Key Takeaways

- The UK has passed a landmark law officially recognizing ‘crypto as third kind of property’.

- This creates a new legal category distinct from physical objects (“things in possession”) and contractual rights (“things in action”).

- The law provides a clear statutory footing for ownership disputes, inheritance, and recovering stolen digital assets.

Table of Contents

A Legal Milestone for the Digital Age

The United Kingdom has enacted historic legislation, formally establishing that digital assets like Bitcoin and Non-fungible tokens (NFTs) are part of our everyday life and can be legally recognized “crypto as third kind of property”.

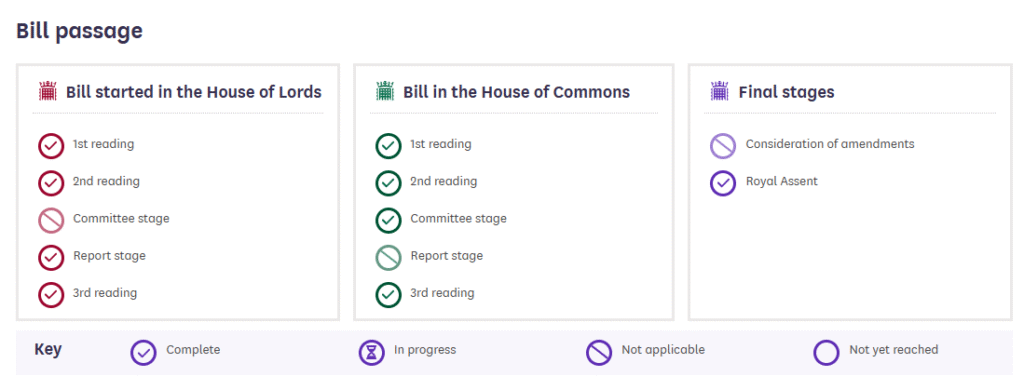

The Property (Digital Assets, etc.) Act 2025 received Royal Assent, moving beyond the previous patchwork of court rulings to enshrine the principle in statute. Now, UK citizens and businesses can be clear about their rights and responsibilities regarding these assets, and the courts will have a clearer framework for adjudicating disputes.

This classification of crypto as third kind of property provides clarity to consumers, giving governments and courts a single, consistent legal definition for dealing with crypto assets and NFTs, while still allowing users to protect their privacy. Digital assets have now gained the same type of legal rights as physical property and will be treated as such in inheritance laws.

At the same time, it creates a new category separate from traditional “things in possession” (like a car) and “things in action” (like a debt), modernizing centuries-old property law for the digital era.

Read also: UK Launches First-Ever Crypto Investment Fraud Protection Campaign Targeting Men Under 45

Clarity for Consumers and Courts

The move to recognize crypto as third kind of property is far more than symbolic. It provides a solid legal foundation for critical real-world scenarios, for example:

- Individuals now have clearer rights to prove ownership, include crypto in wills, and pursue stolen assets through the courts.

- For businesses, it reduces litigation uncertainty in cases of insolvency or fraud.

As advocacy group CryptoUK stated, this gives digital assets “a much clearer legal footing,” transforming them from a legal gray area into a recognized form of personal property with defined rights, especially for things like proving ownership, recovering stolen assets, and handling them in insolvency or estate cases, they added.

Read also: Euro Stablecoin: Banking Giants Forge Alliance for 2026 Launch

Solidifying the UK’s Digital Ambition

By being the first major jurisdiction to explicitly legislate crypto as third kind of property, the UK has positioned itself as a global leader in digital asset development and innovation. By providing legal recognition, the UK gives institutions, innovators, and investors the confidence they need to engage with and invest in cryptos and digital assets.

This initial step also supports ongoing developments in the UK’s regulation of stablecoins and associated markets, painting a picture of a country systematically developing a coordinated and competitive regime that will enable it to establish itself as the jurisdiction of choice for the future of finance.

FAQs

What does this law (the UK officially recognizing crypto as third kind of property) actually do?

It amends UK property law to explicitly state that digital assets (like crypto and NFTs) can be the subject of personal property rights, creating a third legal category for them. This clarifies their status for courts, businesses, and individuals.

Does this mean crypto is now regulated?

Not directly. This is a property law clarification, not a financial services regulation. It defines what crypto is (property) but doesn’t yet set rules for how it’s traded or offered as a financial product, which is handled under separate financial regulations.

What are the practical benefits?

The key benefits are legal clarity. It makes it easier to:

– Recover stolen crypto through the courts

– Include digital assets in a will or estate plan

– Determine how to handle crypto holdings in the event of a company’s bankruptcy

For more UK crypto-related stories, read: UK Forges Ahead with Comprehensive Crypto Assets and Stablecoin Regulation Under FCA’s Watch