate actions like dividend distributions for securities issuers.

What assets has Plume already tokenized?

The network has facilitated over $62 million in tokenized assets, primarily through institutional fixed-income products like those offered by Nest Credit.

For more asset tokenization stories, read: Ondo & Pantera Launch $250M ‘Catalyst’ Fund in RWA Tokenization Arms Race