Key Takeaways

- The Financial Conduct Authority (FCA) has admitted RegTech firm Eunice into its sandbox to test new disclosure tools aimed at improving transparency in the UK’s crypto market.

- Eunice is collaborating with major exchanges while developing common templates that could bring consistency to how information on digital assets is presented.

- Trials conducted inside the sandbox will help the FCA assess whether the templates improve visibility for investors and regulators as it prepares future disclosure rules.

- The initiative feeds into the FCA’s broader crypto roadmap, which seeks stronger market integrity, better consumer protection and a clearer regulatory framework ahead of final rules expected in 2026.

Britain’s financial regulator has opened the door to a new industry initiative aimed at improving clarity in the country’s digital asset market, giving investors a clearer understanding of what they are buying at a time when the FCA is pushing for higher standards of consumer protection.

The initiative was launched through the Financial Conduct Authority’s decision to admit RegTech firm Eunice into its Regulatory Sandbox, giving the company room to test a system designed to strengthen disclosure standards for crypto assets.

According to the FCA, Eunice builds tools that help institutions and regulators interpret on-chain activity and tokenised products. The company is working with major global exchanges including Coinbase, Crypto.com and Kraken as it develops a format for presenting detailed information about digital assets.

A group convened by Eunice has already drafted a set of common disclosure templates that firms can use when issuing documentation. The templates are intended to bring more uniformity to how firms present information, making it easier for investors to understand the nature of a token and the risks tied to it before deciding whether to buy.

While using the sandbox, Eunice will put the drafts through real-world trials to see if they genuinely improve visibility for regulators and market participants, then send the results back to the FCA to be used as the regulator refines its approach to future crypto asset disclosure rules.

Eunice co-founder and chief executive Yi Luo said the collaboration offers an opportunity for industry and regulators to work side by side on building a safer digital asset market. Luo described the company’s role in leading the disclosures work as a significant moment for a firm created to promote integrity in the sector.

Colin Payne, head of innovation at the FCA, said the sandbox remains open to firms interested in testing ideas that may benefit the market and improve consumer outcomes. He encouraged companies pursuing similar solutions to apply.

FCA Seeks Industry Players as Crypto Framework Takes Shape

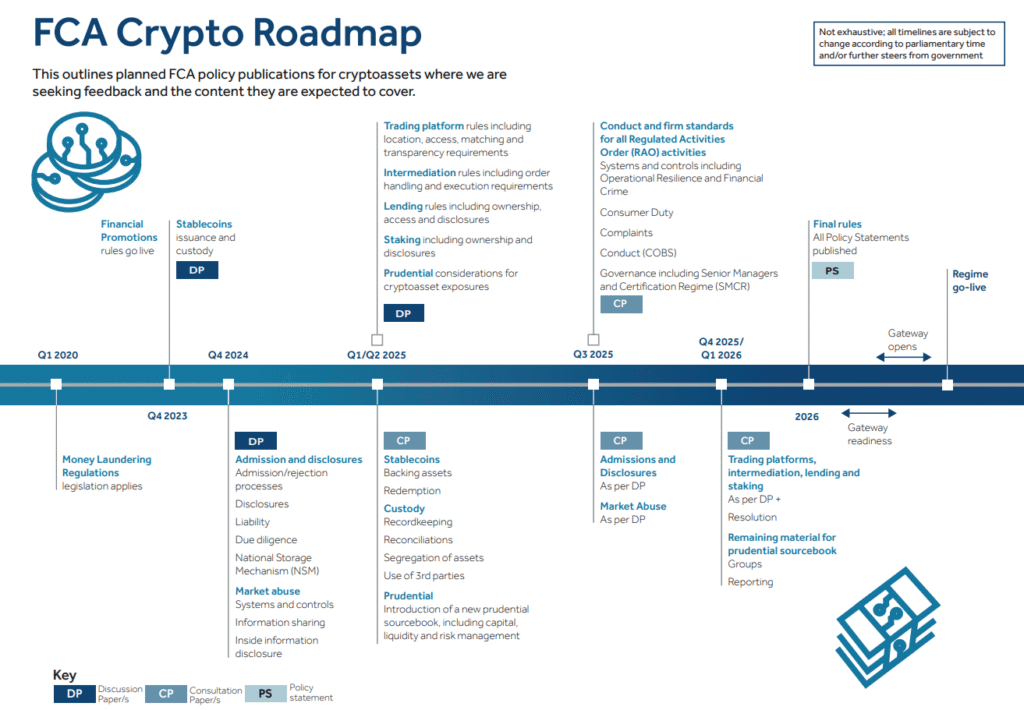

The project follows an FCA paper published last year that sought industry feedback on admission and disclosure standards for crypto tokens. It also forms part of the regulator’s broader crypto roadmap, which outlines planned policy releases ahead of final rules expected in 2026.

The FCA has urged market participants to contribute actively as it builds a regulatory framework aimed at strengthening market integrity, boosting consumer protection and supporting the UK’s competitiveness in digital finance.

Read More: ECB Warns Stablecoin Surge Risks Global Market Turbulence; How Soon Could It Hit?